Inflows into Cryptocurrency Products Reach $2.17 Billion

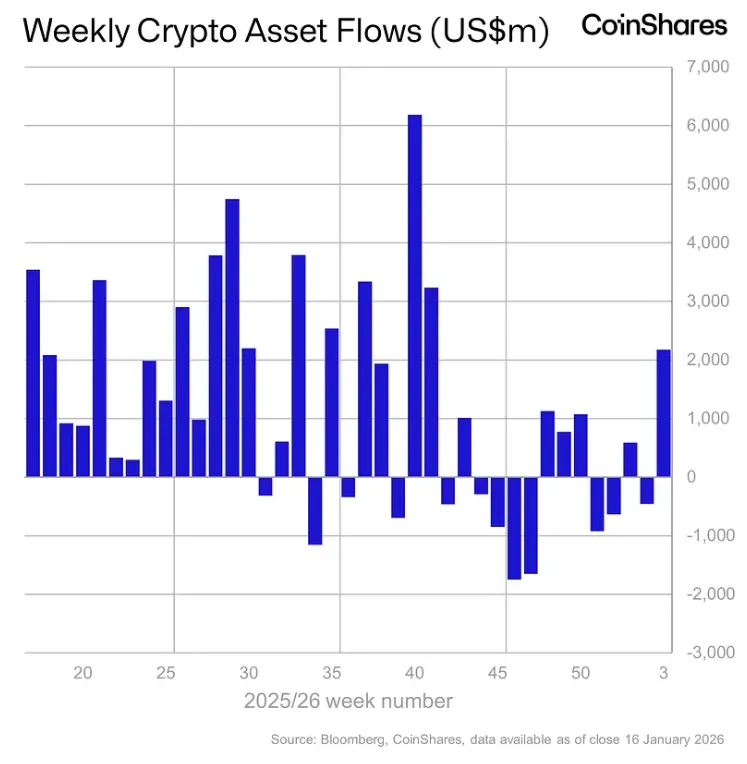

Inflows into cryptocurrency products reached $2.17 billion, a record since October 2025.

Between January 10 and 16, inflows into cryptocurrency investment products totaled $2.17 billion. This marks a record high since October 2025, according to a report by CoinShares.

The positive trend continued until January 16, but investor sentiment shifted by the week’s end. Daily capital outflows reached $378 million.

Experts attributed the reversal to a diplomatic scandal involving Greenland, threats of new trade tariffs, and uncertainty regarding the appointment of the head of the Fed.

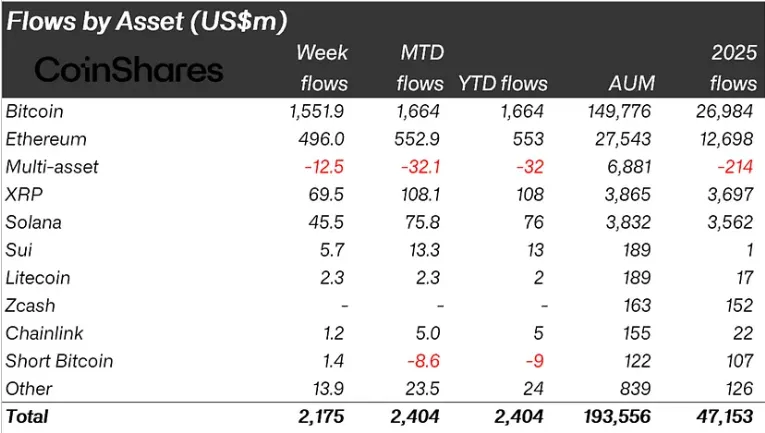

Bitcoin attracted the majority of funds, amounting to $1.55 billion.

Ethereum funds received $496 million, despite the U.S. Senate’s discussion of the Clarity Act. The bill potentially limits the yield of stablecoins.

Instruments based on Solana garnered $45.5 million. Positive dynamics were also shown by:

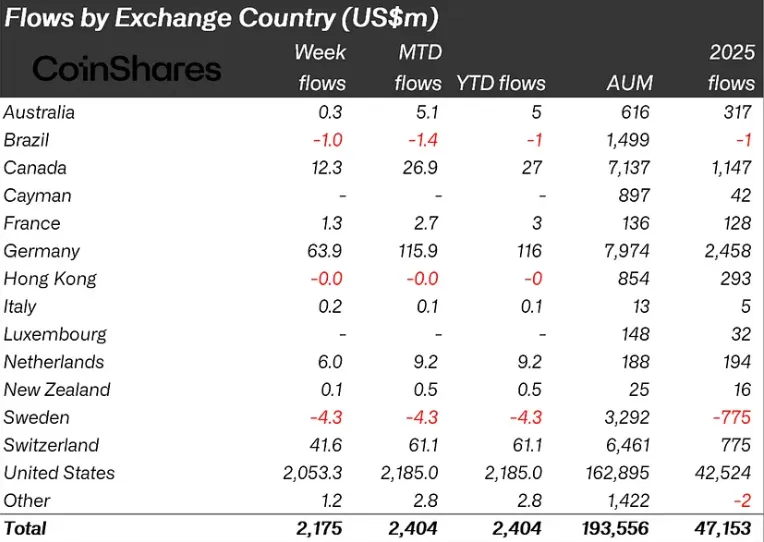

Regionally, the United States dominated with inflows of $2.05 billion. Germany ($63.9 million), Switzerland ($41.6 million), and Canada ($12.3 million) followed at a significant distance.

Blockchain company stocks also showed positive dynamics, recording inflows of $72.6 million.

Bitcoin ETFs

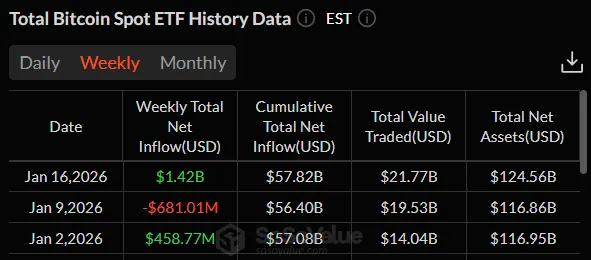

Last week, net capital inflow into U.S. spot Bitcoin ETFs reached $1.42 billion, the highest weekly figure since October.

The IBIT fund by BlackRock led in attracting funds, recording $1.03 billion in net inflows.

Nick Rak, Director of LVRG Research, suggested that the inflow into ETFs signals a resurgence of institutional demand and confidence in Bitcoin’s long-term prospects. He noted that continued coin accumulation could lead to a supply shortage and support price recovery.

However, the current price correction has led to a wave of liquidations. According to CoinGlass, the volume of forced position closures in the crypto market reached $874.53 million in a day. The main impact was on traders betting on price increases: long position losses amounted to $788.05 million.

CIO of Kronos Research, Vincent Liu, linked the decline to an overheated derivatives market.

“Bitcoin’s pullback to $92,000, despite strong ETF inflows, underscores the impact of derivatives. Excessive leverage amid low liquidity during the reversal triggered cascading liquidations,” explained the expert.

Liu added that structural support remains intact, but in the short term, digital gold is vulnerable to sharp downward movements due to leverage and liquidity factors.

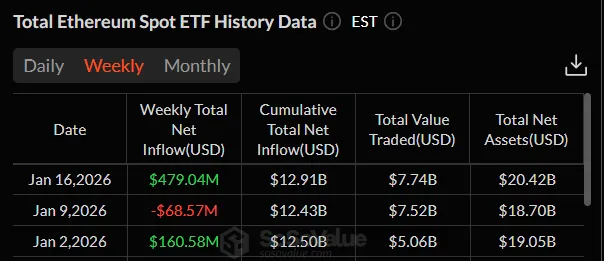

Spot Ethereum ETFs also demonstrated positive dynamics, attracting $479 million over the week, marking the best result since October.

Earlier, from January 2 to 10, cryptocurrency investment products recorded an outflow of $454 million.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!