COVID-19 Pandemic Dampened Japanese Interest in Cryptocurrencies

Analysts at Japanese exchange Bitbank reported the first decline in the number of active accounts on the country’s Bitcoin exchanges in two years. Aggregated data for two years from the local self-regulatory body JVCEA are presented in the blog of the company.

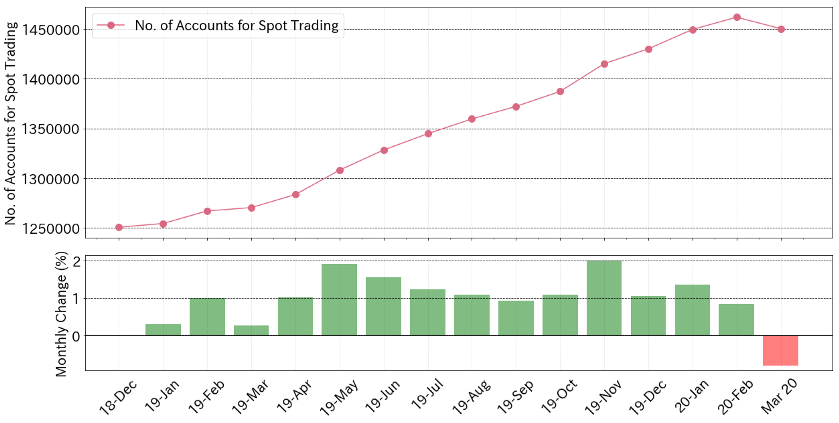

Dynamics of active accounts for spot cryptocurrency trading. Source: Japan Virtual Currencies Exchange Association

In the chart above one can observe a steady rise in the metric since December 2018, which was interrupted in March 2020. An account is classified as “active” if it has a non-zero balance and at least one transaction in a month.

Bitbank attributes this reversal to the coronavirus outbreak. Analysts say that economic uncertainty and volatility in the crypto market in March may have constrained trading activity and driven demand for fiat. They emphasise that withdrawals were not dramatic in a historical perspective.

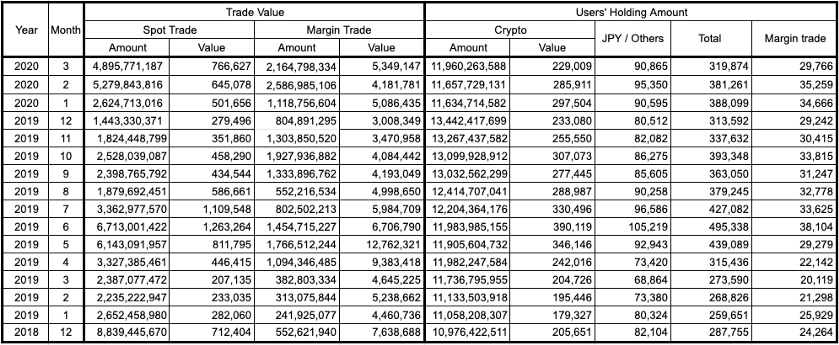

Trading volume and asset sizes on trading accounts. Source: Japan Virtual Currencies Exchange Association

“The corona shock hit traditional financial markets and triggered margin calls. At that time, many investors perhaps had little choice but to withdraw funds from crypto exchanges,” the analysts noted.

Psychological factors may also have driven such decisions. Many Japanese might have begun bracing for reduced incomes and rising unemployment amid the state of emergency.

Experts do not believe that the decline in activity on Japan’s Bitcoin exchanges will persist. After the stock market stabilised, trading in the first cryptocurrency rose in April and May.

Ripple (XRP) is the second-most popular cryptocurrency among investors in Japan, not far behind Bitcoin.

Subscribe to ForkLog news on Telegram: ForkLog FEED — the full news feed, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!