Fear index drops to April levels as analysts see a ‘turning point’ for bitcoin

Not all market participants are optimistic.

As the leading cryptocurrency slipped below $109,000, the Fear and Greed Index fell from 44 to 28 points. Analyst Michael Pizzino called the current setup a “turning point.”

MORE fear and a HIGHER price.

Could this be the turning point Bitcoin and Crypto has been waiting for?

The analysis looks good, but it has not been confirmed.

I explain all in this video:https://t.co/FiZUJCb4Ry pic.twitter.com/PCoT7r2370

— Michael Pizzino (@PizzinoMichael) September 26, 2025

The expert pointed to an emerging divergence between bitcoin’s price and market sentiment.

The last time the index dipped below 30, digital gold traded around $83,000. A few days earlier, the asset had breached a local low near $75,000.

Against this backdrop, Pizzino suggested that conditions may be favourable for a reversal.

“Could this be the turning point that bitcoin and the crypto market have been waiting for? The analysis looks convincing, but it has not yet been confirmed,” he added.

The Santiment platform recorded a spike in “buy the dip” mentions after the leading cryptocurrency fell below $112,000 early in the week. Analysts suggested this could indicate a near-term rebound: prices often move counter to crowd expectations.

“A negative narrative is forming on social media. After dropping below $114,000, euphoria quickly gave way to fear. However, its level is not yet high enough to speak of a true market capitulation — like that seen in early April (due to US President Donald Trump’s trade tariffs) or mid-June (amid geopolitical turmoil),” the experts said.

Santiment highlighted two “encouraging signals”:

- whales continue to accumulate digital gold — since 27 August, wallets holding 10–10,000 BTC have bought another 56,327 BTC;

- bitcoin supply on exchanges is falling — over four weeks the metric declined by 31,265 BTC.

According to the analysts, these factors reduce selling pressure and limit the potential for further downside.

Not everyone is so optimistic

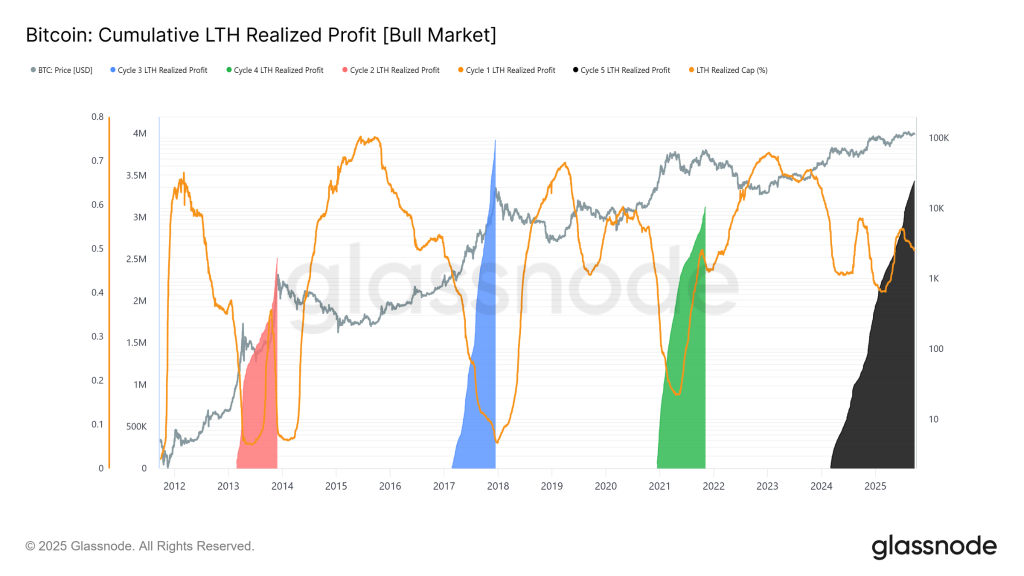

Meanwhile, Glassnode analysts forecast a deeper correction amid signs of “overheating”. In their view, long-term holders have sold 3.4 million BTC in the current market cycle.

The share of profit-taking in the total volume of coins moved has exceeded 90% three times, and the market has just passed the third such peak.

Historically, such surges have coincided with key cycle tops, increasing the likelihood of a “cooling” phase, the experts noted.

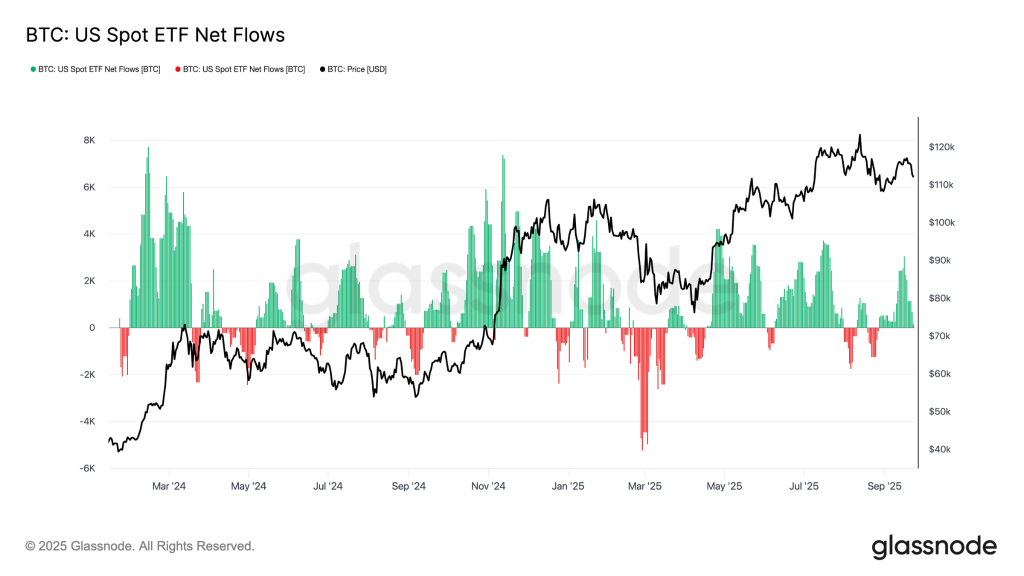

They also pointed to a slowdown in inflows to bitcoin ETFs, which had previously offset selling by long-term holders.

During the period around the most recent meeting of the Fed, the volume of realised coins surged to 122,000 BTC per month. Meanwhile, net inflows into exchange-traded funds fell from 2,600 BTC per day to almost zero.

“The combination of rising sell-side pressure and weakening institutional demand has created a fragile market setup, laying the groundwork for a decline,” Glassnode said.

Markus Thielen of 10 Research did not rule out a fall in the leading cryptocurrency to around $107,000. Earlier, QCP analysts warned of a risk of a decline towards that level.

At the time of writing, the asset is trading at $109,500.

Analysts are split on the outlook for digital gold.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!