Ethereum’s Transaction Surge Linked to Spam Attack, Researcher Claims

Ethereum's transaction surge linked to spam attack, researcher claims.

The surge in activity on the Ethereum network, the second-largest cryptocurrency by market capitalization, may be attributed to a wave of address “poisoning.” This theory is supported by blockchain security expert Andrey Sergeenkov.

Record-high Ethereum activity that everyone’s celebrating is an address poisoning attack.

— Over $740K already stolen, and growing

— This became possible thanks to the Fusaka upgrade

— This attack is ongoing right nowhttps://t.co/cqoEvqttQd— Andrey Sergeenkov (@Nikopolos) January 19, 2026

In January, Ethereum reached a historic high in transaction numbers. The seven-day average of transfers approached 2.5 million, double the figures from the previous year.

Glassnode analysts also recorded a twofold increase in blockchain activity retention.

The expert suggested that the growth is due to a massive spam attack. Following the December Fusaka upgrade, which reduced fees by more than 60%, such schemes have become economically viable for fraudsters (conversion rate is 0.01%).

“I wanted to find out what caused the surge in address creation, and it turned out that this unusual 80% increase was due to stablecoin operations. Then I needed to understand their nature. I calculated how many users received less than $1 in their first transaction, and it turned out that 67% of wallets (3.86 million out of 5.78 million) fit this pattern,” Sergeenkov noted.

How Does Address “Poisoning” Work?

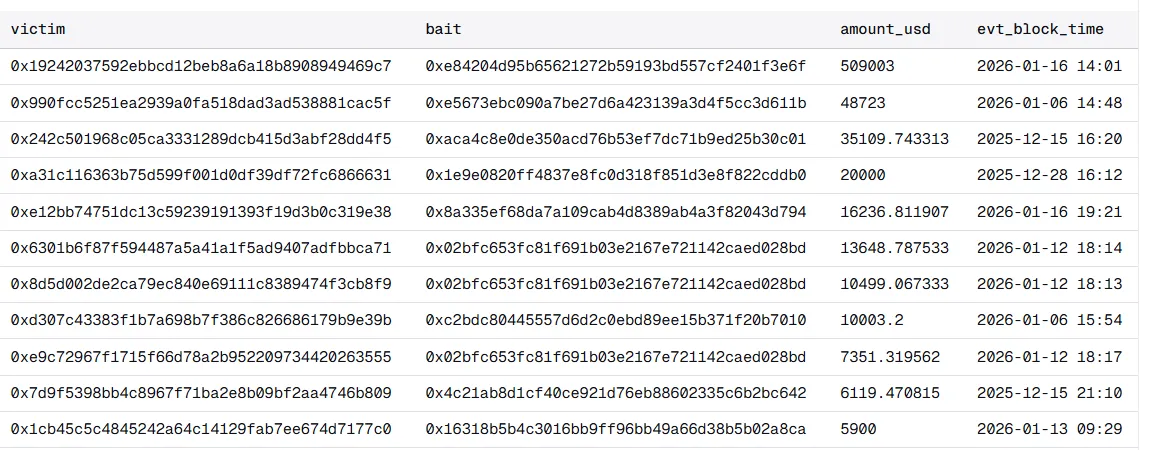

To identify scam addresses, the expert selected all USDT/USDC transfers of less than $1 from December 15, 2025, to January 18, 2026, and highlighted those that sent funds to at least 10,000 different wallets.

These addresses turned out to be smart contracts automating the mass distribution of “dust” to a vast number of random users to “clutter” their transaction history.

The essence of the attack lies in deception through similarity. Fraudsters deliberately generate addresses that visually resemble legitimate ones (e.g., matching beginnings and endings).

When a user later sees a “similar” address in their history, they might mistakenly copy it and send a large transfer to the fraudster, thinking they are sending funds to a familiar counterparty.

According to Sergeenkov, this method has already deceived 116 people, stealing over $740,000.

The researcher blamed Ethereum developers for the rise in attacks:

“You can’t scale infrastructure without first addressing user security issues! And while the industry celebrates record metrics, people are losing their funds because Ethereum developers improved the architecture for mass attacks,” he wrote.

Another Record

L2 network MegaETH achieved 47,000 TPS during testing.

Ok @megaeth you have our attention, we see you testing things out.

Over 45k TPS, that’s more transactions in 1 second than some chains have in a whole day. Excited to see this capacity put to good use! https://t.co/9AqJIOqJXv pic.twitter.com/LHuBfLrV6Q

— growthepie 🥧📏 (@growthepie_eth) January 16, 2026

“We see you testing the network. Over 45,000 TPS — that’s more transactions in one second than some chains process in a whole day. Can’t wait for this capacity to find useful application!” wrote growthepie.

Developers announced a “global stress test” on January 22. For a week, the blockchain will operate under intense load; the target is 15,000-45,000 TPS.

The MegaETH Global Stress Test

11B transactions in 7 days.

On Jan 22nd, we’re opening mainnet to users for several latency-sensitive apps while the chain is under intense sustained load.

Ultra-low fees. Real-time transactions.

Public Mainnet in the days that follow. pic.twitter.com/ZIOZnctCZJ

— MegaETH (@megaeth) January 19, 2026

The plan is to process 11 billion transactions.

Users will gain access to Web3 applications like stomp.gg, Smasher, and Crossy Fluffle. On the backend, the team will load the network with Ethereum transfers and swaps.

MegaETH positions itself as the “first real-time blockchain,” optimized for speed rather than decentralization, with a stated goal of exceeding 100,000 TPS.

Back in October, following a token sale, the project raised $1.39 billion — oversubscription exceeded 27x.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!