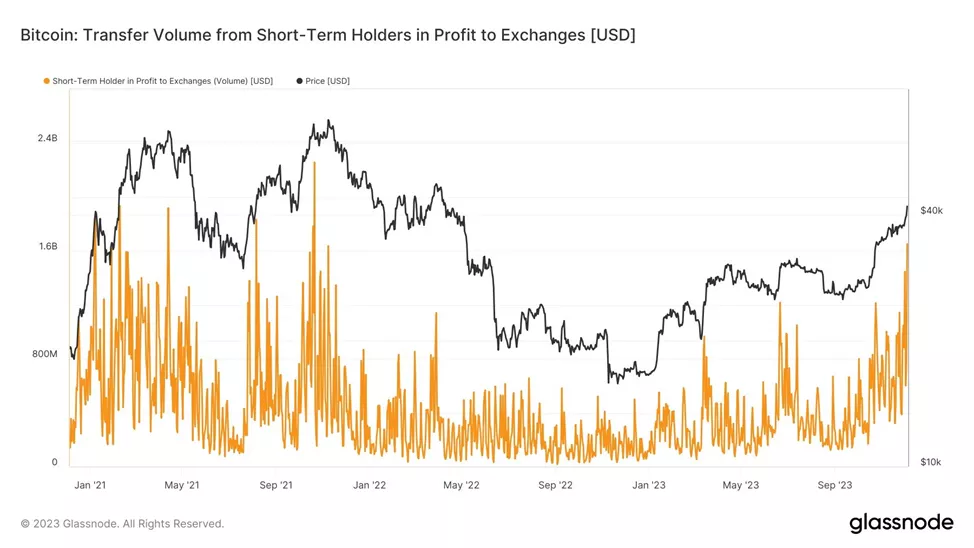

Expert identifies $5 billion of profit-taking by Bitcoin speculators

Digital gold faced a wave of profit-taking worth $5 billion, comparable to levels seen during the run to ATH near $69,000. Such estimates were provided by analyst James van Straten.

The figure corresponds to the dollar value of coins sent from wallets to exchanges between December 1 and December 4.

Speculators include those who hold coins for less than 155 days. Their activity helped form a trough in this year, Van Straten noted.

“By December 1, the price had reached $38,000. This threshold led to the most significant profit-taking by short-term holders since November 2021,” — the specialist said.

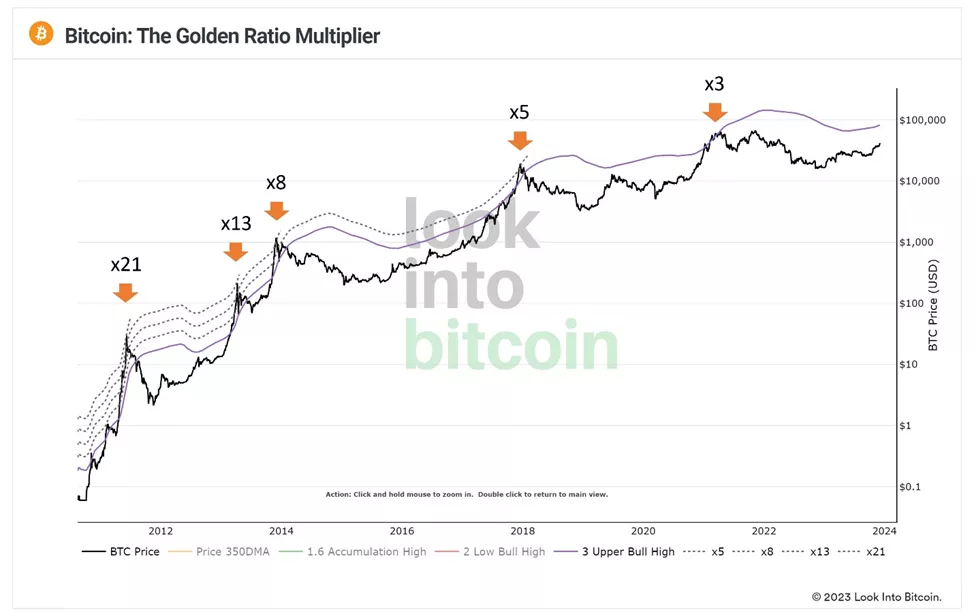

Philip Swift, founder of LookIntoBitcoin, highlighted Fibonacci ratios that were characteristic of previous bull markets.

“Metrics acted as resistance in early bull markets. The x1.6 (green line) is currently at $43,739 and continues to rise,” — he noted.

The specialist explained that higher levels “have successfully identified every cycle’s peak.”

IntoTheBlock researchers noted the steadfastness of hodlers who did not exit positions after surpassing the $40,000 psychological level. According to the analysts, long-term investors have increased holdings by 360,000 BTC since early November, to 13.8 million BTC.

Even with Bitcoin breaking $40k, long-term Bitcoin holders aren’t cashing out. In fact, they’ve upped their game, collectively acquiring over 360,000 BTC since early November. This group now holds over 13.8 million BTC.

?https://t.co/qWhryCeM0D pic.twitter.com/SLdSBTphtX— IntoTheBlock (@intotheblock) December 5, 2023

Earlier in December, Matrixport confirmed the forecast for Bitcoin to reach $63,000 by April 2024.

Earlier, Blockstream CEO Adam Back forecast Bitcoin to $100,000 in the coming months.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!