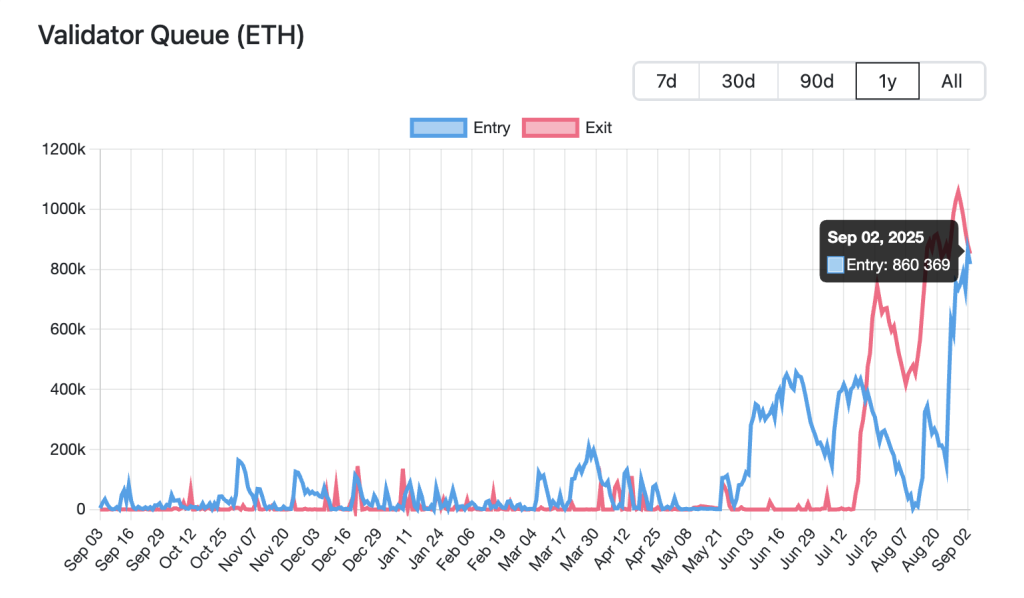

Ethereum Staking Queue Reaches Two-Year High

Volume exceeded 860,000 ETH, valued at $3.7 billion.

On September 2, the volume of Ethereum entering staking surpassed 860,000 ETH, valued at $3.7 billion, according to Validator Queue. This marks the highest level since September 2023, following the network’s Shanghai upgrade.

The average waiting time is 14 days.

At the time of writing, the figure had decreased to 817,213 ETH, yet remains at record levels. According to an expert known as everstake.eth, the surge in activity is attributed to several key factors:

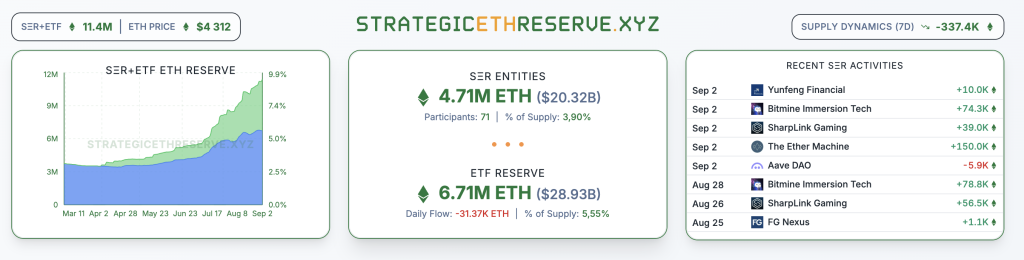

- increased confidence in Ethereum’s long-term value;

- favorable market conditions — on August 24, the altcoin reached an all-time high of $4946;

- low network fees at approximately ~0.2 Gwei, according to Etherscan;

- growing demand from institutional investors — public companies manage 3.9% of the second-largest cryptocurrency’s supply.

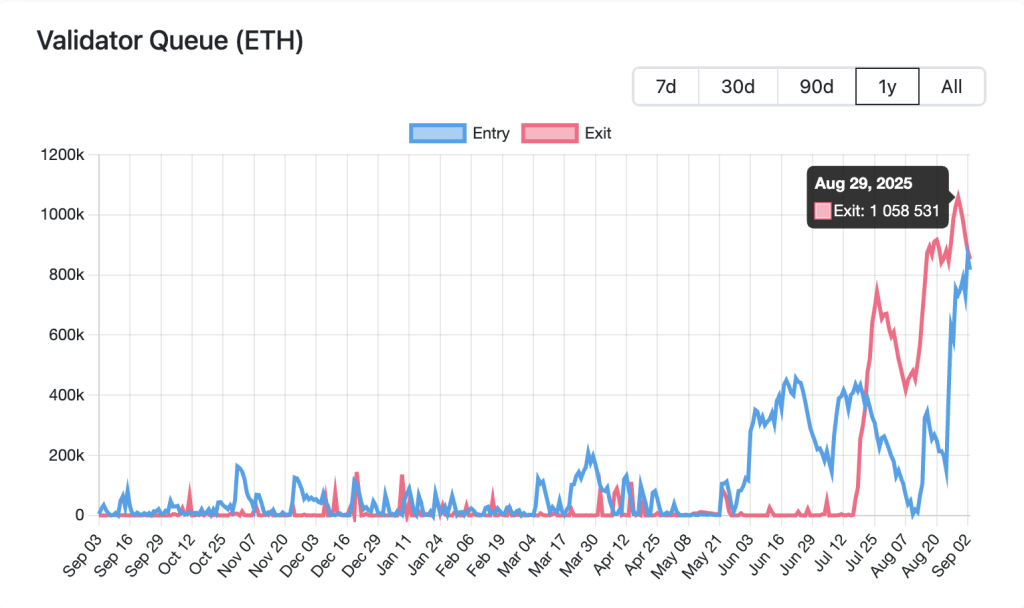

The queue for exiting staking decreased by 20% after reaching a record 1 million ETH on August 29, down to 851,931 ETH.

According to crypto analyst Bull Theory, the sharp increase in withdrawal requests was triggered by profit-taking and staking optimization by major players.

According to Ultrasound.Money, a total of 35.7 million ETH, worth approximately $162 billion, is staked in the network. This represents 31% of the total coin supply.

In the past 24 hours, Ethereum’s price has dropped by 2.1%. At the time of writing, the asset is trading at $4298.

Analysts have warned of a “bear trap” for the leading altcoin in September.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!