CryptoQuant Highlights Benefits of Bitcoin’s Price and Hashrate Divergence

The rise in Bitcoin’s hashrate and mining difficulty, despite negative price trends, indicates strong underlying factors in terms of intrinsic value and network security. This view was expressed by CryptoQuant contributor Yonsei_dent.

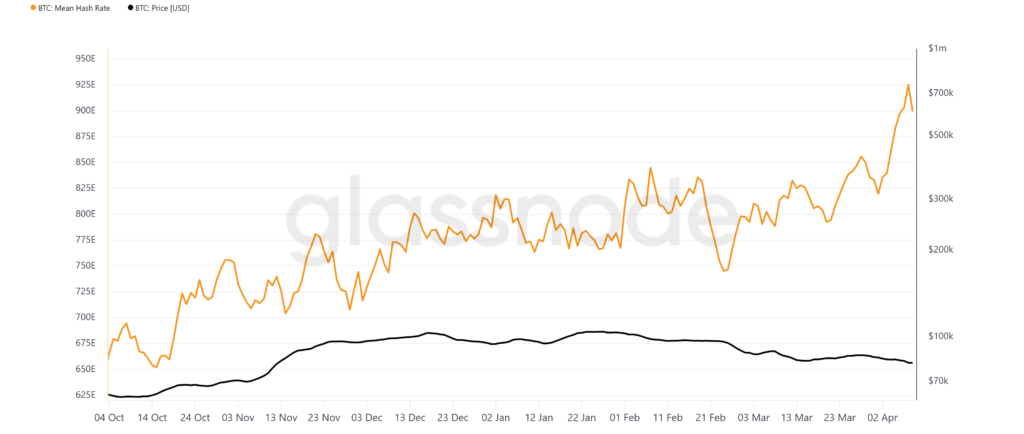

Bitcoin Drops to $80K, but Hashrate Hits ATH

“Despite Bitcoin’s price dropping from $109K to around $80K, both the hashrate and mining difficulty have continued to reach all-time highs.” – By @Yonsei_dent

Read more ⤵️https://t.co/bI6w3jOs7g pic.twitter.com/rAnPXi8c4Q

— CryptoQuant.com (@cryptoquant_com) April 10, 2025

At the time of writing, the leading cryptocurrency is trading around $81,600, recovering following U.S. President Donald Trump’s announcement of a 90-day delay in implementing new trade tariffs. Current prices are approximately 25% below the all-time high ATH recorded in January near $109,000.

According to Glassnode, on April 8, Bitcoin’s hashrate, smoothed by a seven-day moving average, reached a new all-time high of 925.4 EH/s before adjusting to 899 EH/s.

On April 4, the network’s computational power intraday value surpassed the significant threshold of 1 ZH/s for the first time.

The mining difficulty, which correlates with this metric, reached a record 121.51 T the following day, increasing by 6.81%. The current forecast suggests that the metric will remain at its current level after the next recalculation in about a week.

Previously, several analysts noted that the divergence between Bitcoin’s price and hashrate dynamics pressures the mining economy. In the long term, this poses risks to network security, experts believe. They also pointed to the extremely low share of transaction fees in miners’ revenue (1.33% in the first quarter) and a decline in on-chain activity as additional negative factors.

According to Hashrate Index, the hashprice is stagnating near a low of ~$40 per PH/s per day. The current figure is $42.7.

According to Yonsei_dent, while the growth of the network’s technical metrics “may seem unfavorable,” increasing mining costs, it actually confirms the prospects of the leading cryptocurrency. The expert referred to CryptoQuant CEO Ki Young Ju, who suggested that Bitcoin’s market capitalization could potentially grow to $5 trillion based on hashrate dynamics.

The activities of American miners have been negatively affected even by the yet-to-be-implemented “liberating” tariffs of Trump. Should the announced tariffs come into effect, industry specialists predict a 22-36% increase in the cost of cryptocurrency mining equipment in the U.S. The country’s share in the digital gold’s hashrate is 35-40%.

During his election campaign, Trump called himself a “crypto president,” promised to make the U.S. the “world capital” of the digital asset industry, and globally protect the mining sector.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!