CoinShares Dismisses Bitcoin Liquidity Crisis Claims

CoinShares dismisses claims of Bitcoin liquidity crisis, emphasizing dollar value over coin count.

The widely held belief in the community regarding a liquidity crisis for the leading cryptocurrency does not align with reality, stated Christopher Bendiksen, Head of Bitcoin Research at CoinShares.

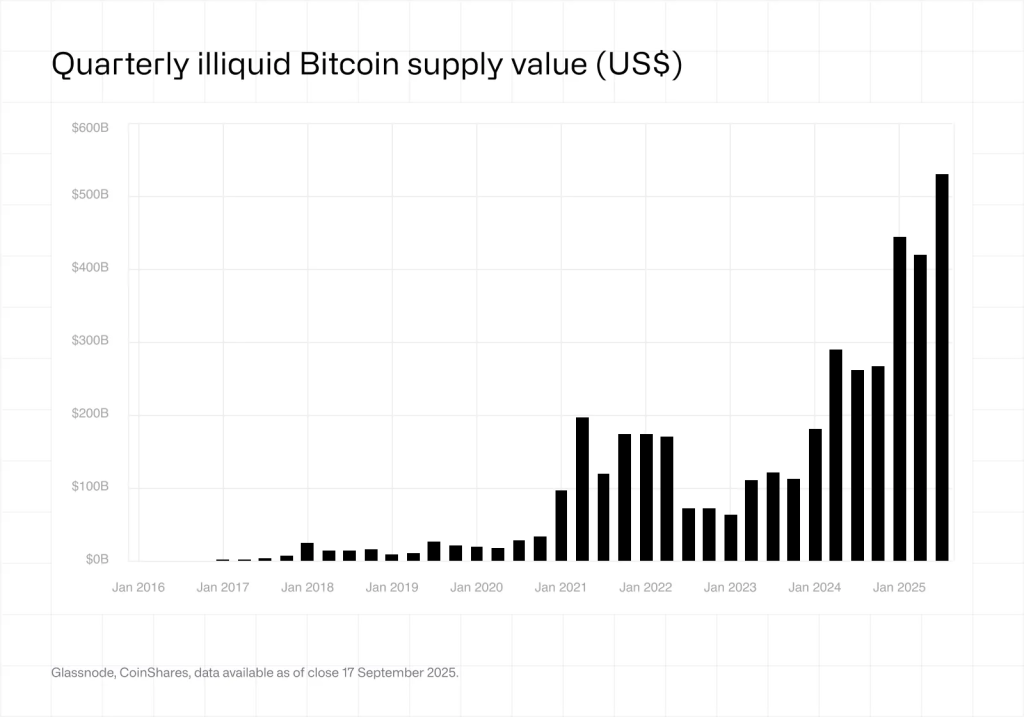

The expert dissected two key arguments: the reduction of digital gold reserves on exchanges and the increase in coins within illiquid UTXO. He pointed out a misinterpretation — when assessing liquidity, it is crucial to consider not the number of coins, but their value in dollars.

“Even with a reduction in the number of liquid bitcoins, their total value continues to rise. […] As seen [in the chart above], it increases almost in the same progression as the illiquid supply, as the determining factor here is the price,” explained Bendiksen.

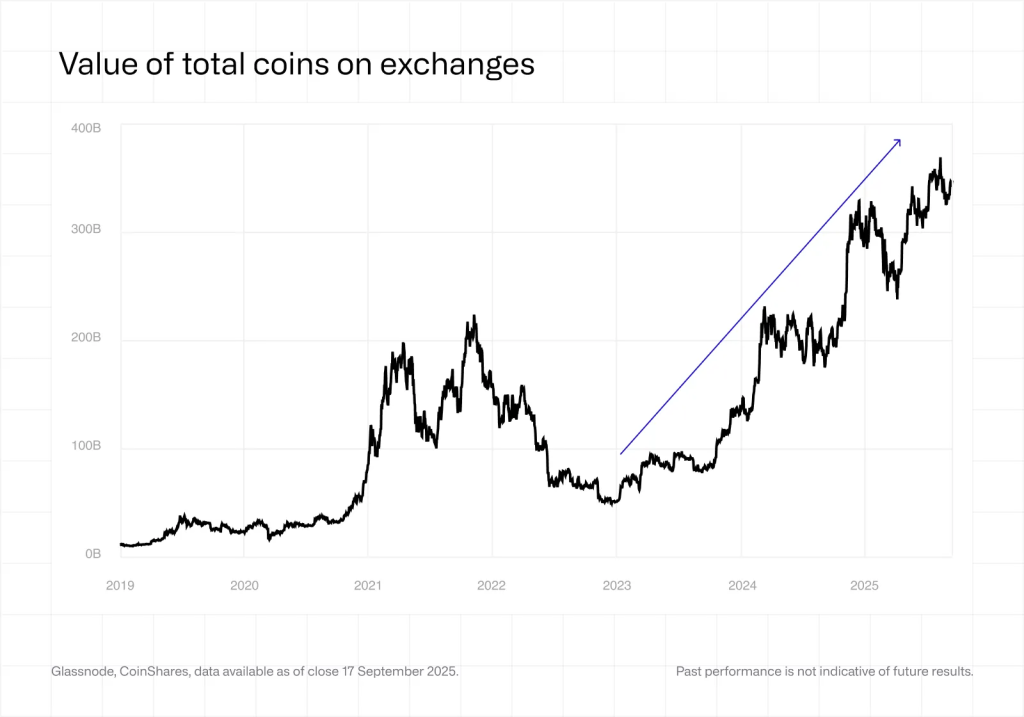

The expert also created a chart of the total value of coins on exchanges, which indicates that there is no liquidity issue:

“The volume of available liquidity is nearly double the peak levels of the last bull cycle, and a new major source has been added — Bitcoin-ETF, traded on Nasdaq,” he noted.

According to his calculations, for a sharp rally in prices, investors would need to purchase over a million coins each year at current prices. Only such a scale of demand could create a shortage and trigger a frenzied growth.

“There Will Always Be Enough Coins”

Bendiksen believes that “any amount of the first cryptocurrency will be sufficient to meet any dollar demand.” He referred to the ability of digital gold to be infinitely divided (for example, into satoshis).

In his view, notions of liquidity reduction to levels described by some experts “seem detached from reality.” The only scenario for a “God candle” is a collapse in demand for the US dollar as the base currency. While such an outcome is possible in a historical perspective, it is unlikely in the foreseeable future, the analyst emphasized.

“Meanwhile, with the steady rise in Bitcoin’s price and the slow sale by long-term holders in response to new demand during each price rally, it seems there are enough coins for everyone at any prevailing rate,” he concluded.

Earlier, a trader under the pseudonym CrypNuevo suggested that digital gold could form a bottom at $101,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!