Fusaka upgrade: what it means for Ethereum’s future

The second-largest cryptocurrency has finally stirred after a prolonged slump, particularly visible in the ETH/BTC pair.

Despite a recent outperformance rally, ether still trades nearly 50% below its all-time high of ~$4900 set in November 2021. Rising competition from DeFi ecosystems on Solana, BNB Chain and, paradoxically, Ethereum’s own layer-2 (L2) solutions is taking its toll. The latter are meant to help scale the base chain but have, in practice, siphoned off a large share of on-chain activity.

Developers, however, are steadily laying the groundwork for comprehensive upgrades. One of the latest — Pectra — improved L2 efficiency, added smart-contract functionality to wallets and restarted the deflationary mechanism.

The next phase will be the Fusaka upgrade, slated for year-end. ForkLog examined this ambitious, strategically important update and how it could shape Ethereum’s future.

Lingering problems

Ethereum faces criticism for stagnant on-chain activity on the base chain — the Dencun hard fork sharply reduced L2 costs, to which transaction volumes migrated. Markets have therefore come to see ETH as less valuable, Sygnum’s experts reckon.

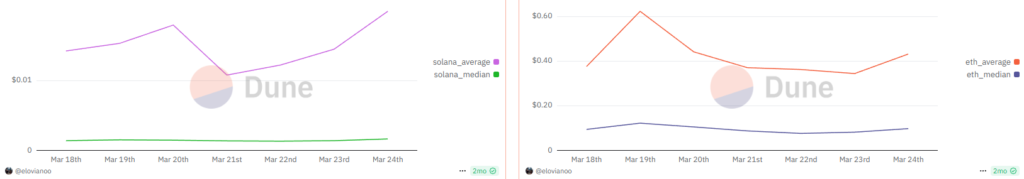

On many key metrics the network trails Solana: for most users, speed and low fees seem to outweigh the degree of decentralisation.

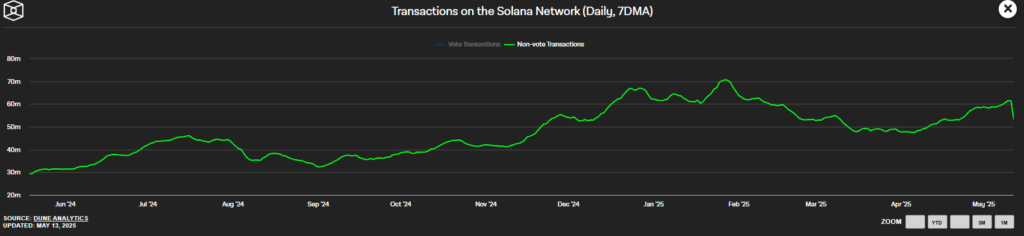

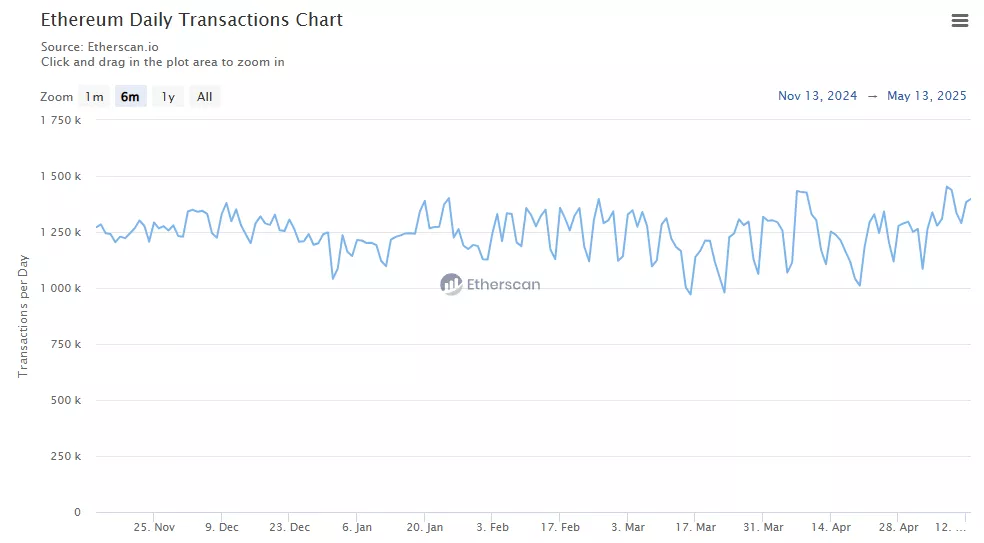

Each day the “people’s” network handles 30–60m transactions. Ethereum’s layer 1 manages just over 1m.

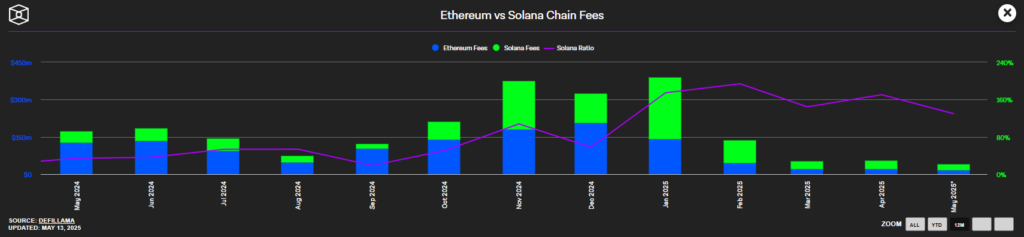

Fee revenue on Solana already exceeds that of the second-largest crypto network.

Ethereum also trails Solana and now BNB Chain by aggregate DEX turnover.

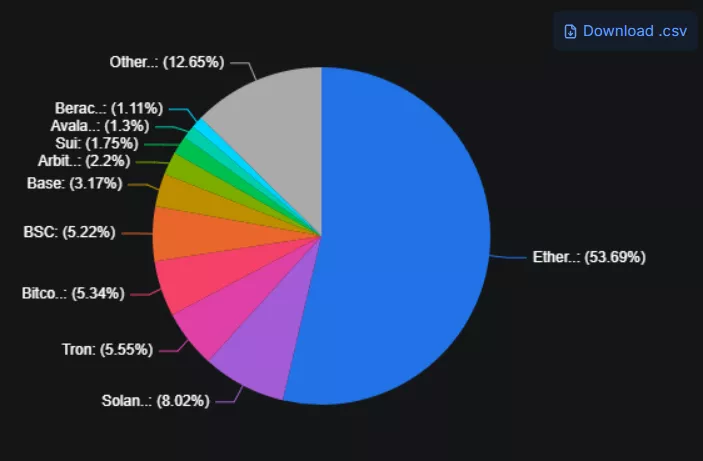

Although the lion’s share of TVL in DeFi is still on ether, competition is intensifying. Ethereum’s share of the ecosystem will likely soon drop below 50%.

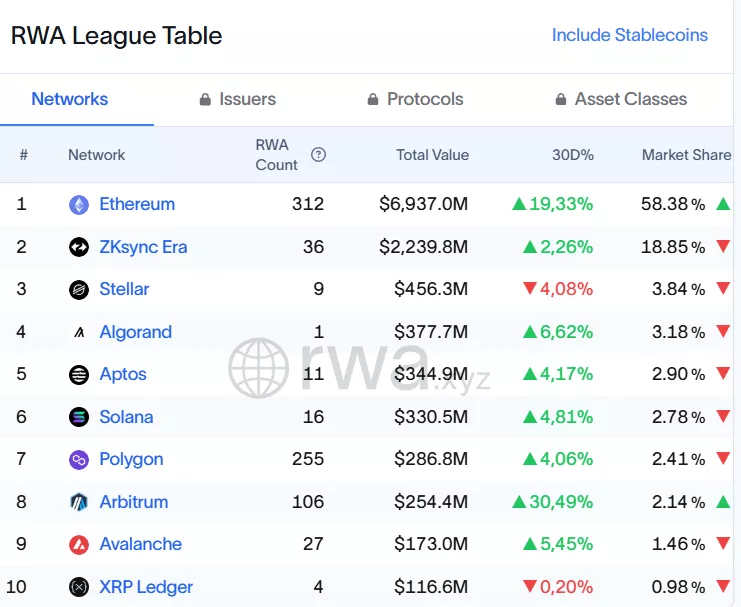

On the other hand, there are no convincing signs that Solana will surpass Ethereum as the preferred blockchain for institutions.

Ether dominates tokenisation, which is popular among traditional financial institutions.

Yet opinions are being voiced that Solana will overtake Ethereum by the number of consumer decentralised applications (dapps).

To withstand the intensifying competition and retain leadership, Ethereum needs comprehensive upgrades that improve scaling and UX.

What did Pectra change?

On 7 May the Pectra upgrade went live. The largest update by number of proposals was activated at epoch 364,032.

The upgrade bundles a series of improvements aimed at convenience and efficiency. It includes 11 key EIP.

One important change adds smart-contract functionality to wallets, simplifying their use and recovery.

The update also doubled storage for scaling L2 networks and improved the UI for validators.

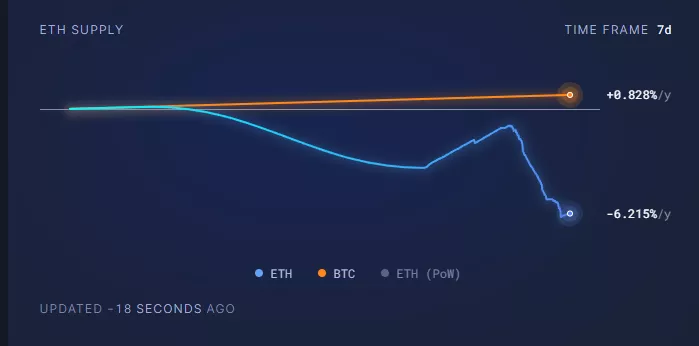

Shortly before activation, some argued that Pectra would not “boost” Ethereum’s price. The upgrade, however, helped restore ether’s deflationary model.

Binance partner and Web3 growth manager Kas Abbe believes that a pick-up in burning “within hours of Pectra’s activation” supported the price. He forecasts it will reach $3000 in the second quarter.

“If ETH burning intensifies, the supply problem will be solved, and that will ultimately attract demand,” Abbe suggested.

Pectra did reinforce the burn: more data in blocks (EIP-7691), more complex transactions (EIP-7702) and the ability to batch have meant more ETH is being destroyed than created.

The update increased BLOB capacity per block, doubling throughput for ZK and optimistic rollups. A higher volume of transactions carrying large binary payloads boosts fee revenue that is automatically burned.

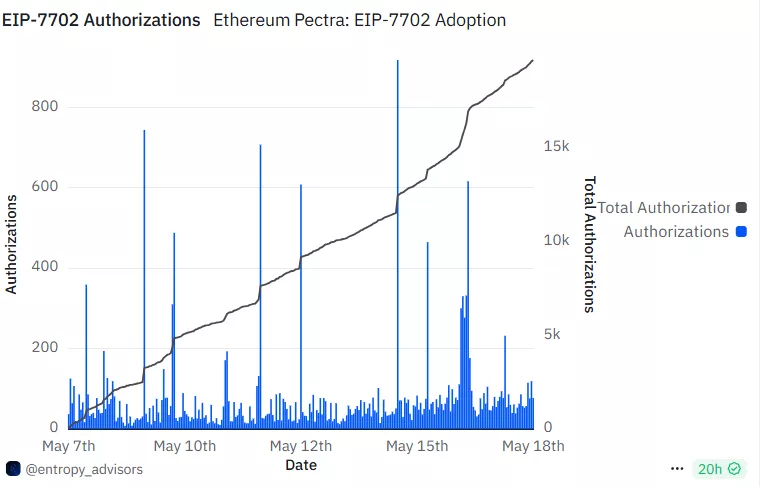

Exchanges, wallet providers and dapp developers are showing keen interest in the new features. This is evident in the surge of smart-account authorisations under EIP-7702 — more than 19,000 since Pectra’s activation.

Post-upgrade, a regular EOA address can delegate operations to a smart contract by setting a special flag. When a transaction arrives, the corresponding code runs instead of the standard logic. Delegation can be revoked at any time — control over funds remains with the owner.

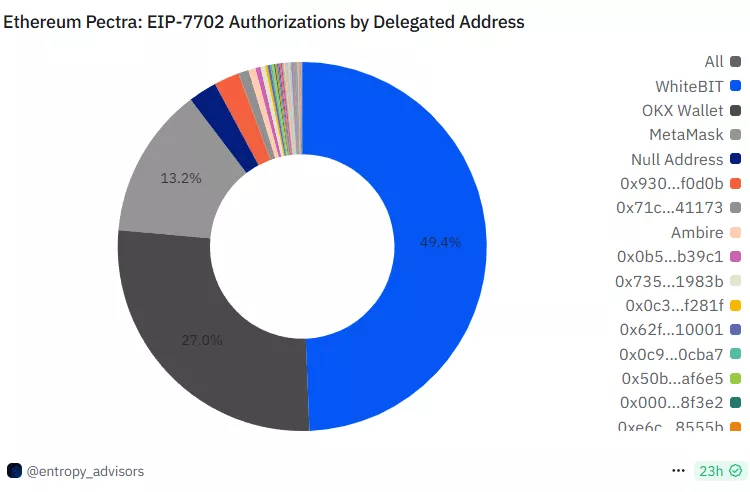

WhiteBIT, OKX Wallet and MetaMask lead by number of authorisations:

Smart accounts allow complex actions within a single transaction — for example, approving a token and executing a DEX swap simultaneously. They support multisig, spending limits, autopayments and even paying gas in a chain’s native token instead of ETH.

What will Fusaka bring?

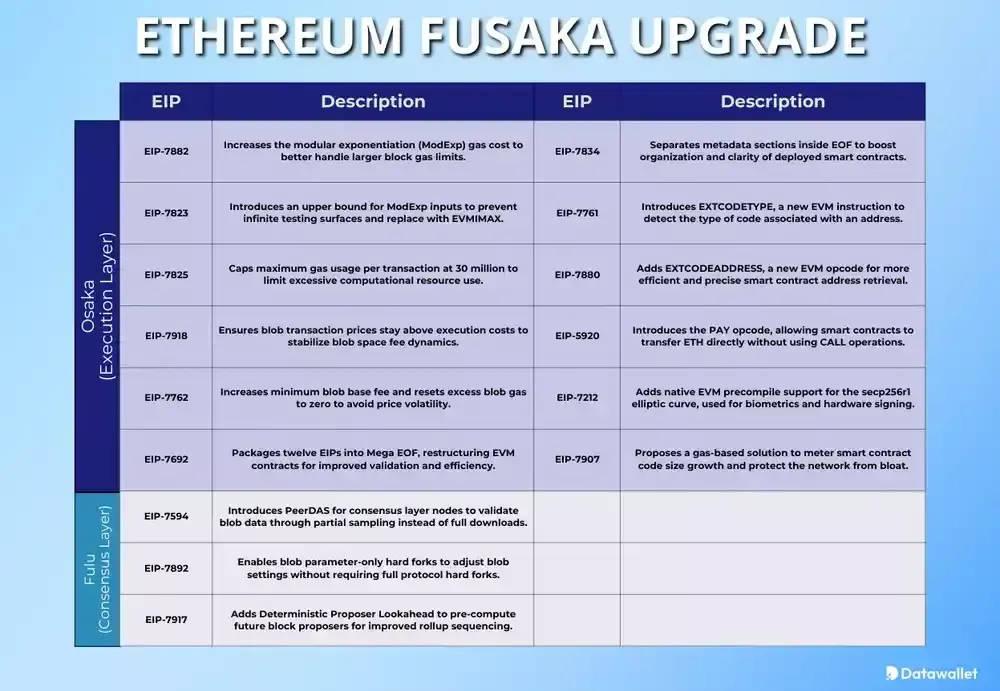

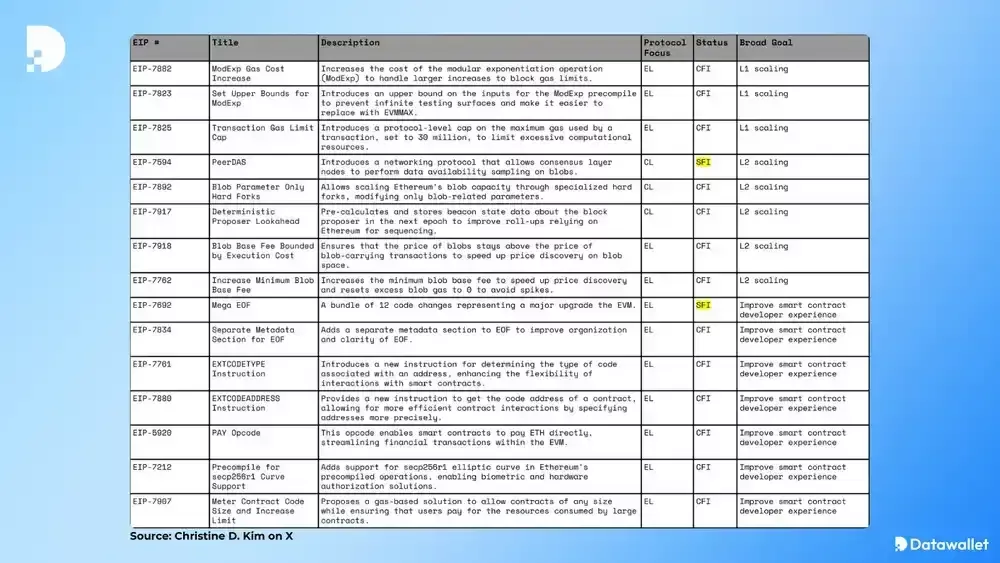

The next major update, dubbed Fusaka, is pencilled in for the second half of the year. Under an optimistic scenario, the hard fork could arrive as early as September or October.

The comprehensive upgrade focuses on improving Ethereum’s scalability and smart-contract reliability, simplifying development across the ecosystem and increasing transaction efficiency.

The centrepiece of Fusaka is the PeerDAS protocol (EIP-7594), which lets nodes request only specific fragments of data instead of the entire block. This reduces node load, improves data distribution and increases network throughput.

“This method preserves data-availability guarantees without requiring high bandwidth or significant storage costs from node operators,” explained DataWallet experts.

In 2024, developer Péter Szilágyi called PeerDAS a blow to home Ethereum stakers and a threat to the network’s decentralisation. It was initially expected to be included in Pectra.

Fusaka also envisions more than doubling the layer-1 gas limit, which should materially increase throughput.

Core developer Tim Beiko removed the Ethereum Object Format (EOF) improvement from Fusaka’s specification. The initiative proposed reworking EVM bytecode structure to improve contract execution efficiency and reduce gas costs. Its implementation is now postponed until at least the next hard fork.

“Developers have put the emphasis on PeerDAS, pushing all other Fusaka features to the background. This technology is the key to scaling Ethereum given the growing needs of layer-2 solutions and resource-intensive dapps,” DataWallet noted.

The next upgrade will also implement more than a dozen previously deferred EIPs.

Among other changes:

- raising the limit from 12 to potentially 50 BLOBs per block (EIP-7594), significantly expanding the capabilities of layer-2 solutions;

- flexible parameter tuning via BPO forks (EIP-7892) — enabling quick, straightforward and gradual changes to blob parameters without large-scale upgrades;

- enhanced validator coordination (EIP-7917) — a mechanism by which participants know in advance who will produce the next block, improving consensus resilience and speeding up pre-confirmations;

- EIP-7825: sets a 30m gas limit per transaction to improve reliability and prevent Ethereum from being overloaded by resource-intensive operations;

- EIP-7918 ensures proper operation of the auction for BLOB-related fees;

- EIP-7762: raises the minimum base BLOB fee (the MIN_BASE_FEE_PER_BLOB_GAS parameter) to “maintain a healthier data market and reduce the risk of sharp price swings”.

Also under discussion are several other proposals, including:

- EIP-7761 — the EXTCODETYPE instruction;

- EIP-5920 — a new opcode, PAY;

- EIP-7907 — a hard cap on contract code size.

These are considered secondary to the core scaling initiatives. They primarily aim to increase smart-contract flexibility, improve execution efficiency and optimise EVM built-ins.

Risks

The Fusaka update could test Ethereum’s resilience. Its rollout entails technical difficulties and organisational challenges.

Key risks:

- PeerDAS pitfalls: if data sampling fails to ensure stable access to BLOBs under heavy load, it would undermine the reliability of Ethereum’s data-availability system;

- delay risks: failures in devnets/testnets or misaligned client releases could push back the mainnet launch of the upgrade;

- proposal bloat: adding too many EIPs to the final list could slow testing, scatter teams’ efforts and raise the likelihood of vulnerabilities;

- coordination complexity: Fusaka requires synchronous changes at both the execution layer and consensus — notably more complex than previous hard forks;

- if things go wrong, rolling back to a previous version would be extremely difficult given the complexity and deep integration of the update’s components.

What lies ahead for Ethereum?

With on-chain activity stalling, price action subdued, L2 solutions “parasitising” the base chain and Solana in vogue, Ethereum sceptics have multiplied.

One of the fiercest critics is Cardano founder Charles Hoskinson. He is convinced that over the next 10–15 years the ecosystem will see a mass migration of users.

He argues that the network’s architecture struggles with scaling and suffers from internal contradictions.

He also pointed to shortcomings in the EVM, the Proof-of-Stake algorithm and the account model. Many problems, he says, could have been avoided if the Ethereum Foundation had heeded outside advice.

He nonetheless welcomed Ethereum co-founder Vitalik Buterin’s proposal to replace the EVM with a RISC-V architecture. But Hoskinson stressed that technical improvements will not fix Ethereum’s deeper issues. Unless its account model is revised, he argues, the blockchain will lag behind more adaptable networks.

At the start of the year, Buterin said the ecosystem would keep scaling primarily through L2 solutions. Yet the Ethereum Foundation’s simplified roadmap focuses on scaling BLOBs and improving L1 performance.

Among the long-term aims:

- integration of AI agents;

- deployment of autonomous machines;

- ensuring privacy in human interactions;

- building an open-source system.

Vitalik Buterin hinted that upgrades may now land faster thanks to developers’ willingness to accelerate the cadence of hard forks.

In March, there were changes in the Ethereum Foundation’s leadership. After these reshuffles, the organisation shifted focus to UX and L1 scaling issues.

In April, Buterin presented a privacy roadmap for the network. He proposed default, built-in features to anonymise user transactions.

After a prolonged downtrend, CryptoQuant analysts expressed cautious optimism about Ethereum’s price dynamics.

They note that ETH/BTC fell to levels last seen in January 2020. That may indicate a local bottom and a potential altseason.

“Ethereum recently entered an extremely oversold zone relative to bitcoin — according to the MVRV metric for ETH/BTC — for the first time since 2019. Historically, in 2017, 2018 and 2019 similar conditions preceded periods when ether significantly outperformed digital gold,” the experts commented.

They also noted:

- higher demand for Ethereum relative to bitcoin;

- less selling pressure;

- a revival in spot trading;

- rising demand for spot ETH ETFs.

“The increase in Ethereum allocation likely reflects expectations of the cryptocurrency’s outperformance — against the backdrop of recent scalability improvements and a more favourable macroeconomic environment,” CryptoQuant noted.

Given the long-term roadmap, developer activity and sustained investor interest, it is premature to write off Ethereum’s prospects.

Conclusions

Amid rising competition, Ethereum remains the most popular smart-contract platform and the backbone of DeFi, with TVL above $60bn. Its ecosystem engages more than 6,000 developers, far outstripping Solana and other networks.

Despite persistent scaling challenges and rapid innovation among rivals, the second-largest crypto network remains among the most decentralised and secure in the industry.

Whatever the future holds, one thing is clear: Ethereum laid the foundation for all comparable platforms and catalysed key innovations — from DeFi and NFTs to blockchain gaming. The transition to Proof-of-Stake, the Shapella, Dencun and Pectra upgrades, and the forthcoming Fusaka release all attest to steady development in a network that continues to set the industry’s direction.

If the major upgrade is executed successfully, it will strengthen the network’s position amid intensifying competition. If not, pressure from Solana and the L2 ecosystem could grow — and Ethereum’s long-term leadership would be in question.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!