Bitcoin’s Current Pattern Mirrors 2022 Dynamics, Glassnode Analysts Say

Glassnode sees echoes of early 2022 in bitcoin as 25% of supply sits at a loss.

The overall market structure increasingly resembles the first quarter of 2022, which preceded a deep correction, Glassnode analysts said.

Echoes of Early 2022

Bitcoin stabilizes above the True Market Mean, but market structure now mirrors Q1 2022 with over 25% of supply underwater. Demand is weakening across ETFs, spot, and futures, while options show compressed volatility & cautious positioning.

Read the full… pic.twitter.com/DYxi9c9zWe

— glassnode (@glassnode) December 3, 2025

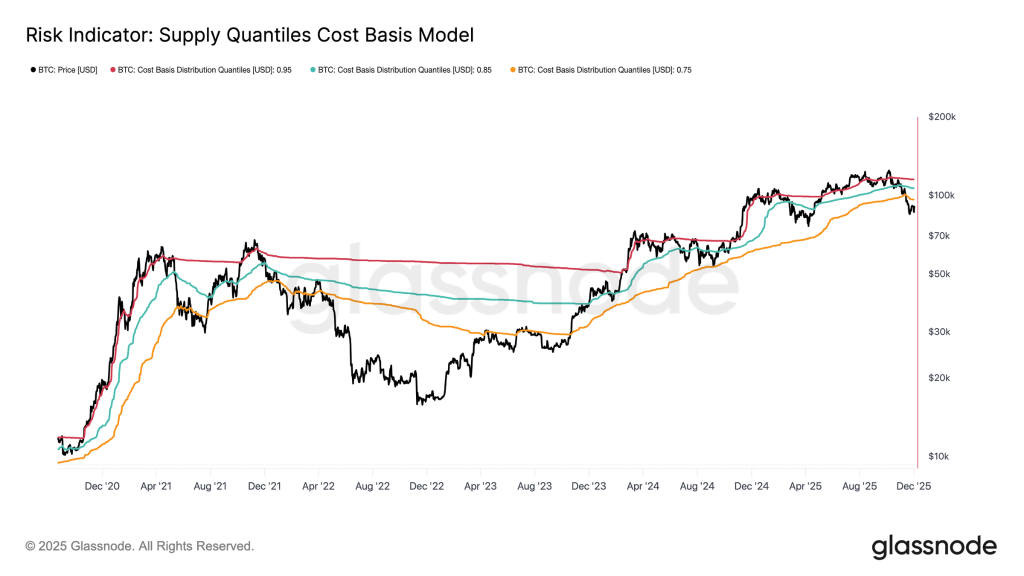

The resemblance is corroborated by a Supply Quantiles Cost Basis model, which tracks the entry price of the largest coin clusters. Since mid-November bitcoin has fallen below the 0.75-quantile (around $96,100), leaving roughly a quarter of the supply underwater.

This has created a highly unstable equilibrium. On the one hand, there is a risk of capitulation by large holders; on the other, a chance that sellers are exhausted and a bottom forms.

Market resilience will remain in doubt until the price can hold above the 0.85-quantile (~$106,200), which now acts as critical resistance. Until then, any negative macro event could easily disrupt the “fragile balance”.

Pressure is rising, but there is a backstop

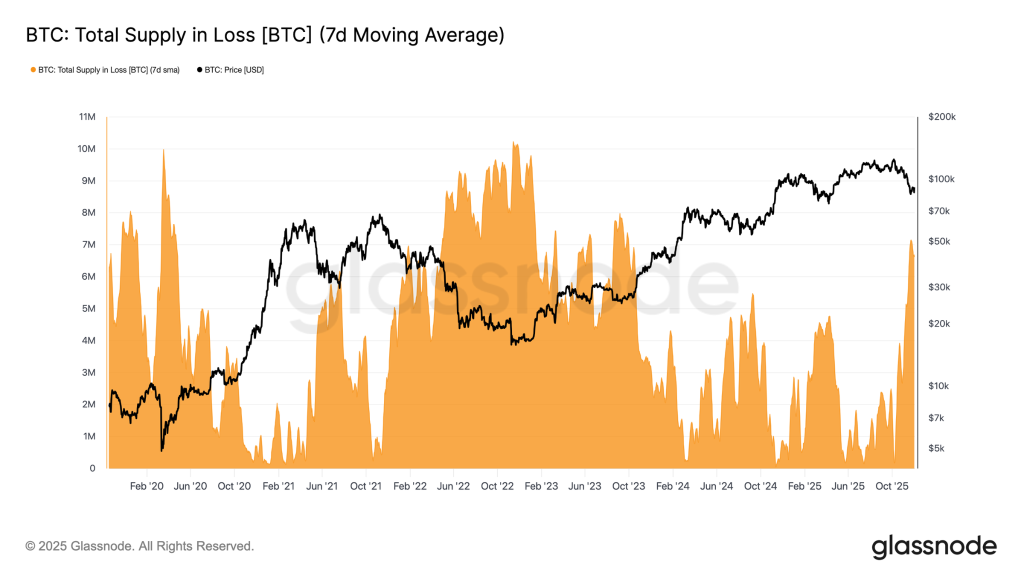

The share of coins at a loss points to heavy pressure. The seven-day moving average reached 7.1m BTC last week, the highest since September 2023. Investors’ unrealised losses are now at their highest level of the two-year bull market.

The current range of underwater supply (5–7m BTC) is almost identical to early 2022, when the market entered a prolonged sideways phase.

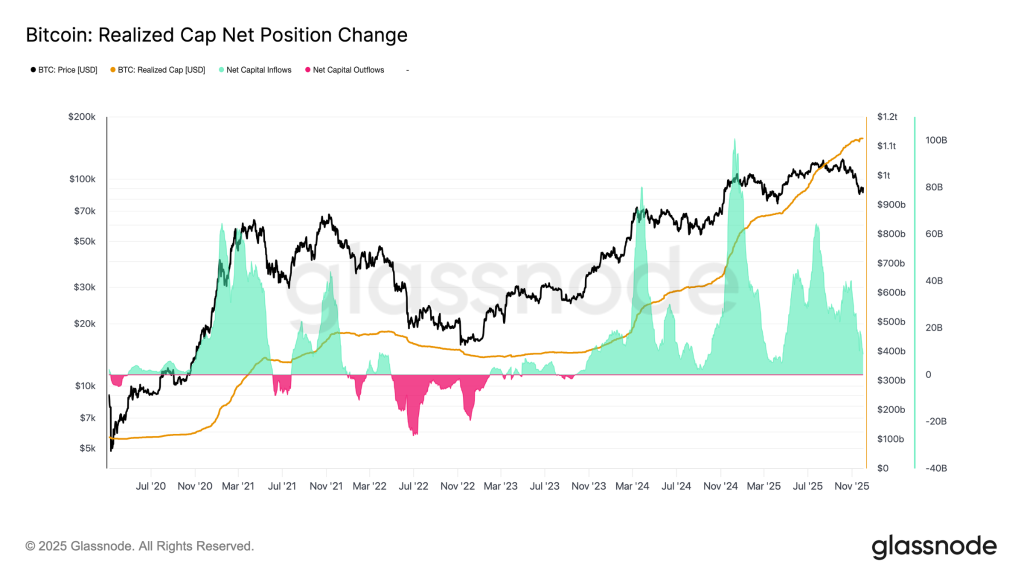

Despite the grim parallel, one important difference remains: a positive net inflow of capital. Net Change in Realized Cap has increased by $8.69bn per month.

Although below the summer peak of $64.3bn, this helps explain why the price is finding support at key levels and holding above $90,000, the experts noted.

Long-term investor activity underscores a mixed picture. The SOPR index (30-day average) has fallen but remains above 1 (1.43). This implies they are still realising profits.

However, profit margins are narrowing, mirroring early 2022 ahead of a lengthy range-bound phase.

“Although demand momentum is relatively stronger than in early 2022, liquidity continues to decline, making it crucial for bulls to hold above the True Market Mean until a new wave of demand arrives,” the analysts noted.

An unpopular view

Amid active institutional participation, many in the crypto community have questioned the relevance of bitcoin’s cycle theory, which holds that the cryptocurrency rises for three years and falls for one.

Analyst Axel Adler Jr still regards this pattern as the most reliable.

We’ve spent the last three years rising from $16K to $125K without COVID-level shocks, Luna/FTX-scale collapses and yet the talk about the death of the four-year cycle keeps getting louder. It’s amusing how easily people ignore Bitcoin’s most reliable pattern: three years up, one… pic.twitter.com/OXIAc8lsFi

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) December 3, 2025

“We’ve spent the last three years rising from $16,000 to $125,000 without COVID-level shocks, collapses on the scale of Luna/FTX, and yet the talk about the death of the four-year cycle keeps getting louder. It’s amusing how easily people ignore Bitcoin’s most reliable pattern: three years up, one year down, unfailingly since 2009,” he wrote.

In his view, institutional demand remains important but does not change the fundamental rhythm of digital gold.

“BlackRock’s clients do not buy at any price; they go through the same emotions: FOMO, fear and capitulation, as everyone else. And the sooner the market accepts this, the lower the odds of missing the next big move,” the expert noted.

Growth drivers

K33 analysts highlighted three dominant “fear narratives” that have lately filled the media. According to the firm’s head of research, Vetle Lunde, these issues are either premature or overstated.

- Quantum threat. Theoretically about 6.8m BTC could become vulnerable if sufficiently powerful quantum computers emerge. However, timelines for such technologies remain undefined.

- Forced sales at Strategy. Although management has not ruled out the possibility of selling bitcoins, there are no signs of preparations to sell.

- Tether reserve concerns. The issuer’s financials point the other way.

Countering the short-term worries, the experts pointed to several emerging medium-term factors that could form a strong foundation for growth.

By February 2026, US regulators are due to issue new rules for 401(k) retirement savings, potentially opening a $9trn market to bitcoin.

In the coming months, Congress is also expected to pass a market-structure bill — the CLARITY Act. This would accelerate asset tokenisation and could legitimise using the first cryptocurrency as collateral in the banking system.

A shift in the rhetoric of the Fed could also favour digital assets. The leading candidate for the post of the new chair is crypto-friendly Kevin Hassett.

At the time of writing, bitcoin is trading around $93,100. Over the past 24 hours the asset has risen by 0.6%, and by 2.1% over the week.

Earlier, Glassnode and Fanara Digital analysts reported a decline in the first cryptocurrency’s volatility.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!