Investors accuse JPMorgan of targeting Michael Saylor’s Strategy

Max Keiser claims JPMorgan shorted Strategy; no official confirmation.

JPMorgan has opened a short position in Strategy shares, claimed TV host Max Keiser, though there is no official confirmation.

UNCONFIRMED: JP Morgan appears to have an existentially threatening short $MSTR position that can potentially bankrupt $JPM if $MSTR trades 50% higher above Friday’s close.

GAMESTOP VIBES INTENSIFY‼️@FoxBusiness @cvpayne

— Max Keiser (@maxkeiser) November 23, 2025

He added that a 50% rise in MSTR from Friday’s close could bankrupt the bank.

Some users allege that JPMorgan intends to mount a coordinated attack against Strategy. They point to a 10 October report the bank circulated only at the end of November — 42 days later.

PROOF of coordinated FUD against $MSTR

I said it feels manufactured. Here is the smoking gun.

Look at the source date on the “news” they are using to panic you today. October 10th.

This document has been public for 42 days.

The market ignored it for 6 weeks. Now suddenly,… https://t.co/Nu4S65cZ8n pic.twitter.com/3UnyUjrvZk

— Adrian (@_Adrian) November 21, 2025

The document discusses the risk of MSTR being excluded from major MSCI equity indices, potentially triggering $2.8 billion of outflows. Matthew Sigel, head of digital-asset research at VanEck, affirmed this.

$MSTR — JPM says MicroStrategy “at risk of exclusion from major equity indices as the January MSCI decision approaches.”

“With MSCI now considering removing MicroStrategy and other digital asset treasury companies from its equity indices…outflows could amount to $2.8bn if… pic.twitter.com/gMqlYtcZII

— matthew sigel, recovering CFA (@matthew_sigel) November 20, 2025

“In light of MSCI’s decision to consider removing MicroStrategy and other digital-asset treasury companies from its equity indices, potential outflows could reach $2.8bn if MicroStrategy is removed from MSCI indices. Should other index providers adopt this practice, cumulative outflows across all equity indices could total $8.8bn,” the expert quoted the report as saying.

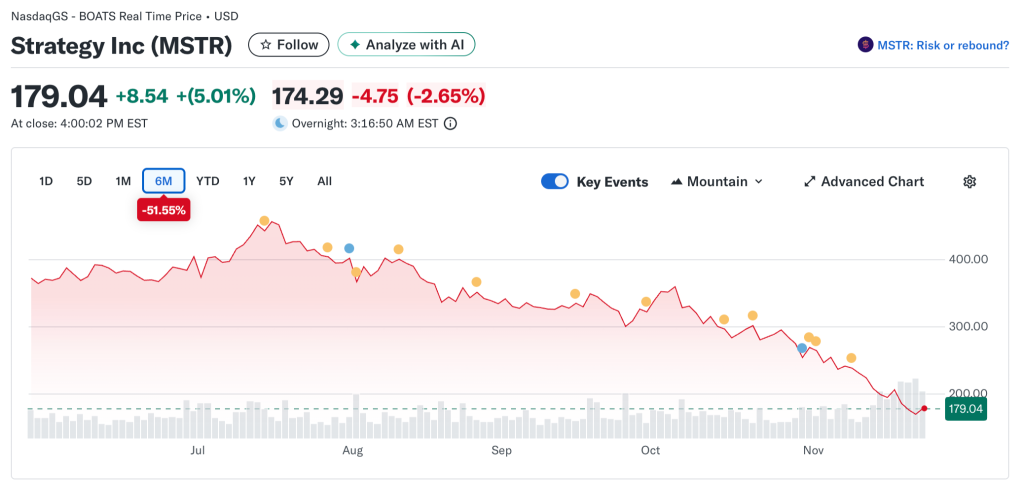

As another argument for a coordinated attack, users noted that in July JPMorgan tightened margin requirements on loans backed by MSTR shares. In their view, that was when Strategy’s problems began.

MSTR was on a tear until JPMorgan quietly tightened margin rules on MSTR-backed loans in July. pic.twitter.com/Q50UH6RRXJ

— TFTC (@TFTC21) November 24, 2025

Over the past six months, the shares of Michael Saylor’s company have fallen by more than 51% — from $370 to $179.

Still, some disagree. Users called the sharp drop in MSTR since July a coincidence and noted that tighter requirements are standard practice.

Notably, in the third quarter JPMorgan sold Strategy shares worth $134 million.

Some in the crypto community also recalled GameStop and proposed engineering a similar short squeeze against the bank.

At the same time, another scandal flared around the corporation related to Jeffrey Epstein. Democratic senator Ron Wyden of Oregon called for an investigation into JPMorgan — the bank allegedly hid suspicious Epstein transactions worth more than $1 billion for years.

Crypto winter lows

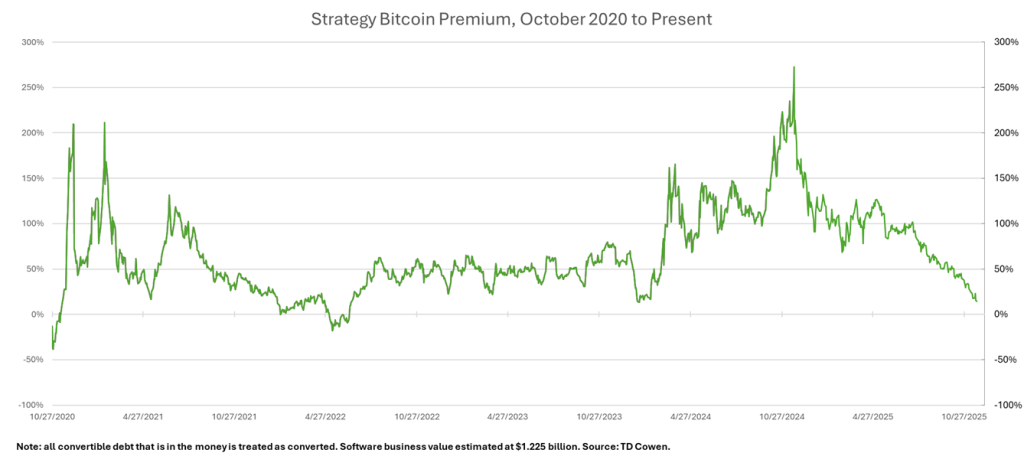

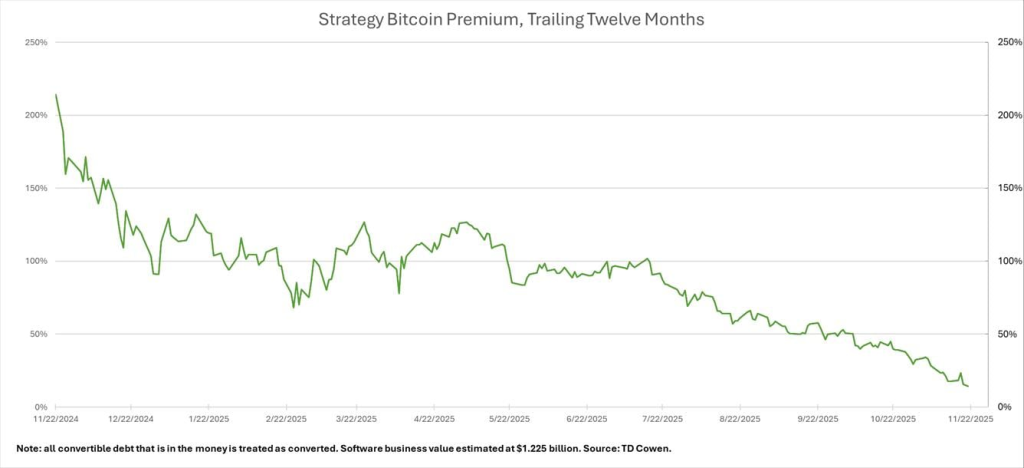

The premium of Strategy’s shares to bitcoin mNAV has approached lows last seen in 2021, TD Cowen analysts told The Block. The experts shared updated charts:

Both show mNAV trending down toward the prior crypto-winter levels.

However, the specialists maintain an optimistic outlook on MSTR with a $535 target price.

“We are not changing our base bitcoin forecasts and still expect Strategy to hold 815,000 BTC by the end of fiscal 2027. Accordingly, we project holdings above $185bn by December 2027, which implies an intrinsic value of roughly $540 per share,” they stressed.

TD Cowen also deemed it likely that the company will be excluded from MSCI indices in February 2026. In their view, that awaits all companies with bitcoin on their balance sheets.

Saylor responded on 21 November, saying that “classification in the indices does not reflect the essence of the company.”

Response to MSCI Index Matter

Strategy is not a fund, not a trust, and not a holding company. We’re a publicly traded operating company with a $500 million software business and a unique treasury strategy that uses Bitcoin as productive capital.

This year alone, we’ve completed…

— Michael Saylor (@saylor) November 21, 2025

“Strategy is not a fund, not a trust, and not a holding company. We are a publicly traded operating company with a $500 million software business and a unique treasury strategy that uses Bitcoin as productive capital,” he wrote.

Saylor emphasized that no vehicle can replicate Strategy’s activities.

“Our strategy is long-term, our conviction in Bitcoin is unshakable, and our mission remains unchanged: to build the world’s first digital monetary institution based on digital money and financial innovation,” he concluded.

Commentators noted that six months ago Saylor called Strategy a “bitcoin treasury.” In October 2024 he said he intended to transform the firm into a bank for the first cryptocurrency with a market value of $1 trillion.

At the time of writing, the company oversaw 649,870 BTC worth $56.5 billion, according to Bitcoin Treasuries.

In October 2025, S&P Global Ratings assigned Strategy a junk-bond issuer rating.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!