DeFi Digest: TVL Keeps Rising as Euler Finance Hacker Returns $177 Million

The decentralized finance (DeFi) sector continues to attract heightened attention from cryptocurrency investors. ForkLog has gathered the most important events and news from the past weeks in a digest.

Key DeFi indicators

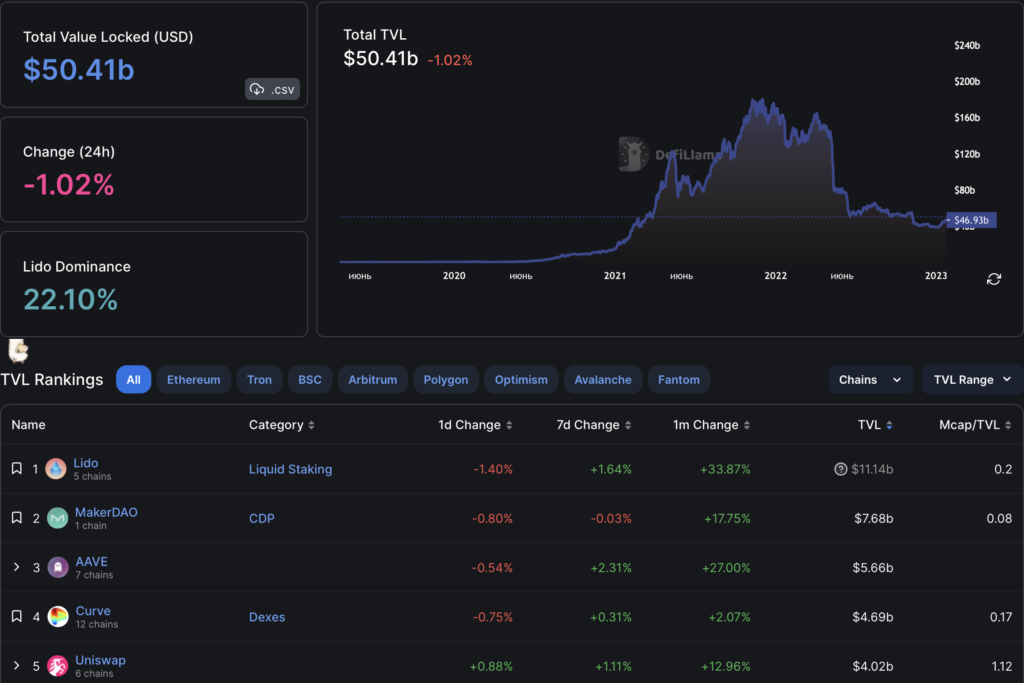

Total value locked (TVL) in DeFi protocols rose to $50.41 billion. Leading is Lido with $11.14 billion, while MakerDAO ($7.68 billion) and AAVE ($5.66 billion) hold the second and third spots respectively.

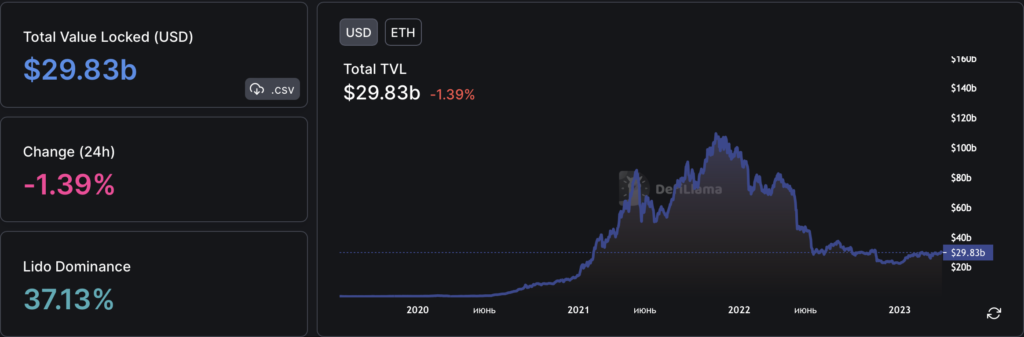

TVL in Ethereum applications rose to $29.83 billion. In the last 30 days, the figure increased by 4.4% (on March 8 the value was $28.57 billion).

Trading volume on decentralized exchanges (DEX) over the last 30 days was $127.4 billion.

Uniswap continues to dominate the non-custodial exchange market — accounting for 63.9% of total turnover. The second DEX by volume is PancakeSwap (10.8%).

Euler Finance hacker returns $177 million to the project

On March 25 the attacker who hacked the DeFi protocol Euler Finance returned a large portion of the stolen funds — over 58,700 ETH.

On March 27 the hacker sent the project another 22,214 ETH and $10.7 million in DAI. On April 3 the attacker returned the remaining assets to Euler Finance amounting to $31 million.

In total the hacker transferred $177 million, which represents 90% of the withdrawn funds. The remaining 10% — about $19 million — the hacker received as a reward that the project team had previously offered.

On March 13 Euler Finance was hacked using flash loans. The attacker withdrew assets worth $196 million from the protocol. In particular, the hacker stole more than 85,800 ETH.

Sentiment hacker returns $870,000 to the protocol

On April 4 the attacker exploited a re-entrancy bug on the Balancer platform to execute malicious code. He borrowed a flash loan on Sentiment, manipulated the data to inflate the collateral price and withdrew 536,738.4 USDC through the Synapse Bridge to the Arbitrum network .

Two days later the hacker returned 90% of the stolen funds. The protocol team sent the hacker a message offering a reward of $95,000 if the assets were returned by April 6. Otherwise, Sentiment would offer a similar reward for any information about the offender.

The MetaMask developer Taylor Monahan tracked the sequence of transactions — in total the hacker sent 465.75 ETH to the platform (roughly $870,000 at the time of writing), leaving 51.75 ETH as a reward.

Uniswap Labs loses exclusive rights to Uniswap v3 code

Third-party developers got the ability to fork the Uniswap v3 protocol. According to the project’s technical documentation, the Business Source License (BSL) expired on April 1, 2023.

BSL is a software license that restricts use for a period. In the case of Uniswap, until recently anyone could copy the software for non-commercial purposes, but for commercial products one needed permission from the entity behind the project.

As of April 1, the protocol code was released under the General Public License (open license), and Uniswap Labs no longer holds exclusive rights to it. This means developers can freely use it to deploy smart contracts on any available networks.

The community suggested that the change would lead to Uniswap forks on blockchains where the decentralized exchange is not yet present. Examples include Tron and Avalanche.

Uniswap noted that the DAO should decide which forks could be considered “official.” A proposal was put to the community suggesting that the organization supports only one fork in each network. For this fork to be considered official it must meet a number of criteria. For example, its code must be equivalent to the original.

Also on ForkLog:

- European DeFi project Li Finance attracted $17.5 million.

- Aave will integrate the BNB, StarkNet and Polygon zkEVM networks.

- The U.S. Treasury warned about the risks of DeFi services.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!