DeFi Bulletin: Liquity launches on Ethereum and more than $100 billion in locked funds

The decentralised finance (DeFi) sector continues to attract heightened attention from cryptocurrency investors. ForkLog has compiled the most important events and news of the past weeks in this digest.

Key metrics of the DeFi sector

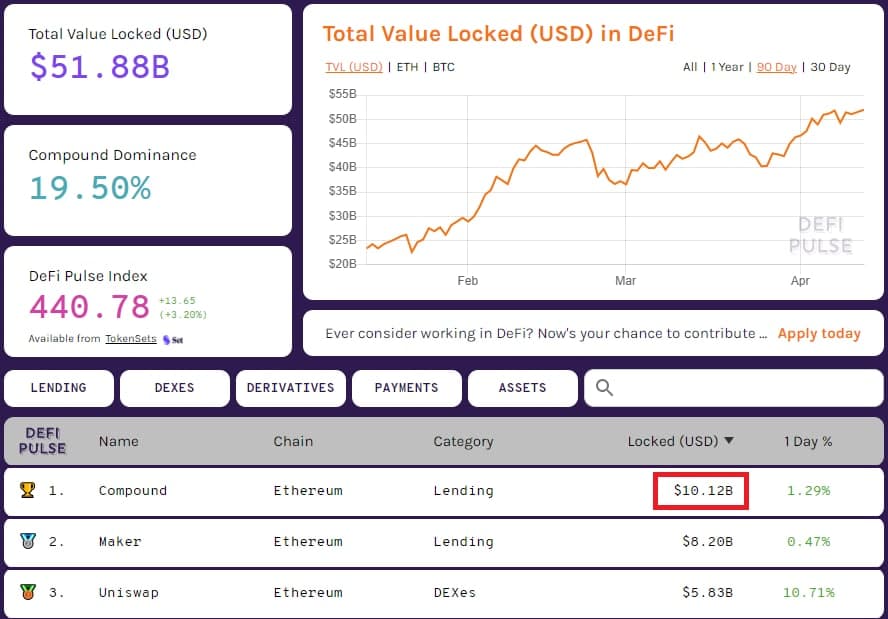

Total value locked (TVL) in DeFi protocols reached nearly $113 billion. The first and second spots are held by lending protocols MakerDAO ($8.56 billion) and Compound ($8.44 billion).

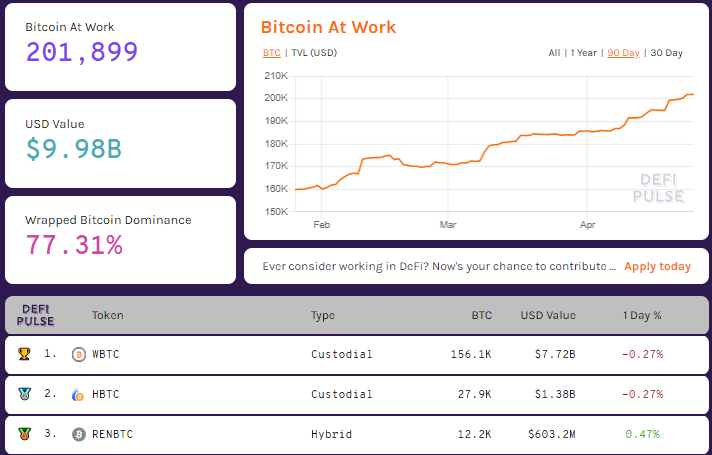

DeFi Llama includes in the final total a group of tokenised bitcoins. WBTC with $7.68 billion ranked fourth. hbTC with $1.37 billion ranked 20th.

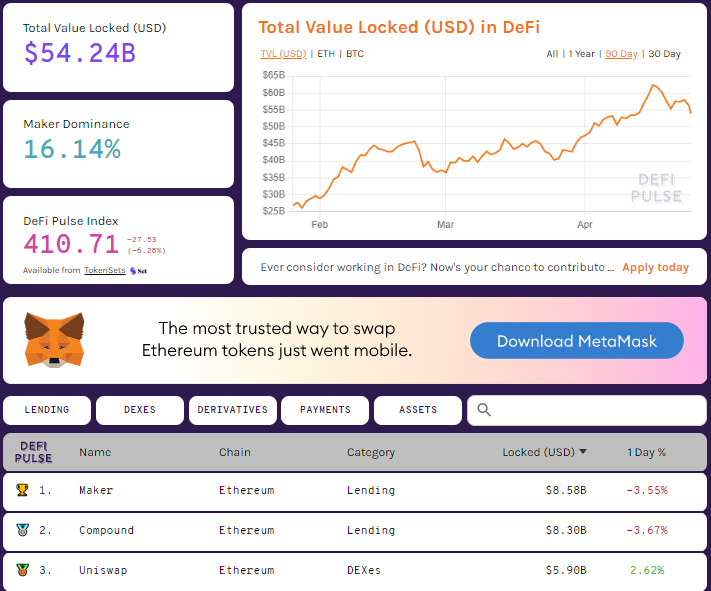

TVL in Ethereum applications reached $54.24 billion. Over the last 30 days, the figure rose by 25%.

The tokenised-Bitcoin segment began to fall. The combined market capitalisation of WBTC, HBTC and other Bitcoin tokens on Ethereum fell to $9.98 billion. Three weeks ago the figure stood at $11.03 billion.

Trading volume on decentralised exchanges (DEX) over the last 30 days totalled $67.8 billion.

53.8% of non-custodial exchange turnover comes from Uniswap. The second DEX by turnover is SushiSwap (19.4%), the third is Curve (10%).

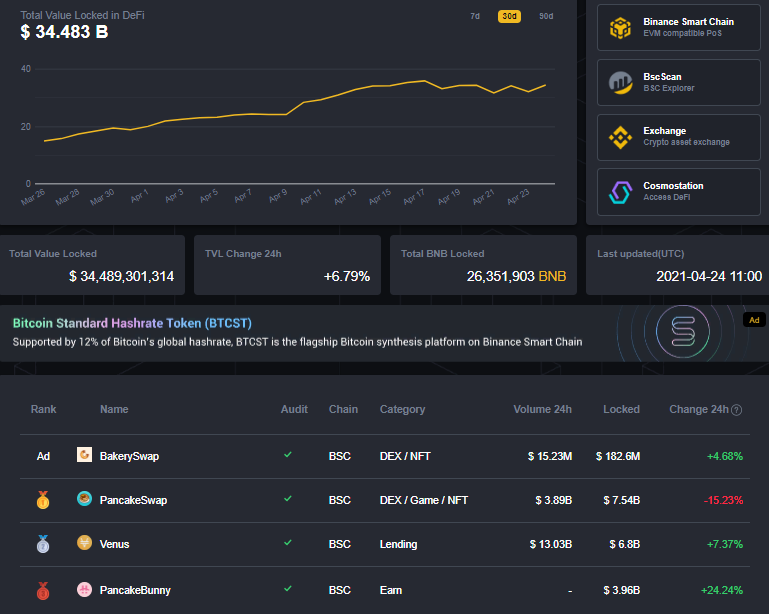

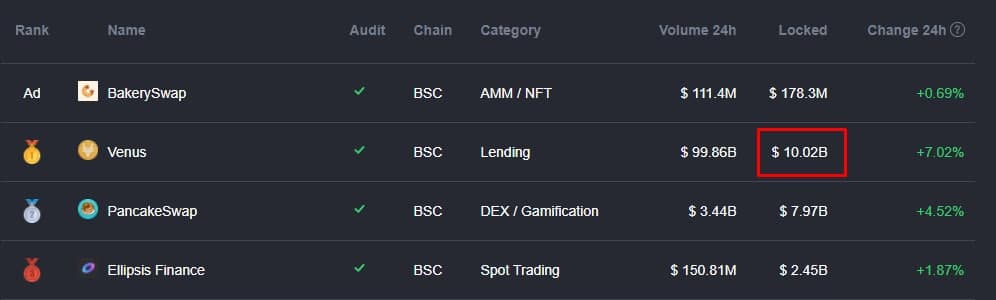

TVL of projects on BSC is rising decisively. The aggregate figure reached $34.49 billion, up 130% over the last 30 days.

Liquity protocol developers launched on Ethereum mainnet

On 5 April the launch of the Liquity lending platform on the Ethereum mainnet took place. The protocol offers zero-fee liquidity against collateral in the second-largest cryptocurrency by market cap.

Liquity uses an algorithmic monetary policy. Loans are issued in the USD-pegged stablecoin LUSD.

The minimum collateral ratio for a debt position is 110%. The corresponding value for the popular lending platform Maker is 150%.

LUSD can be contributed to the “stability pool.” The mechanism envisages regular liquidations of LUSD, with users rewarded in ETH and the LQTY governance token on a pro-rata basis.

Holders of LQTY can lock tokens in staking to receive a share of the fees charged by the protocol in Ethereum and LUSD.

TVL in Compound and Venus briefly surpassed $10 billion

On 12 April the Ethereum-based lending protocol Compound became the first DeFi project to surpass $10 billion in TVL. By the time of writing the figure had fallen to $8.3 billion.

On 13 April the Venus lending protocol on the Binance Smart Chain crossed a similar first threshold. By the time of publication the figure had fallen to $6.8 billion.

Price of Chainlink surpasses $44 all-time high

On 15 April the Chainlink (LINK) cryptocurrency rose to a new all-time high of $44 as the DeFi project’s 2.0 white paper outlining development plans was published.

LINK briefly returned to the top ten by market capitalisation with a valuation of $18 billion. At the time of writing the token had fallen to around $32.

Investments in DeFi

Binance’s venture arm led a strategic investment round of the startup MOUND, behind the development of Pancake Bunny on BSC.

The round included IDEO CoLab, SparkLabs, Andrew Lee of Handshake and other individual investors.

The raised funds will be used to expand platform functionality and create new products. Developers will add cross-chain collateral support and “smart vaults,” and optimise the DeFi service.

The project Enso Finance, aiming to build a platform for social trading within DeFi, raised $5 million from Polychain Capital, Beacon Fund, Multicoin Capital, P2P Capital, Spartan Group, Zola Global and The LAO.

The team says the platform will allow endless strategies incorporating all ERC-20 tokens available in the DeFi ecosystem and enable revenue farming integration.

Developers noted that via an intuitive interface users will be able to design their own strategies, follow and copy other traders, and combine different trading approaches.

Positioned as the first Layer-2 exchange protocol, Injective Protocol closed a funding round for $10 million from billionaire Mark Cuban, Pantera Capital, BlockTower, Hashed Ventures, CMS Holdings and QCP Capital.

The team will channel the funds into platform improvements, building a native trading venue and expanding the staff by 2022.

Hacks and scams

On 4 April the DeFi protocol Force DAO reported a hacker attack just hours after launch. The FORCE token shed 90% of its value.

According to the developers, attackers exploited a vulnerability in the smart contract. The team estimated the damage at 183 ETH (about $400,000 at the time of writing).

On 20 April the DeFi project EasyFi lost $6 million due to a hacking incident. CEO and founder Ankitt Gaur said attackers gained remote access to his computer and seized keys to the MetaMask wallet.

According to him, the attack was “well-planned.” The hackers managed to obtain USDT and DAI stablecoins and move 2.98 million EASY tokens. Gaur offered the hacker a $1 million bounty for the return of funds.

Also on ForkLog:

- The 1inch team unveiled the 1inch Network ecosystem.

- NEAR Protocol developers launched a “bridge” to Ethereum.

Follow ForkLog’s Bitcoin news in our Telegram — crypto news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!