Experts Note a Slowdown in Bitcoin Profit-Taking

In recent weeks, the pace of profit-taking by hodlers has decelerated. The market has reached a balance between long-term holders and the influx of fresh demand, according to Glassnode.

Discover more in the latest Week On-Chain below?https://t.co/a0VGutY5x2 pic.twitter.com/hJceAii1T5

— glassnode (@glassnode) April 10, 2024

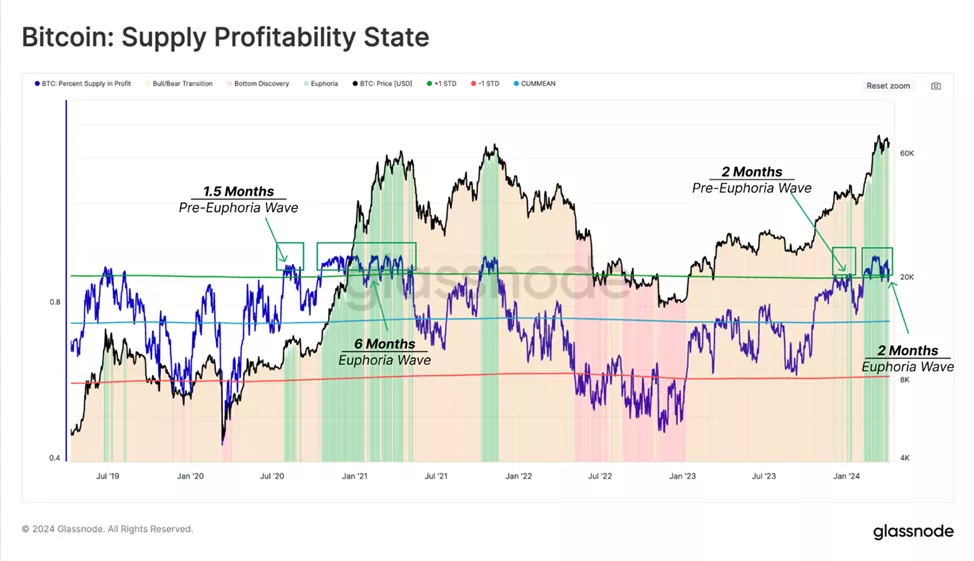

Experts illustrated the situation with a chart showing the average share of “profitable” coins and levels of one standard deviation (SD) in both directions.

According to their observations, periods when the indicator exceeds 95% coincide with the market’s rise to the previous ATH (pre-euphoria stage), as well as breaking beyond it (FOMO).

“We can observe a general pattern in the operation of this tool in the previous cycle. The early stage of the rally led to testing +SD […]. After a period of correction and consolidation, the market finally rises and surpasses the ATH, resulting in the metric rising significantly above 95%,” analysts wrote.

The growth of unrealized profits creates an incentive for profit-taking. The next chart shows the total weekly volume of realized profits, normalized by capitalization for cycle comparison.

After the price rose to the peak of the 2021 bull market, the indicator reached a maximum of 1.8%. In other words, over a seven-day period, investors realized a positive financial result equivalent to 1.8% of capitalization. This is a significant figure, but it falls short of the profit-taking intensity during the January 2021 rally (3%).

Based on these data, specialists reached the following conclusions:

- Profit-taking, typically by long-term investors, tends to intensify with ATH updates.

- Local and global market peaks are often observed after major events related to the realization of positive financial results.

- One investor’s profit is accompanied by demand from a buyer on the other side. This provides insight into the scale of new capital inflow.

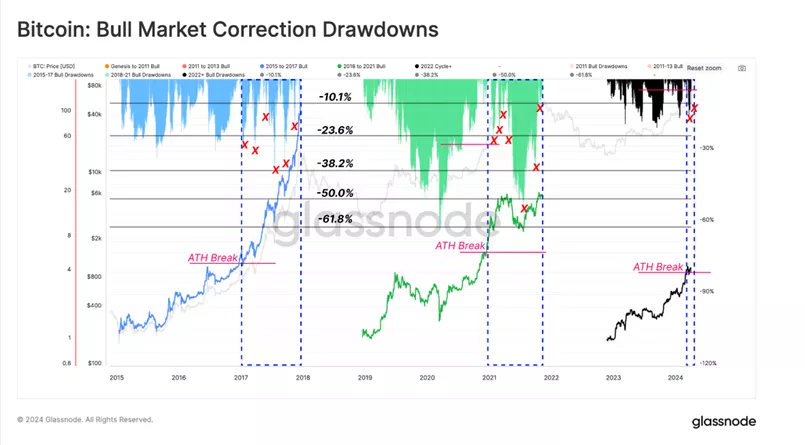

Analysts also noted that amid the large-scale wave of long position closures in March, the magnitude of pullbacks remained historically small.

“If we compare the ATH breakout in previous cycles, it can be argued that the current phase of euphoria is still relatively young. In previous phases, there were numerous price dips exceeding -10%. Most of them were much deeper, and more than 25% was a common occurrence,” experts explained.

Since the ATH breakout in the current phase, there have been only two corrections of more than 10%.

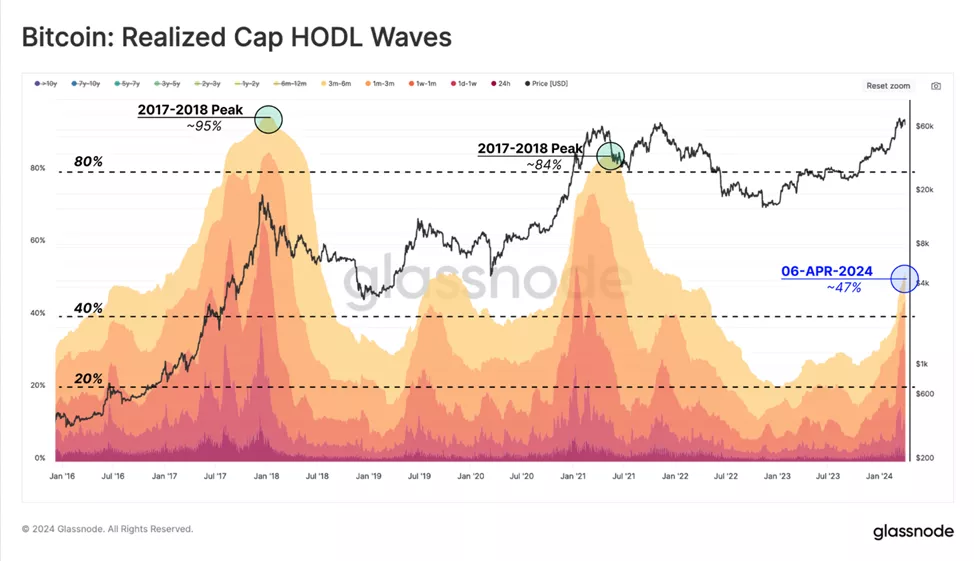

Experts also concluded that the sale of coins by hodlers is roughly balanced by fresh demand. This is confirmed by the influx of new investors through the growing share of assets held by bitcoins younger than six months in the context of the Realized Cap HODL Waves metric.

During the last two bull markets, the share of “wealth” held by coin holders “aged” less than six months ranged from 84% to 95%. Since the beginning of 2023, the figure has increased from 20% to 47%.

On April 10, bitcoin fell below $68,000 amid accelerating inflation in the US.

Earlier, analysts at Grayscale identified macroeconomic factors such as high inflation and the key interest rate as the main barriers to the growth of the first cryptocurrency in the short term.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!