DeFi Bulletin: Aave Secures $25 Million Investment as DEX Trading Volumes Fall

The decentralized finance (DeFi) sector continues to attract heightened attention from cryptocurrency investors and traders. ForkLog has gathered the most important events and news from the last three weeks in one piece.

Value of Locked Assets, Market Capitalization, and DEX Volumes

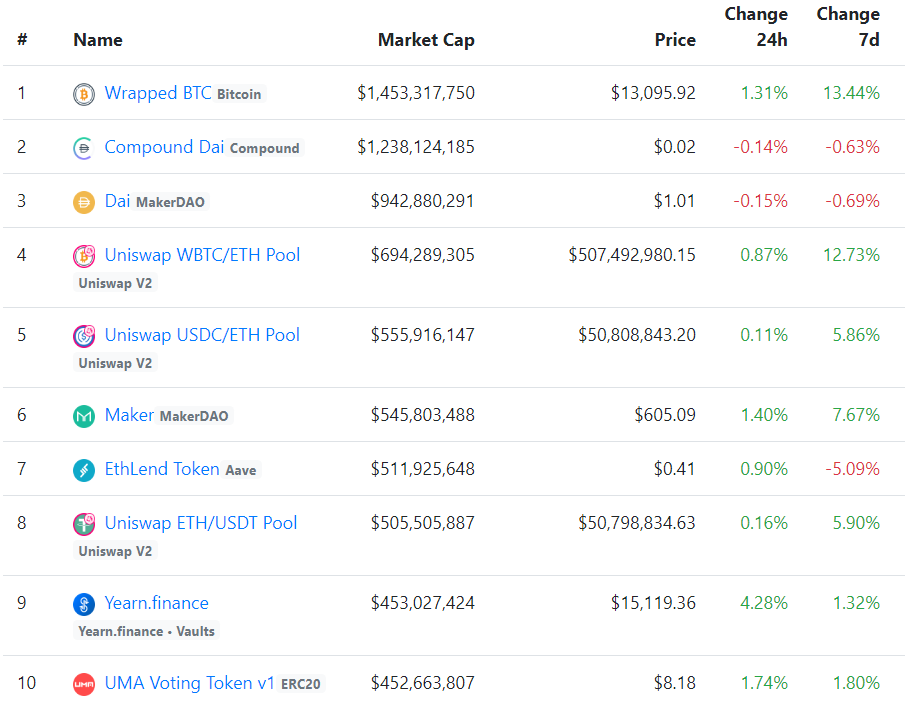

At the time of writing, the market capitalization of DeFi tokens stood at $12.272 billion. Leading with a figure close to $1.5 billion is the Bitcoin-backed Wrapped Bitcoin (WBTC).

Source: DeFiMarketCap.

Following other valuation principles, CoinGecko shows the market capitalization of the top 100 DeFi tokens at $14.529 billion. Three weeks ago this figure was $13.2 billion.

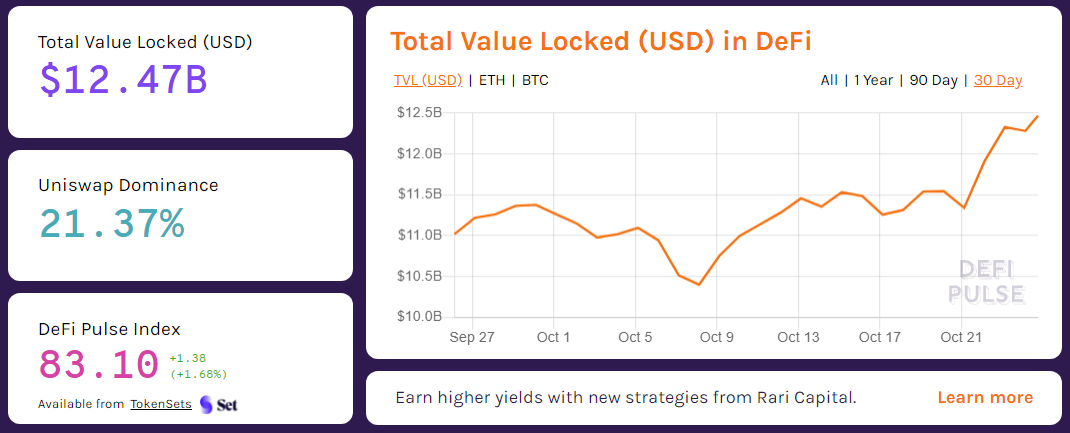

Source: DeFi Pulse.

At the time of writing, Uniswap accounts for $2.67 billion of all funds in DeFi protocols. Maker follows with $2.14 billion. In third place with $1.44 billion is WBTC, leaving Aave ($1.15 billion) and Compound ($1.09 billion) behind. Close behind them with $1.06 billion is Harvest Finance.

Source: DeFi Pulse.

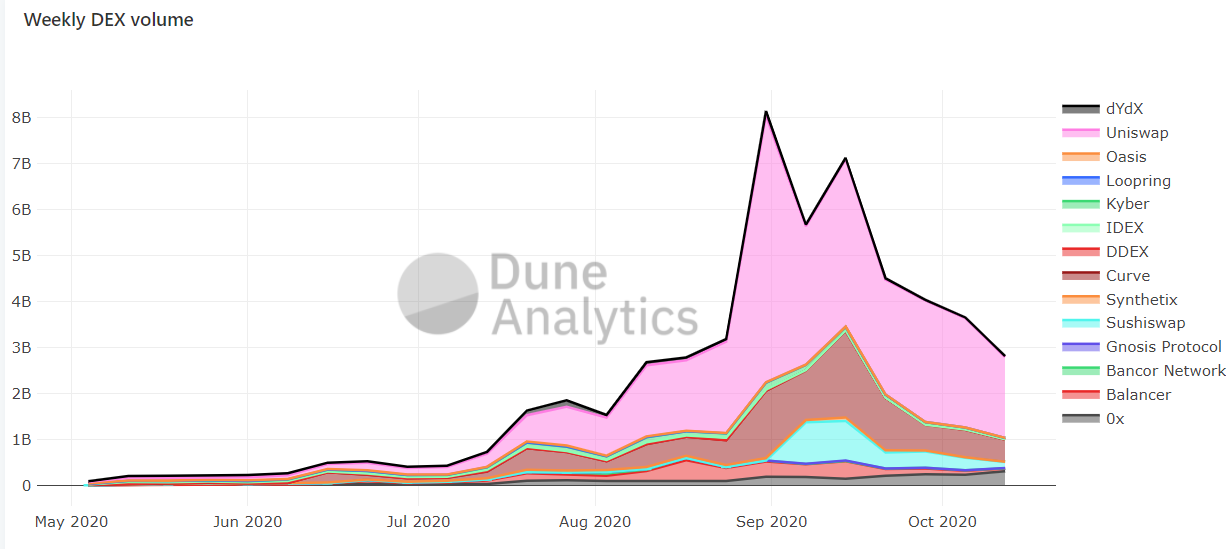

Trading volumes on decentralized exchanges (DEX) over the last 30 days fell by 41%. According to Dune Analytics, at the end of August this metric reached a record $8 billion, the September high was already $6 billion, but this week trading volume dropped to $3 billion (62% of peak values).

On September 1, trading volumes on the leading exchange Uniswap were almost $1 billion; by Thursday, October 22, this figure had fallen to $234 million.

Source: Dune Analytics.

Aave Team Raises $25 Million in Investments

On Monday, October 12, the lending protocol Aave announced $25 million in investments from Blockchain Capital, Standard Crypto, Blockchain.com, and several other firms.

“Aave has received funds from strategic investors to bring DeFi closer to institutional use cases and to expand the team to support growth in Asian markets,” said Stani Kulechov, the company’s CEO.

He added that the new investors would participate in staking and governance of the protocol.

In September, Aave launched a governance system via community voting. The first governance proposal for the protocol was the transition to a new governance token—LEND was replaced by AAVE.

As explained by Kulechov, after migrating from LEND to AAVE, everyone can create new functionality in the protocol together with the Aave team. He said that essentially this is about decentralizing development and governance of the project.

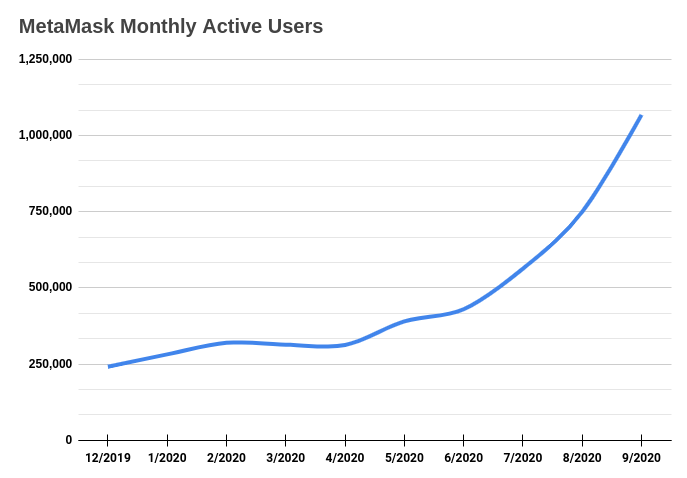

Number of Active MetaMask Users Surpassed 1 Million

The user base of the Ethereum wallet MetaMask surpassed 1 million active users per month. The team regards achieving this milestone as “the most important milestone for the entire ecosystem.”

Source: MetaMask blog.

Back in May 2019, MetaMask had 264,000 users. Company representatives say users are increasingly turning to MetaMask to participate in “the DeFi revolution.” Additionally, a key factor in expanding the user base was the launch of a mobile version of the wallet in early September.

The MetaMask team announced the launch of a unified interface, aggregating multiple decentralized exchanges and aggregators for on-wallet token swaps. The integration of MetaMask with major DEXs and aggregators, including 1inch, Airswap, Kyber, 0x API, Uniswap, dex.ag and Paraswap, will give users access to all liquidity sources in the DeFi sector in one place.

Recall, in August the MetaMask developers restricted the free use of the extension’s source code. Commercial projects with more than 10,000 active users will need to sign an official agreement with the company.

Investors Got Burned on New Experimental Token by yEarn.Finance Founder

Users suffered losses after yet another pump-and-dump scheme involving the token of the new DeFi experiment by yEarn Finance founder Andre Cronje.

On October 19, the developer posted on GitHub on GitHub the code for the third project in two months, Keep3r Network. It is a marketplace for developers’ tasks.

In Keep3r Network, the process of creating/approving requests is planned to be migrated to smart contracts. The native token KPR, which features a revenue-farming option, will serve as the project’s internal currency.

A group of bots and opportunistic traders monitored Cronje’s activity on GitHub and his Ethereum wallet, which was used to interact with Keep3r Network. Crypto investors were not deterred by the lack of an official launch notice and by the mention that the project was in beta testing.

Earlier in October, Cronje showed interest in tokens acting as liquidity bridges between different exchanges. As with KPR, users uncovered one of these tokens, LBI, on Uniswap. Despite the developer’s warnings, they orchestrated its pump and dump. At that time, the token’s daily trading volume reached $5.5 million.

Cronje paused his activity on Twitter for two weeks after threats against him. Those threats came from users who lost money on the hack of Eminence’s unfinished contract.

Earlier in October, a group of EMN Investigation investors opened a fundraising drive to finance a lawsuit against Cronje.

Bancor v2.1 became available on the Ethereum network

The Bancor project released the 2.1 update of its protocol, which has already been approved by the community and launched on the Ethereum mainnet. A key feature of the upgrade is liquidity staking with impermanent loss protection.

“Liquidity providers can finally stake with single-sided AMM exposure — while earning fees & protection from impermanent loss,” said project representatives.

1/ Bancor v2.1 passed the community vote earlier today & is now live on Ethereum mainnet!

Finally, LPs can stake with single-sided AMM exposure — while earning fees & protection from impermanent loss.

Stake at: https://t.co/fVdI1tWZvD

Guide: https://t.co/ezsBLg3f39

— Bancor (@Bancor) October 18, 2020

The protocol has been developed since 2017 and consists of several smart contracts intended to pool liquidity and execute peer-to-peer trades within a single transaction without intermediaries. Users stake BNT on automated market makers in exchange for a trading fee, rewards for staking BNT, and voting rights in Bancor DAO.

According to CoinGecko, the 24-hour trading volume of the BNT token was around $42 million, with $14.5 million of value locked in smart contracts.

Waves announces integration of Solana blockchain into Gravity protocol to grow DeFi

The Solana blockchain will become the first external element in Waves’ strategy aimed at mass-adoption of cross-network DeFi via the Gravity interoperability protocol. As a result, Solana will be available for data transfer between Gravity network participants.

Solana will initially be integrated as the target network, allowing the blockchain to operate with other connected networks, oracle systems and data services.

The native Solana token (SOL) will appear on exchanges on the Waves protocol and in future Gravity target networks. Tokens issued on Waves will be available on Solana.

Developers of Solana- and Waves-based dapps will gain access to Gravity’s oracle data. They will also be able to build cross-network dapps.

Synthetix launched derivative trading with infinite liquidity

Developers of Synthetix introduced a new product called Kwenta, offering the ability to trade synthetic cryptocurrencies, stocks and other assets.

Kwenta is live! 🥂

Derivatives trading with infinity liquidity is here.

Powered by the @synthetix_io protocol, Kwenta is a new interface for trading Synths.

— Kwenta (@kwenta_io) October 15, 2020

The platform is characterized by the absence of an order book and depth charts. Instead, the user sees price charts of two traded assets and an exchange window, somewhat similar to what is available on Uniswap.

The exchange is non-custodial and requires using a wallet such as MetaMask. The protocol’s complexity, however, implies somewhat high gas costs.

Binance grants to six DeFi projects

The cryptocurrency exchange Binance selected the first batch of projects that will receive grants from a seed fund with $100 million in capital.

Among the winners are the automated market makers AnySwap and BakerySwap, the data platform for gaming solution providers Arkane Network, the leading liquidity provider on the Binance Smart Chain – PancakeSwap, and the projects Bitquery and Proxima.

They were selected from 180 projects based on strict criteria: team, product, vision and contribution to the blockchain ecosystem. In total, the winners will receive $350 000.

Hodl Hodl launched a DeFi project for bitcoin loans

On October 22, Hodl Hodl launched a non-custodial P2P platform Lend at Hodl Hodl, enabling users to take loans secured by bitcoin.

The new platform requires no KYC procedure. Built on smart contracts, the structure provides a transparent collateral storage system.

“The first cryptocurrency has all the properties needed for DeFi, but until now no one has offered users the opportunity for P2P lending in bitcoin. We decided to change that,” said Hodl Hodl CEO Max Keidan.

The project opens a new market for the company – Lend at Hodl Hodl will be available to users in the United States.

American Regulator: DeFi will Change Banks’ Role in Society

Distributed ledger technology and DeFi will transform the traditional banking sector into an archaic structure, according to Brian Brooks, Comptroller of the Currency.

According to him, with the growth of decentralization, banks will lose their role as money aggregators. In the same way, the traditional postal service was disrupted by electronic services.

“People need financial services; they do not need banks,” said the head of the OCC.

Brooks did not rule out that in the future banks will focus on asset management and custody services. Instead of money aggregation they will take on the role of payment networks and become nodes within blockchains.

This path, however, will likely not be smooth. As stated by SEC Special Counsel Hester Peirce, the DeFi sector will challenge the regulatory framework and raise many difficult questions about what it really is and how it should be regulated.

ForkLog Exclusive

Yield farming is one of the hottest trends in the DeFi space. The DEX segment is no exception — many platforms have issued native tokens. Among such platforms is Uniswap, the leader by locked liquidity volumes.

Nevertheless, there are still DEXs that operate without native tokens.

DEX without a native token — relic of the past or viable direction?

Also we wrote:

- The R3 consortium announced a token for the DeFi sector.

- Opinion: governance token airdrops do not threaten DeFi project decentralization.

- Opinion: Neo could challenge Ethereum in the DeFi space.

- Anthony Pompliano: Amazon could disable many DeFi applications.

- The WLEO token fell to zero after its issuance by hackers.

- A user lost $140,000, becoming a victim of a DeFi scam.

Subscribe to ForkLog news on Telegram: ForkLog FEED — the full news stream, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!