Crypto Market Enters a Stabilisation Phase, Experts Say

The cryptocurrency market is entering a phase of stabilisation.

The cryptocurrency market is entering a phase of stabilisation, marked by a sharp reduction in debt burden, seller exhaustion, and capitulation of short-term holders, according to analysts at Bitfinex.

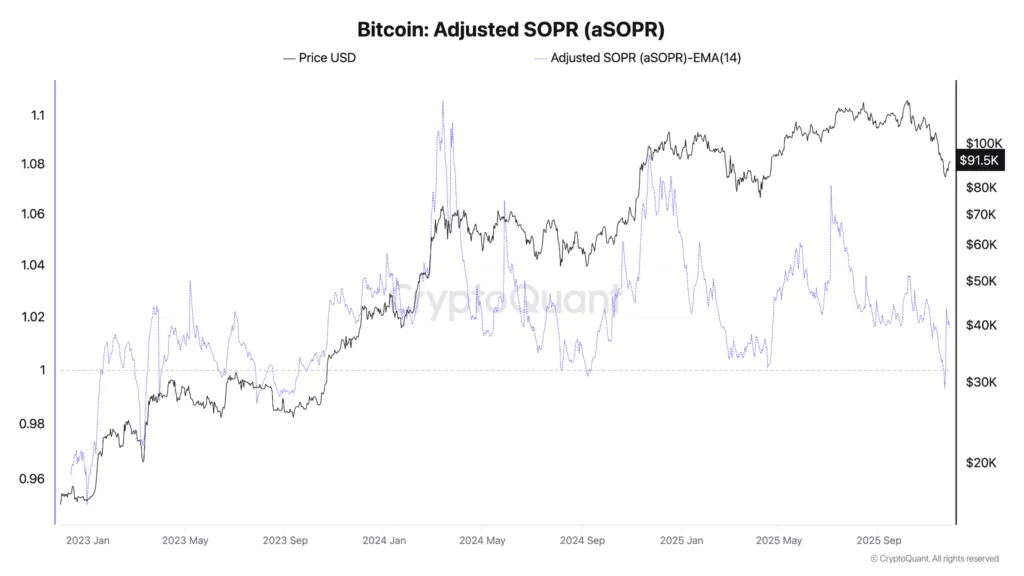

The report further supports this thesis with the dynamics of the SOPR indicator. During the recent correction, it fell below 1 for only the third time in the past 25 months.

A similar situation was observed at previous cyclical lows in August 2024 and April 2025.

However, the depth of the current downturn is highlighted by the adjusted realised losses of organisations, which have risen to $403.4 million per day. This significantly exceeds the figures of past major declines.

“Such a level of realised losses usually signals an approach to the end of capitulation, rather than the start of a deeper correction,” the analysts noted.

Data on derivatives also point to the beginning of a controlled reset: The total open interest in BTC futures has decreased to $59.17 billion, significantly below the peak of $94.12 billion. This indicates a gradual reduction in leverage.

The past week showed a clear strengthening of institutional integration of Bitcoin, noted Bitfinex. According to BlackRock’s reports, the reserves of the IBIT fund in its strategic portfolio increased by 14%. The total volume of acquired shares reached 2.39 million.

According to experts, even traditionally conservative bond funds are now using Bitcoin-ETF as diversification tools.

Simultaneously, ARK Invest continued to invest in digital assets despite liquidity pressures in the sector. The firm purchased shares of crypto companies worth $93 million last week.

“Supporting this institutional momentum, Texas became the first US state to publicly invest in Bitcoin […]. Despite modest scale, this move is symbolic and marks the beginning of a transition to direct Bitcoin custody once the necessary infrastructure is ready,” the study’s authors emphasised.

Earlier, analysts at Glassnode noted similarities between the current dynamics of the cryptocurrency market and those of 2022.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!