Fed cuts key rate; bitcoin holds at $117,000

Investors expect further monetary easing

On September 17 the Fed cut its key rate by 0.25 percentage points to 4–4.25%, the first reduction since December 2024. The outcome matched investor expectations and market reaction was muted.

“Recent data indicate that economic activity slowed in the first half. Job gains have moderated and the unemployment rate has edged up, while remaining low. Inflation has risen and remains elevated,” the statement said.

On the news, the price of the first cryptocurrency briefly dipped below $115,000. By the time of writing, it had recovered to $117,000.

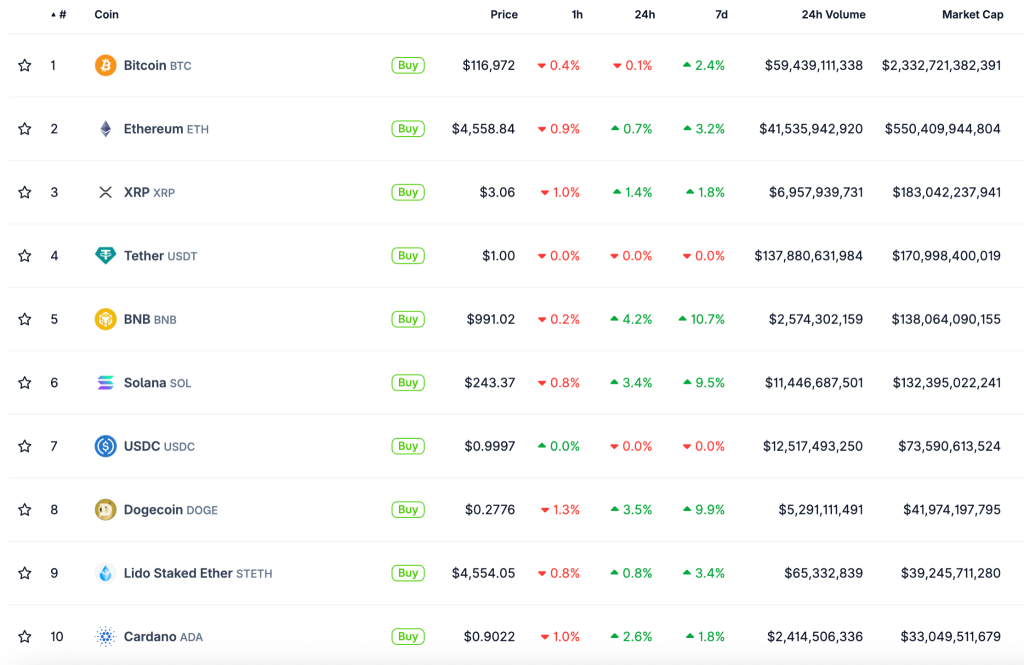

Ether rose 0.9% over the past 24 hours to $4560.

Among the top ten cryptocurrencies by market value, Solana, Dogecoin and Cardano posted the biggest gains. BNB also made the leaderboard, having set a new all-time high of $994 on September 18.

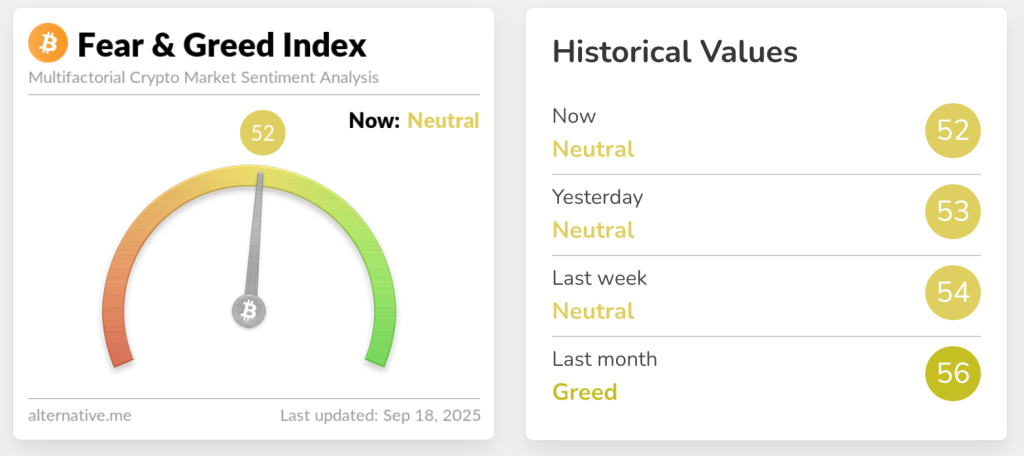

The Fear and Greed Index remains in neutral territory—down one point over the past 24 hours and now at 52.

What next?

At a press conference, Fed chair Jerome Powell said the FOMC had not reached a consensus on further monetary easing.

“Ten of the 19 Committee members project two or more cuts in the policy rate by year-end, while nine project either fewer cuts or none at all,” he said.

According to the median projections in the Fed’s quarterly Summary of Economic Projections, rates are expected to be:

- 3.6% by the end of 2025;

- 3.4% by the end of 2026;

- 3.1% by the end of 2027.

Ahead of the meeting, experts were split on how the Fed’s decision would affect bitcoin. Fundstrat co-founder and BitMine chairman Tom Lee predicted a “grand rally” in bitcoin and Ethereum next quarter.

He said the price of digital gold could reach $200,000 by year-end.

Crypto analyst Ted Pillows forecast a correction in the first cryptocurrency to $92,000 before a new leg higher.

In the view of Kraken economist Thomas Perfumo, the market will rise—but not yet. He believes further cuts to the key rate will matter most for digital assets.

“Investors are projecting rate normalisation around 3–3.5%. Given the non-linear impact on asset prices, the next 100-basis-point reduction could have a more significant effect than the previous one,” he said in a comment to The Block.

Earlier, the co-founder of the ETH Strategy protocol, known as Clouted, said the dollar was “useless” amid bitcoin’s rise.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!