Ethereum ETFs attract a record $2.8bn in a week

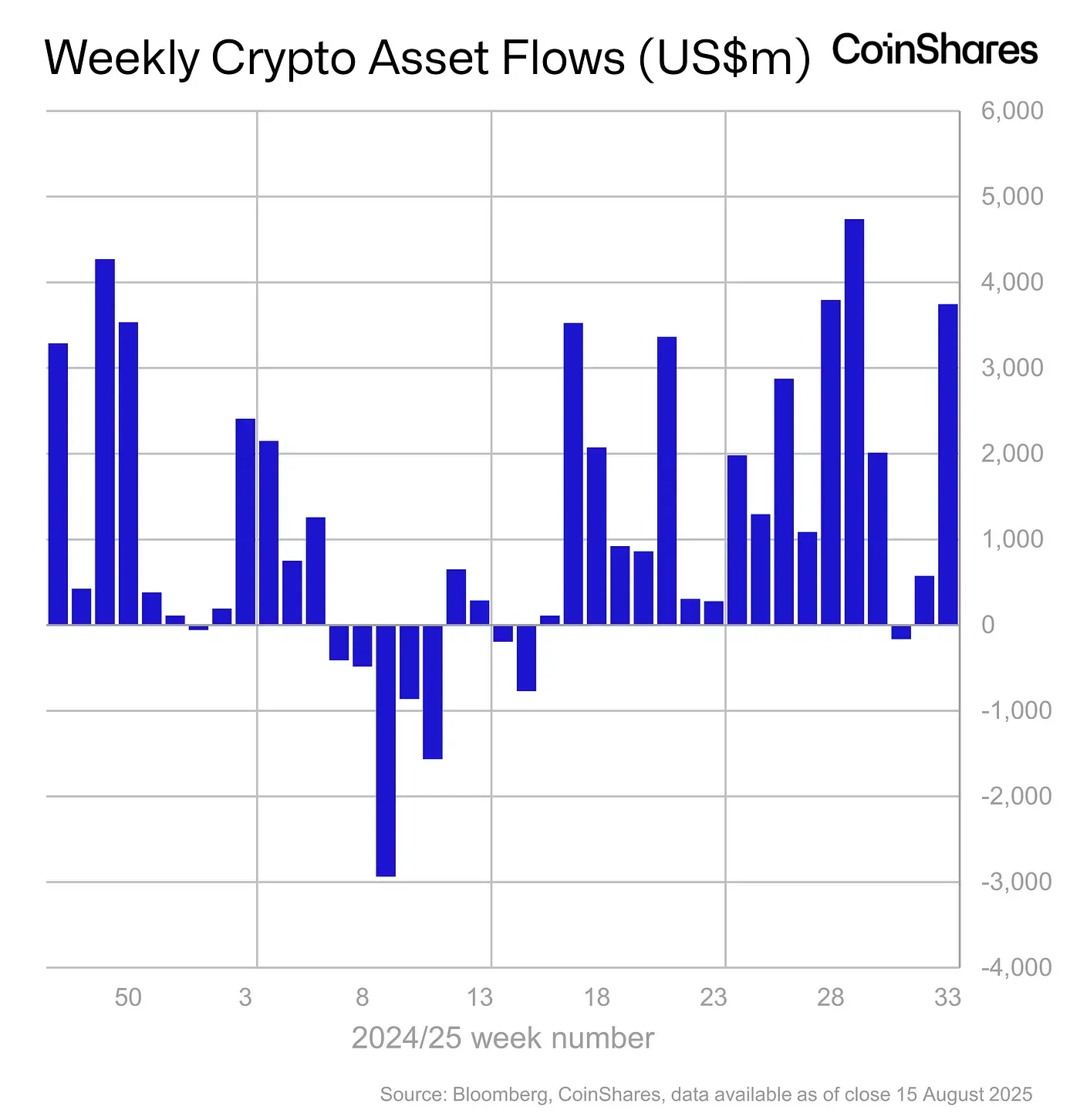

From 9 to 15 August, inflows into cryptocurrency funds reached $3.75bn. That was the fourth-largest weekly figure on record, according to the latest CoinShares report.

Since the start of the year, crypto-backed investment products have taken in $34.4bn. Assets under management (AUM) have exceeded $233.8bn, setting a new record.

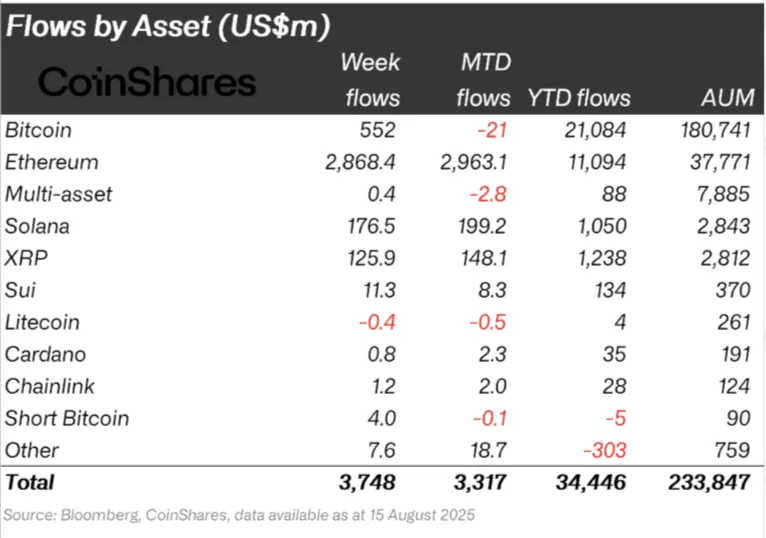

Ether-based funds led with a record $2.8bn of inflows, or 77% of last week’s total. The cumulative figure since January hit an all-time high of $11bn.

Bloomberg analyst Eric Balchunas also noted that weekly trading volumes in Ethereum ETFs topped $17bn, beating all previous records.

ETHSANITY: Ether ETFs weekly volume was about $17b, blowing away record, man did it wake up in July. It’s like it was asleep for 11mo and then crammed 1yr worth of action into 6wks. pic.twitter.com/uC5j91x78G

— Eric Balchunas (@EricBalchunas) August 15, 2025

“Damn, [Ethereum] really woke up in July. As if it had slept for 11 months and then crammed a year of activity into six weeks,” he wrote.

Meanwhile, vehicles oriented towards “digital gold” attracted $552m last week and $21bn year to date.

Investment products for Solana and XRP took in $176.5m and $125.9m, respectively. Litecoin-based funds saw $0.4m of outflows. Vehicles focused on TON lost $1m, CoinShares noted.

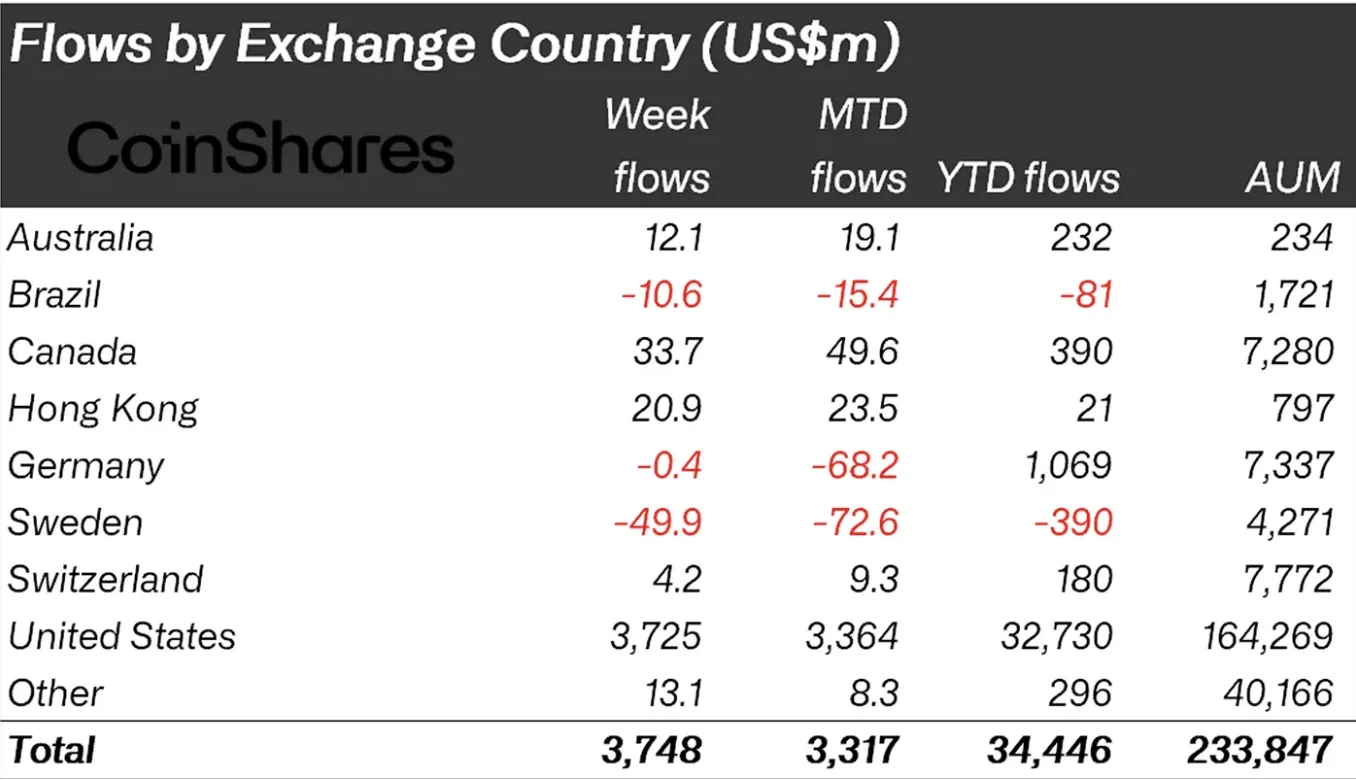

By region, the United States accounted for the bulk of inflows at $3.73bn. Canada came second with $33.7m, followed by Hong Kong at $20.9m.

Outflows were recorded in Brazil and Sweden—$10.6m and $49.9m, respectively.

Why Ethereum ETFs matter for the market

Amid record inflows, Ethereum came close to its 2021 all-time high of $4,878. On 13 August the cryptocurrency tested the $4,700 level.

At the time of publication, ether’s price had corrected to $4,269.

Analysts say that sustained inflows into Ethereum ETFs will be the key driver for a new ATH.

“The rally will continue as long as powerful capital flows and a positive narrative persist,” noted Nansen analyst Jake Kennis in a comment to Cointelegraph.

A trader under the moniker Langerius predicted that ether could rise to $10,000 at the current pace of investments in exchange-traded funds based on the asset.

Why is Ethereum rising?

Just look at these $ETH Spot ETF inflows

Since May, there have been consistent weekly inflows, some weeks seeing $1–2B coming in

If this continues for another month… $10K? pic.twitter.com/lpCu6tDewX

— LANGERIUS (@langeriuseth) August 13, 2025

According to a crypto investor using the pseudonym Ted, thanks to record inflows into Ethereum ETFs the next target for the cryptocurrency is $5,000.

$ETH ETF inflow + $2,852,100,000 last week.

Ethereum is going to $5,000. pic.twitter.com/EDc6ufjtlI

— Ted (@TedPillows) August 18, 2025

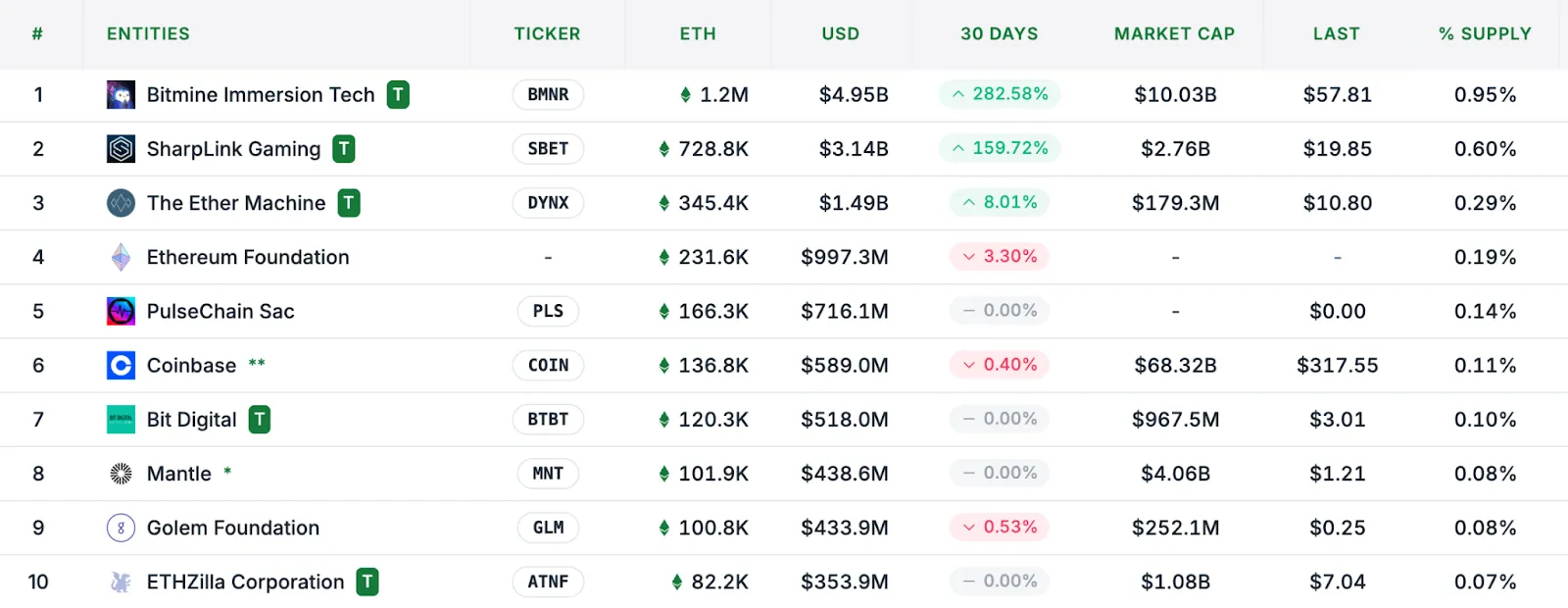

Earlier, Standard Chartered noted that the rise of the second-largest cryptocurrency by market value is also being supported by “treasury” companies such as BitMine and SharpLink. Since June, the companies have accumulated 3.8% of Ethereum’s circulating supply. This pace is almost twice that of bitcoin over the same period.

The experts raised their year-end ether forecast to $7,500. In their view, the price could reach $25,000 by 2028.

The Nasdaq-listed firm Bit Digital turned “in the black” after switching to accumulating Ethereum.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!