Glassnode: 1.55m ETH withdrawal from staking had little impact on price

The withdrawal of 48,000 validators, totaling 1.55 million ETH, from the Beacon Chain deposit contract after activation Shapella did not materially affect the price of the second-largest cryptocurrency. Glassnode analysts said.

We previously simulated the potential economic outcomes of ETH withdrawals enabled by the Shapella upgrade.

In this edition, we will examine what actually happened to the 1.55M withdrawn ETH, and how stake has reshuffled between stakers, staking service providers, and sell-side… pic.twitter.com/x36QNU9RfU

— glassnode (@glassnode) May 8, 2023

Ethereum’s price rose to $2,110, subsequently drifting within a $1,809–$1,995 band.

Experts noted that the pace of change in the number of validators aligned with the mechanism described by the developers, and the consensus mechanism has remained stable since the hard fork.

«Likely, this will reduce the risk of calls for engineers, which should generally benefit the security and economics of the network», — the specialists explained.

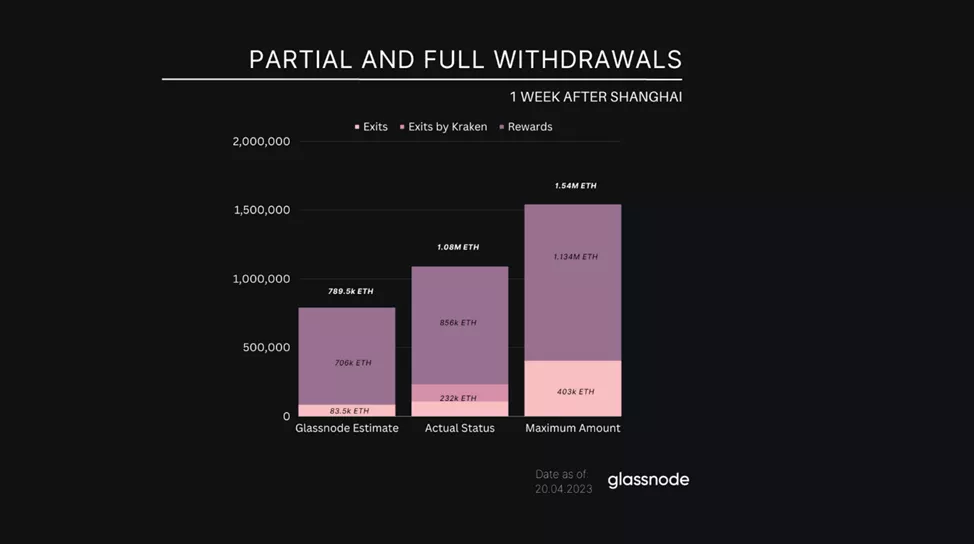

Analysts acknowledged that their baseline estimate of the number of coins withdrawn by validators in the week after Shapella (789 500 ETH) proved conservative (1.08m ETH).

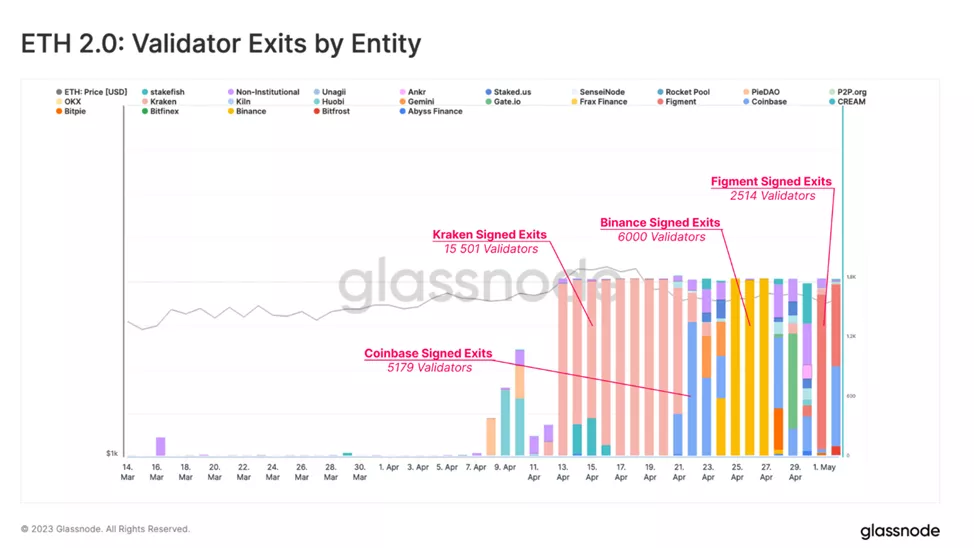

Analysts explained the discrepancy by Kraken’s actions (125 088 ETH), which were not fully reflected in the forecast. The platform actively reduced its presence in the space amid pressure from the SEC, which was followed by the closure of the staking service staking.

Glassnode’s maximum estimate of 1.54m ETH remained out of reach.

Within the 1.08m ETH, 856 000 ETH (80%) went to rewards, and 232 000 ETH (20%) to full withdrawals.

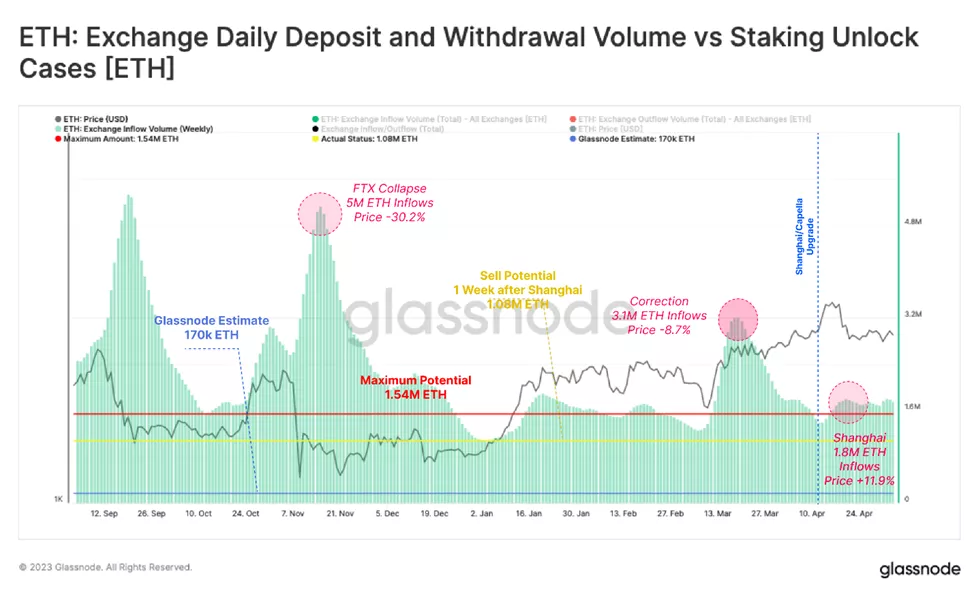

Analysts noted the absence of a spike in Ethereum deposits on CEX. This confirmed their expectation that the earned rewards would not amplify selling pressure.

During the week, 1.8m ETH flowed to platforms, in line with typical models and well below notable dump events of the past.

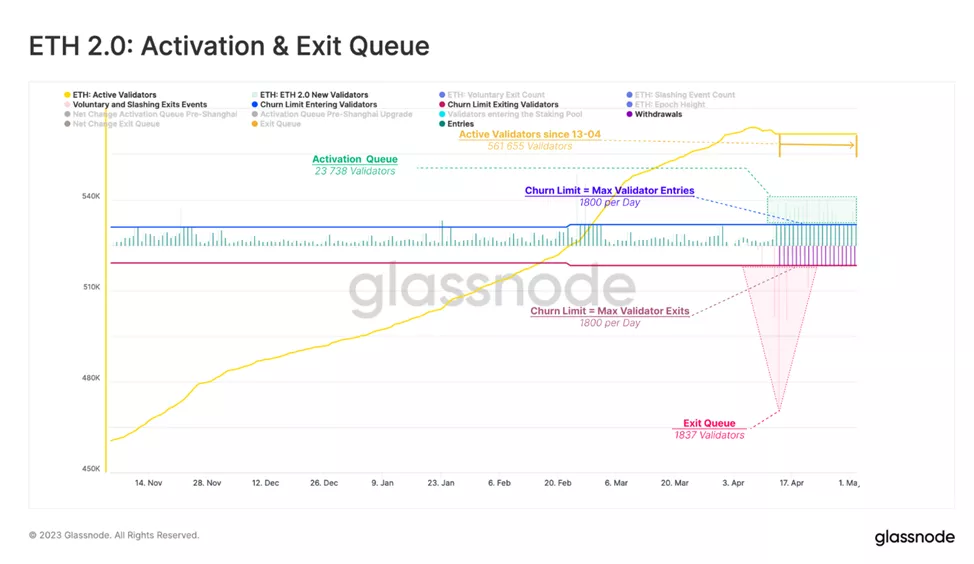

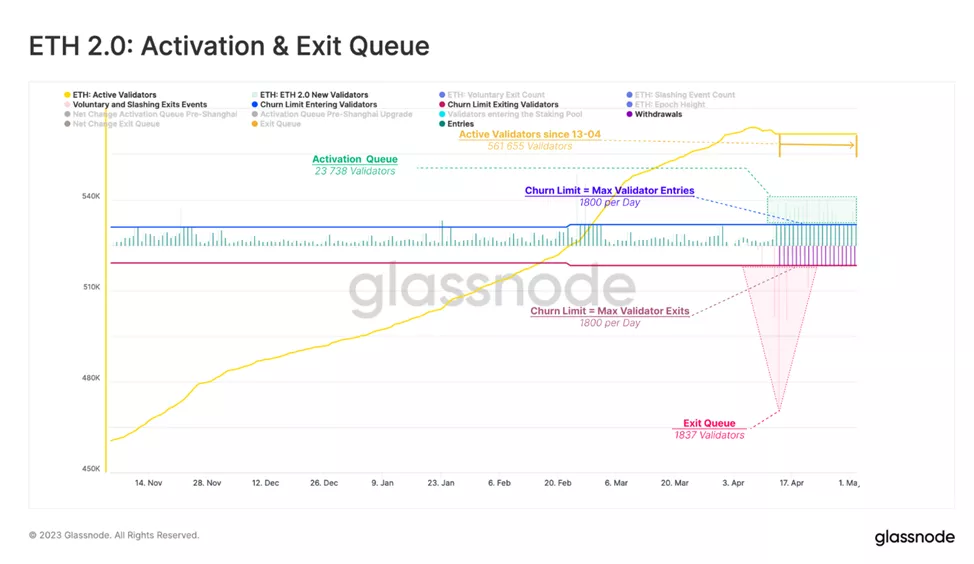

Analysts reminded that the Proof-of-Stake algorithm in Ethereum allows partial and full withdrawals, and to execute the submitted requests may require 4.5 days.

To automatically release funds, validators must update their credential type from 0x00 to 0x01. In the first week, 85% of participants not meeting this requirement did so, primarily in the first two days. In total, only 2% of validators have not yet updated the account type.

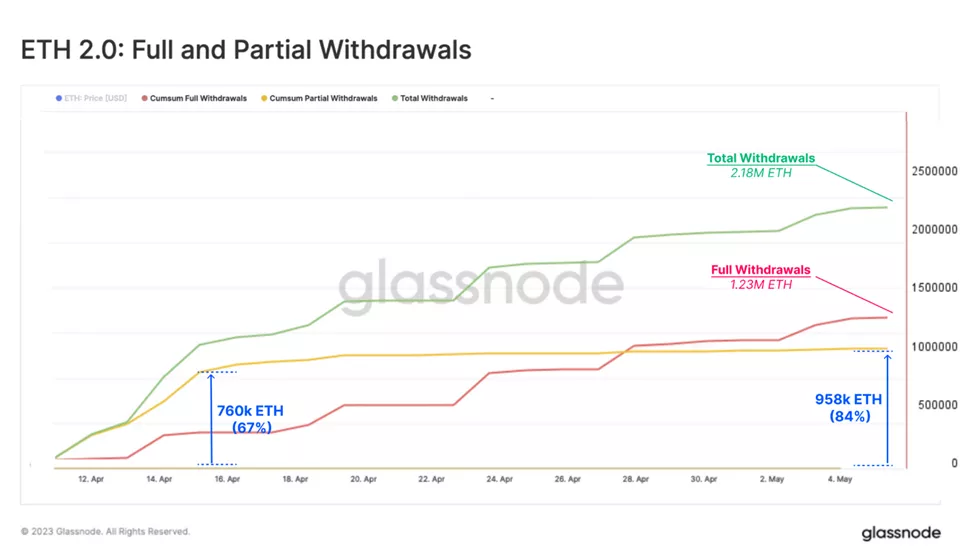

By the time of writing, validators had withdrawn 84% of accrued rewards. The remaining 16% consisted of coins belonging to participants who had not updated their credentials.

As the illustration below shows, in the first hours after Shapella partial withdrawals formed the bulk of withdrawals from the deposit contract. Later the share of full withdrawals rose.

In terms of full withdrawals, an algorithm limits the number of validators who satisfy this rule, by the formula:

Churn Limit = Active_Validators/65536

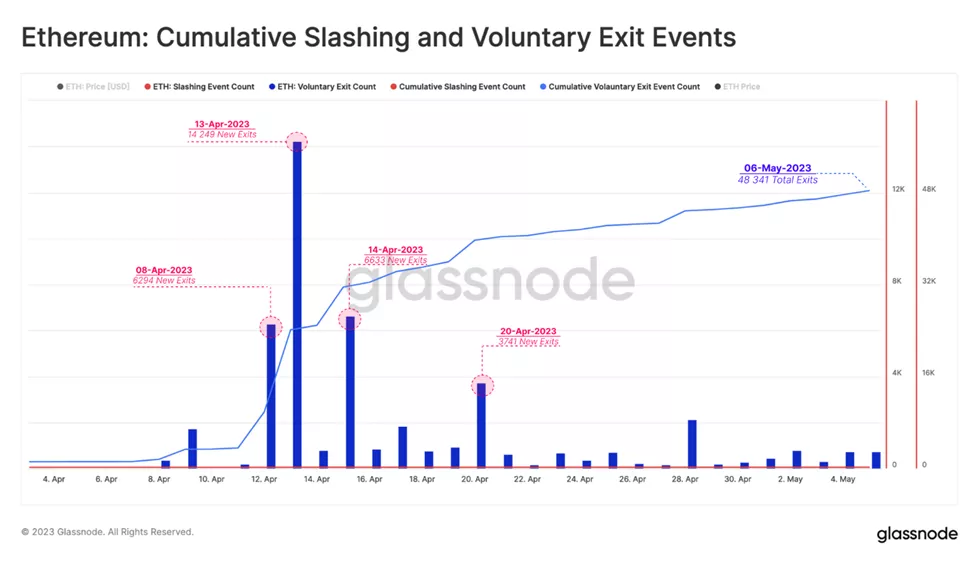

With the current Churn Limit, set at 8 and 225 epochs per day, no more than 1,800 validators can fully withdraw per day, equivalent to 57,600 ETH. This limit was reached immediately after Shapella’s activation.

Since April 28, the cumulative amount of coins tied to full withdrawals surpassed that for partial withdrawals.

By the time of writing, the total full stake amounted to 1.55m ETH ($2.93b) withdrawn by 48,341 validators. The highest daily total occurred on the first day after Shapella — 14,249. Subsequently the figures fell to 300-700 per day.

Full withdrawals are balanced by new deposits — both measures (1,800 per day) are equal. The queue of first withdrawals has reduced to 1,837, the second to 23,738. The number of active validators has stabilised, but is set to resume growth soon.

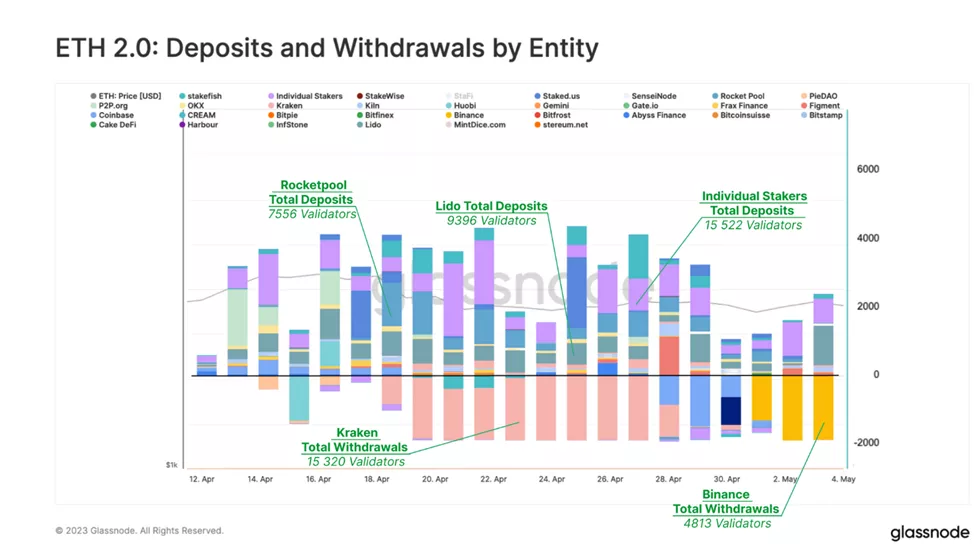

«Such a large number of new deposits is another explanation for the lack of noticeable selling pressure on Ethereum», — the specialists explained.

In the structure of withdrawn funds, centralised intermediaries dominate. Of the total 48,341 validators, only 2,561 (6.6%) are not linked to staking services.

The largest figure was Kraken (15 501 validators), followed by Binance (6,000), Coinbase (5 179), Figment (2 514). Experts noted that in Lido this process has not yet been initiated.

In terms of deposits, the largest number (15 522) of validators belong to individual users. Prominent in this regard are LSD-protocols Lido (9 396) and Rocket Pool (7 556)

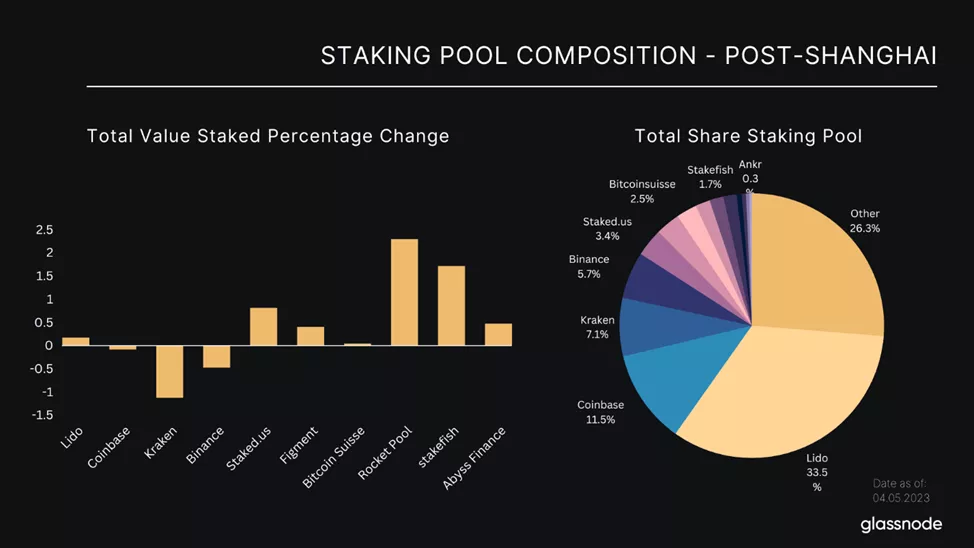

Over the partial month after Shapella, the structure of the staking-protocol market did not undergo meaningful change. Rocket Pool’s share rose 2.3%, stakefish 1.7%, Lido about 0.2%. This came at the expense of Kraken’s share by 1.1% and Binance’s by 0.5%.

Recall, Lido will begin redemptions of stETH after the release of the protocol’s second version on May 15.

Earlier, Glassnode reminded of Lido Finance’s promise to redeploy the rewards earned in staking.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!