Ethereum ETF Experiences $152 Million Outflow

On July 25, the net outflow from spot Ethereum ETFs amounted to $152.3 million, according to SoSoValue.

Inflows into “new” Ethereum-based exchange-traded products were insufficient to offset the $346.2 million withdrawn by clients from Grayscale’s ETHE.

Trading volume fell from $1.05 billion to $955.9 million.

Inflows into CETH from 21 Shares and EZET from Franklin Templeton were zero, while other instruments saw inflows ranging from $6.2 million to $70.9 million. The leaders in this regard were BlackRock’s ETHA ($70.9 million), Grayscale’s ETH ($58.1 million), and Fidelity’s FETH ($34.3 million).

The net outflow from ETH-ETF since approval has reached $178.7 million. The AUM of these products stands at $8.97 billion.

BTC-ETF

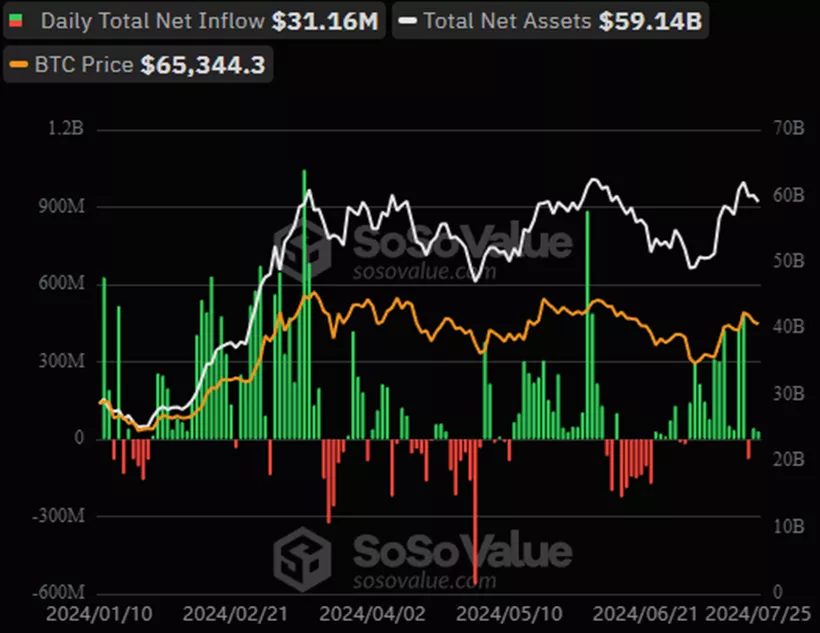

Spot Bitcoin ETFs continued to see positive inflows, with a net inflow of $31.2 million.

Investors contributed $70.8 million to BlackRock’s IBIT, surpassing the $39.6 million withdrawn from Grayscale’s GBTC. Other instruments saw no changes.

Cumulative inflows since the approval of BTC-ETF in January have reached $17.5 billion.

In a comment for ForkLog, trader Vladimir Cohen discussed the importance of ETH-ETF and the current state of the market.

Earlier, 10x Research also noted “signs of new problems” following the Ethereum sell-off.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!