CoinShares Analysts Predict Bitcoin Surge to $58,700

Approval of a spot Bitcoin ETF and the anticipated easing of the Fed’s monetary policy in the first half of 2024 will drive the price of digital gold to approximately $58,700, according to CoinShares analysts in their annual report.

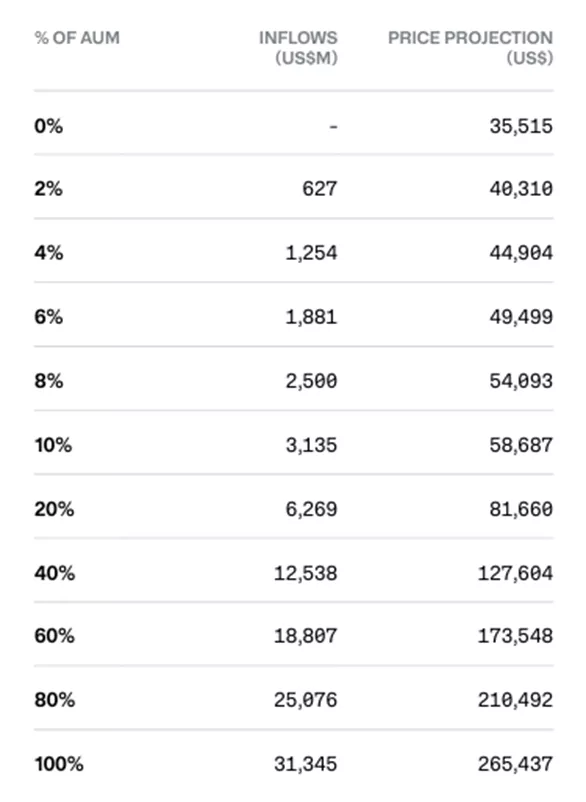

The experts presented a matrix showing the correlation between inflows as a percentage of AUM for management companies and changes in Bitcoin’s price. They assessed the model’s R2 determination coefficient at 0.31, noting its “imperfection.”

As a conservative estimate, the analysts used an ETF inflow of 10% of the industry’s total AUM (~$3 billion).

“Corporations and funds may need some time to accumulate their knowledge and confidence before deciding to invest in the product,” they cautioned.

As an additional factor, experts mentioned the declining appeal of the US dollar amid doubts about the sustainability of US government debt and geopolitical events. The upcoming halving will also serve as a driver.

Analysts pointed to the high correlation between stocks and bonds, which may encourage investors to add the first cryptocurrency to their portfolios for risk diversification.

Experts noted the potential for increased inflows into Ethereum if the Dencun hard fork is successfully implemented and a spot ETF based on the asset is possibly approved.

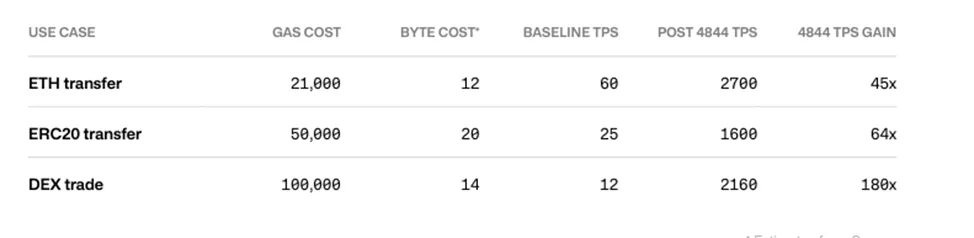

Below is a diagram from specialists on the effect of implementing EIP-4844. It includes the Proto-Danksharding option, designed to scale the network by creating a new type of transaction for large binary data arrays (BLOB). This is expected to reduce the size of fees for L2 solutions based on Rollups technology.

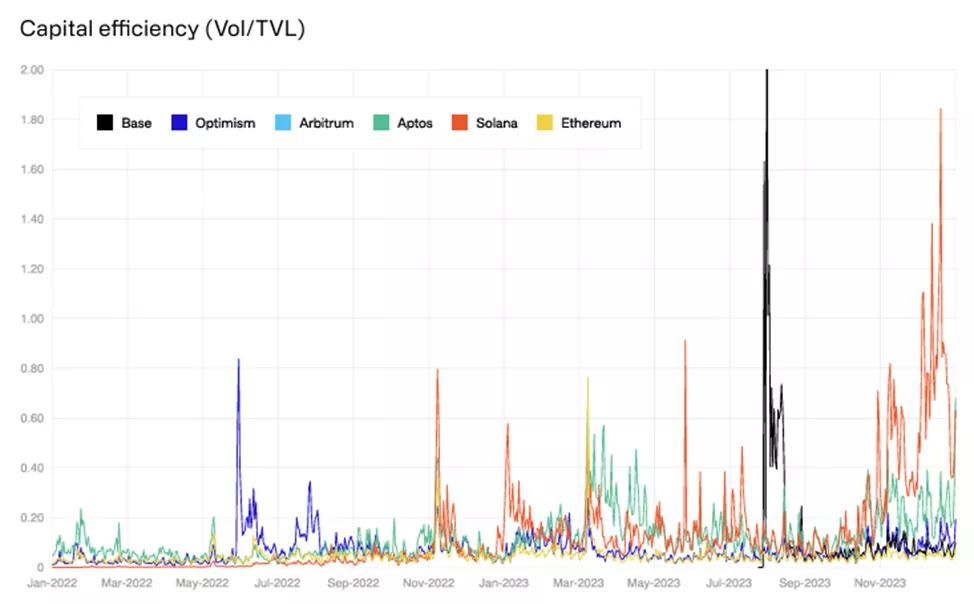

Specialists highlighted Solana’s potential impact in 2024 on DeFi and the data access sector.

This will be realized if high equipment and “light” node connection requirements are met. DeFi project activity will be supported by order book-based DEX, which will enhance user experience in addition to the current high capital efficiency through the lens of transaction volume per $1 in TVL.

Separately, analysts mentioned the high likelihood of an increase in the number of countries providing regulatory clarity in the stablecoin segment.

Experts noted the low chances of legislation being passed in the US and the risks of delays in its implementation in the UK, while the EU will continue to refine MiCA.

An extreme forecast suggests the approval of balanced regulatory norms regarding digital assets instead of bans in India, Nigeria, Turkey, or some of them.

Previously, CoinShares researchers noted the potential impact of Dencun on Ethereum’s issuance dynamics.

On January 17, Ethereum developers activated Dencun on the Goerli testnet.

According to the previously presented schedule, Dencun deployment is set for January 30 on the Sepolia testnet and February 7 on Holesky.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!