CoinShares: The Imitation Strategy Boom Has Largely Ended

The bubble of companies with treasuries in Bitcoin and other cryptocurrencies has largely burst.

The bubble of companies with treasuries in Bitcoin and other cryptocurrencies (DAT) has largely burst. This view was expressed by James Butterfill, head of research at CoinShares.

In August 2020, Strategy became the first publicly traded company to announce the addition of digital gold to its balance sheet. The initial aim of the initiative was stated as asset diversification and currency risk management.

“This also aligned with the growing interest of many corporations in distributed ledger technology and the potential efficiency gains from integrating blockchain infrastructure into existing operations,” noted Butterfill.

The Wave of Imitators

In practice, the strategy declared by Michael Saylor’s company turned into a tool for investing in cryptocurrency using borrowed funds. Many new entrants in the segment followed a similar path, issuing shares not to develop their business but to accumulate more digital assets.

“However, over time, this led to a decline in interest and inflow of funds into the sector, simultaneously questioning the sustainability of such strategies,” Butterfill emphasized.

As a result, treasury companies began using the maximum possible number of funding sources to rapidly increase the number of coins stored, hoping that price growth would offset the downturn’s effects.

The Issues at Hand

The market correction exposed the structural deficiencies of DAT, according to Butterfill.

The lack of operational cash flows contributed to the decline in investor interest.

Many treasury companies’ traditional businesses generate losses. Although these amounts are relatively small compared to crypto reserves, they could trigger some selling pressure on digital assets, the expert noted.

In a liquidity crunch, the need to pay dividends and interest payments could lead to the urgent liquidation of cryptocurrency reserves. However, most DATs raised funds through share issuance, and their debt load is not too high.

An exception is Strategy, which has outstanding loans amounting to $8.2 billion, and the volume of issued preferred shares with dividends reaching $7 billion. In total, this means obligations of about $800 million per year for the company. To cover payments, the firm has already formed a fiat reserve of $1.44 billion.

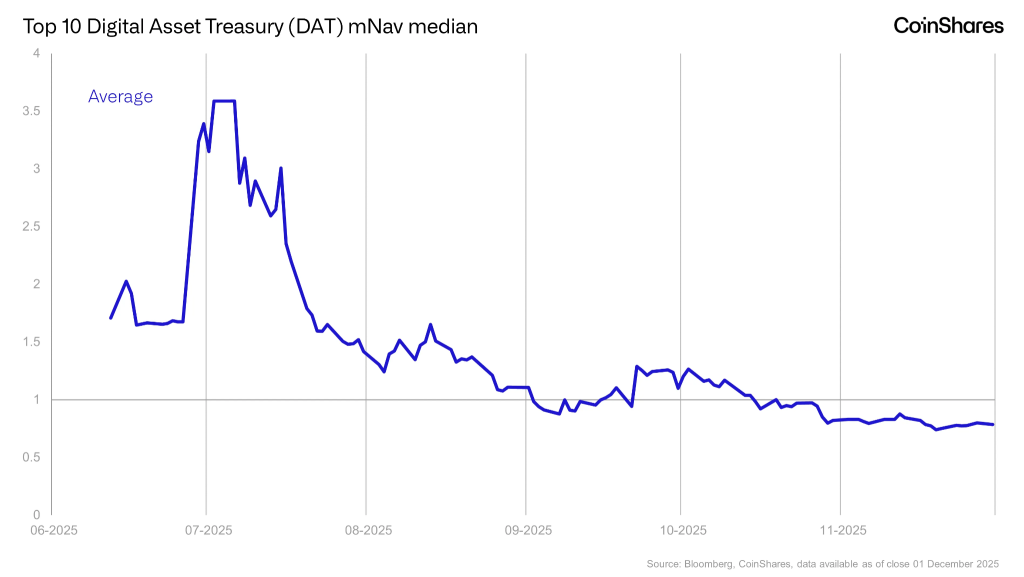

More importantly, CoinShares considered what would happen after the mNAV of sector participants falls below 1. This metric compares the market capitalization of the company and the value of its crypto reserve.

“Has the DAT bubble already burst? Largely, yes,” wrote Butterfill.

In the summer, shares of many segment representatives traded at a premium of 3x and even 10x. However, the median mNAV value has now fallen below one. At the time of writing, Strategy’s mNAV stands at 1.16.

What Lies Ahead?

CoinShares sees two main scenarios for future developments:

- Price declines will trigger aggressive sell-offs of treasury assets, leading to a cascading collapse;

- Companies will maintain their cryptocurrency balances and benefit from price recovery.

“We lean towards the latter option, especially considering the improving macroeconomic situation and the possibility of a rate cut in December, which will generally support the markets,” Butterfill noted.

Additionally, companies with a negative mNAV premium could become attractive acquisition targets for more stable competitors, he added.

“The end of the DAT bubble does not mean the collapse of the treasury concept. Instead, we expect a rethinking,” Butterfill emphasized.

According to CoinShares experts, the sector will move towards clear categorization, and investors will begin to focus on participants with specific strategies:

- Speculative DATs — the main business is secondary, and capitalization entirely depends on the prices of held tokens;

- Reserve managers — companies use Bitcoin and other cryptocurrencies as part of their currency and treasury strategy;

- Token investors — enterprises form diversified portfolios of digital assets, acting more like closed-end funds.

Another group consists of corporations using Bitcoin as a macro-hedging tool but not seeking classification as DATs. Existing examples include Tesla, Trump Media, and Block.

Earlier, JPMorgan analysts linked Bitcoin’s short-term prospects to Strategy’s financial stability.

In November, investors suspected the bank of a coordinated attack on the company.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!