Ethereum records deflation for the first time since The Merge

Over the past seven days, Ethereum supply has contracted by 0.13%. Deflation in the network has been recorded for the first time since transition to the Proof-of-Stake consensus algorithm.

Issuance turned negative amid the launch of XEN Crypto. Over the past seven days, the project burned 3,780.7 ETH (~$4.8 million). By this metric it more than tripled Uniswap v3 (1,250.9 ETH).

Users flagged signs of a pyramid scheme in a project with a market capitalization not exceeding $0.5 million.

The best thing is that’s a ponzi

— nyax.eth (@bosfik2) October 9, 2022

«In the new scheme, a Ponzi token can be issued for free. Users are doing this by pushing up the gas price. I don’t care what project it is, but it has led to Ethereum’s deflation. Now that we’ve surpassed the 15.3 gwei barrier, you are seeing a reduction in supply», — said EthHub co‑founder Anthony Sasano.

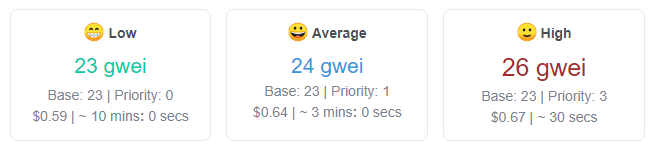

Average network fees jumped to 24 gwei.

После The Merge темпы эмиссии сократились на about 90% из‑за снижения вознаграждения валидаторам по сравнению с вознаграждением майнеров в рамках алгоритма консенсуса Proof-of-Work.

As ForkLog report notes, despite the successful The Merge upgrade, Ethereum’s price in September fell by 14.5%.

Read ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!