CryptoQuant: Bitcoin Outflows from Binance Intensify

Seller pressure in the digital gold market is easing, indicated by negative net inflow trends on Binance.

The pressure from sellers in the digital gold market is easing. This is indicated by the negative trend in the net inflow of cryptocurrency to the Binance exchange, according to CryptoQuant analyst Burak Kesmeci.

Selling Pressure Fades as Binance Netflow Turns Sharply Negative

“This suggests that investors prefer holding over selling, which typically aligns with accumulation phases in market cycles.” – By @burak_kesmeci pic.twitter.com/gxN48Jhc2v

— CryptoQuant.com (@cryptoquant_com) October 21, 2025

The expert highlighted the 30-day moving average (SMA30) of this indicator. In recent weeks, the trend has become markedly negative, with investors withdrawing more bitcoins from the exchange than they are depositing.

The analyst noted that such dynamics indicate an accumulation phase: market participants prefer to hold assets rather than sell them. He emphasized that when assessing the trend, one should focus on the 30-day average rather than daily fluctuations.

The situation is complemented by data from Glassnode. Open interest in bitcoin has fallen by about 30%, leading to a reduction in excess leverage in the market.

With neutral funding rates, the market has become vulnerable to mass liquidations.

Inflows into Crypto ETFs

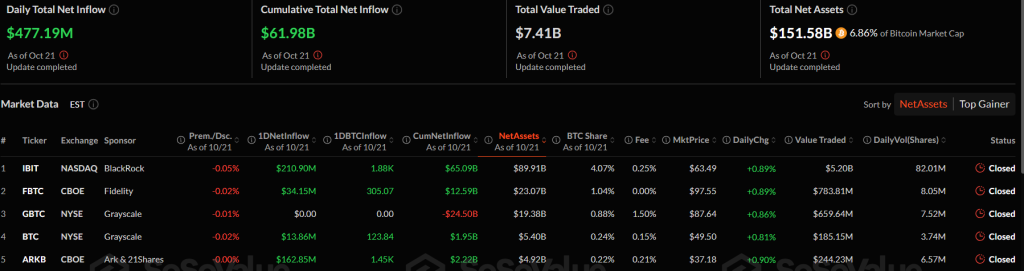

On October 21, the net inflow into US spot bitcoin-ETF amounted to $477.19 million. This followed several days of capital outflows exceeding $1 billion.

The leader was IBIT from BlackRock with an inflow of $210.9 million. The ARKB fund from Ark & 21Shares attracted $162.8 million, while FBTC from Fidelity saw $34.15 million.

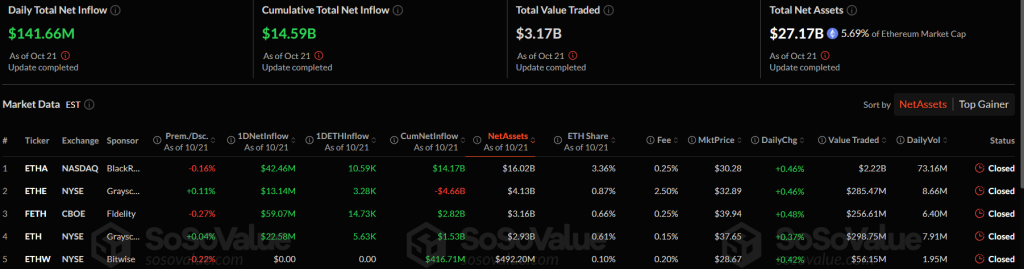

Spot Ethereum ETFs also recorded an inflow of $141.66 million.

The largest inflow was into FETH from Fidelity ($59 million). Products from BlackRock, Grayscale, and VanEck also recorded inflows.

Earlier, analyst PlanB stated that fundamental indicators point to continued growth in the crypto market, despite recent corrections.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!