Derivatives traders hedge against Bitcoin sliding below $85,000

Puts cluster at $85,000 as traders hedge for a short-term bitcoin dip.

In the derivatives market, put options with an $85,000 strike are clustering — traders are bracing for a short-term drop in bitcoin below that level, reports CoinDesk.

In comments to the outlet, Derive.xyz analysts noted that 30-day implied volatility has risen to 45%. A persistent negative skew confirms strong demand for hedging instruments.

The long-dated skew has settled around -5%. That may signal lingering bearishness in the first half of next year.

“At year-end we are seeing clear defensive positioning,” said FxPro senior analyst Alex Kuptsikevich. “The uptrend that formed in late November has been broken, and the trading pattern looks more like October’s sell-off, when sharp rebounds failed to develop.”

A risk zone for Ethereum investors

For the leading altcoin, conditions are relatively stable. The short-term skew remains negative, but longer-term metrics have moved close to neutral. That suggests market participants do not expect a drawn-out decline.

Even so, into the 26 December expiry a large cluster of put options has formed at $2,500. That level is the key risk zone.

A potential reversal and a plunge to $10,000

Beyond short-term risks, experts warned of a possible reversal in the longer-term trend. Bloomberg Intelligence strategist Mike McGlone argues that the surge above $100,000 early in the year set the stage for a much deeper correction.

“Bitcoin’s rally to six-figure levels may have launched a cycle back to $10,000, possibly as soon as 2026,” the specialist noted.

In his view, periods of “extreme capital accumulation” often end with a sharp trend reversal. He warned that the trigger for the next economic downturn could be a crash in high-risk assets with, in effect, unlimited issuance.

On the other hand, McGlone noted bitcoin’s resilience: from the start of 2025 to mid-December the asset’s price has fallen by only 5%.

On-chain metrics, however, point to weakness. According to CryptoQuant, short-term holders have been sitting on unrealised losses for more than a month. Glassnode analysts noted that since July long-term investors have cut their positions by roughly 500,000 BTC.

The Fed factor

FxPro analyst Alex Kuptsikevich believes the rate cut was less a growth driver than a signal that the Fed‘s tight monetary policy had ended. That convinced investors to hold risk assets even during drawdowns.

“This patience helped bitcoin reach new highs earlier this year,” the expert noted. “But leverage remains high, and the October wave of liquidations showed how fragile pricing can be when positions are overly concentrated.”

In his view, geopolitics and leverage will shape market dynamics. Participants expect volatility to rise into year-end and are refocusing on hedging against sharp declines.

“Witching Friday”

Bitcoin traders are weighing risks associated with “witching Friday” in the U.S. stock market — the day when options and futures on indices and single stocks expire simultaneously.

The event is typically accompanied by a burst of trading activity and sharp price swings. Against a busy macro backdrop, the quarter-end contract roll could amplify volatility across asset classes.

“This week, global markets really are facing a multitude of overlapping factors,” — said in a conversation with Decrypt HashKey Group researcher Tim San.

He cited U.S. labour-market data and the Bank of Japan meeting as key events. Alongside the large derivatives expiry, they will shape liquidity dynamics and risk perception.

“It can have an effect, but typically an indirect one,” explained Caladan market maker Derek Lim.

According to him, the effect is transmitted through equity-market moves, which set risk appetite. In turn, that spills over to cryptocurrencies as assets with high beta.

Are institutions to blame?

San linked the spread of “risk-on” sentiment to bitcoin’s high correlation with the Nasdaq, which has strengthened due to inflows from large investors.

“When a large-scale derivatives expiry prompts position adjustments, institutions typically resort to cross-asset liquidity management. That means sharp volatility in U.S. equities can easily lead to passive rebalancing in crypto markets,” he said.

The historical record is mixed. Lim recalled that the March expiry sank prices, while June led to a 2% loss in bitcoin and Ethereum with a subsequent month of stagnation. In September, the impact was minimal.

Current gauges, including a put/call ratio at 1.1, point to caution. The picture is compounded by unstable inflows to ETFs and thinning liquidity ahead of the holidays.

It’s not straightforward

San noted that conflicting macro signals are adding pressure. A recent rise in U.S. unemployment has strengthened expectations of rate cuts in 2026, but other factors outweigh that positive.

“A possible tightening of Bank of Japan policy could lead to carry-trade unwinds and a flight of capital from highly volatile assets such as bitcoin,” the expert explained.

Gains are also restrained by doubts over the payoff from investments in the U.S. artificial-intelligence sector amid scarce liquidity.

Lim considers the stock market’s influence secondary and advises watching developments within crypto itself. In his view, the 26 December expiry on Deribit is far more important than the upcoming “witching Friday”.

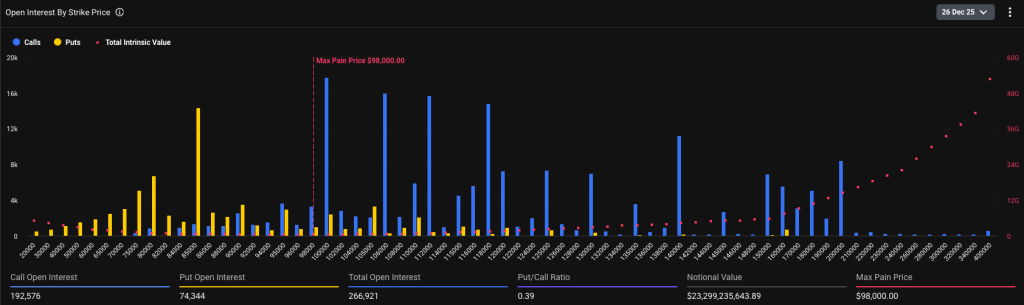

On that day, bitcoin options with a notional value of more than $13.3bn expire — over half of current open interest. The “max pain” level, at which most holders would incur losses, sits near $98,000.

San also pointed to seasonal pressure: at year-end, institutional investors traditionally rebalance portfolios.

“In this process, some players may reduce risk and lock in annual profits. That can create temporary selling pressure or heighten volatility in risk assets, including bitcoin,” the expert explained.

Analysts forecast choppy trading through the day, with a volatility peak into the U.S. close. The stock market’s influence on digital assets should remain moderate.

Earlier, a trader going by Roman suggested that bitcoin could fall to $76,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!