CryptoQuant Identifies Key Condition for Bitcoin Rally in Q4

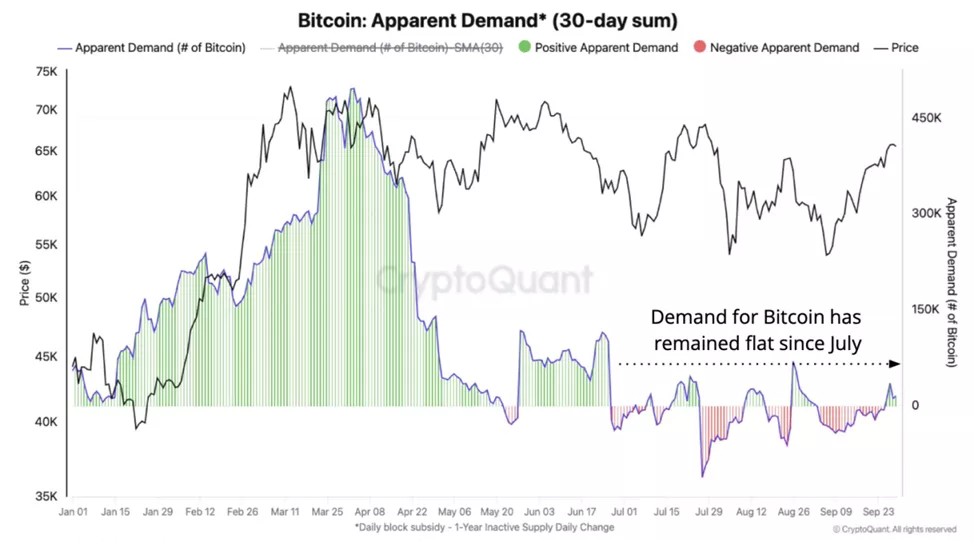

Bitcoin demand is stabilizing, but a stronger metric is needed to sustain price growth in the fourth quarter, according to CryptoQuant, as reported by The Block.

The metric is calculated as the difference between the daily number of mined coins and the change in the number of bitcoins that have remained unmoved for at least a year.

Since July, the 30-day adjusted metric has fluctuated between net losses of 23,000 BTC and gains of 69,000 BTC. September saw less volatility, with demand remaining positive throughout the month.

“In April, when the price was at $70,000, the metric surged to $496,000 BTC. Clearly, demand has a benchmark for growth in the fourth quarter,” commented the specialists.

Experts noted that investor behavior at the start of 2024 mirrors patterns observed during previous halving cycles in 2016 and 2020. In preceding months, hodlers sold bitcoin to new investors, which strengthened demand, but the trend weakened over the summer.

“If historical trends persist, we will see a resurgence in buying, leading to a potential increase in short-term supply,” explained the analysts.

Separately, CryptoQuant examined the situation with BTC-ETF. In September, the products shifted from a net sale of 5,000 BTC to the highest purchase since July, at 7,000 BTC, experts indicated.

Earlier, specialists concluded that the growth of stablecoin capitalization in August-September could extend the upward trend of bitcoin and other major cryptocurrencies.

Canaccord previously stated that a rally of the leading cryptocurrency is inevitable if the historical post-halving pattern continues.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!