Glassnode Advises Caution Amid Potential Bitcoin Sell-Off

On-chain indicators suggest that Bitcoin is experiencing a phase of consolidation and potential correction. Market participants should exercise caution, warned Glassnode.

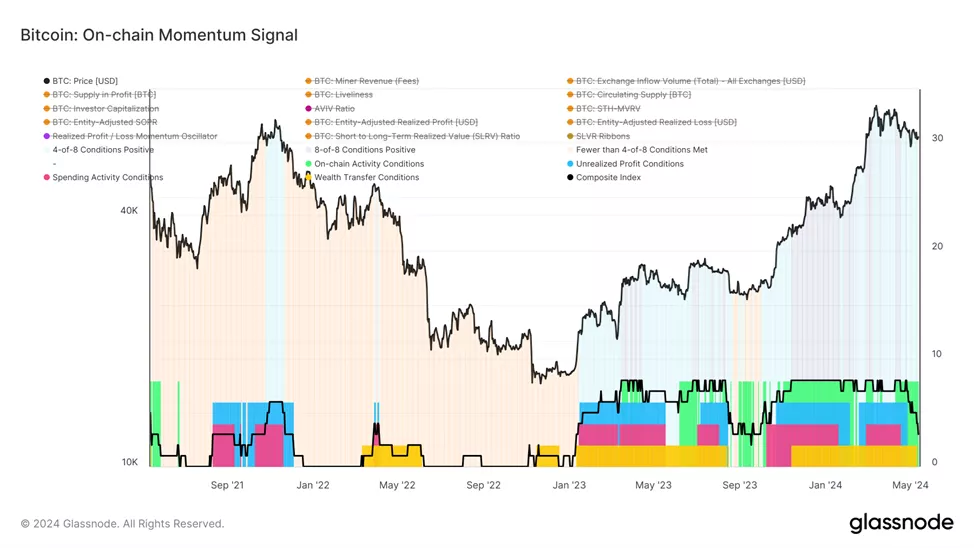

Experts proposed a system of metrics to track market trends and shifts:

- On-chain activity: an increase in these metrics usually correlates positively with price growth.

- Profitability: a trend of rising unrealized profits indicates periods when participants are in the black, suggesting a healthy and upward market trend.

- Spending dynamics: this category identifies periods when demand is sufficient to absorb position closures by existing holders. High buyer interest during such times indicates a stable positive trajectory.

- Wealth distribution: by studying the transfer of wealth between long-term holders and new participants, the metric provides insights into market cycles and potential turning points.

Integrating these indicators into a composite index allows for a more comprehensive assessment of trend strength and direction.

Currently, only four out of eight conditions for strong momentum are met, indicating a cooling market period.

Analysts separately commented on indicators that have “dropped out” of the bullish state.

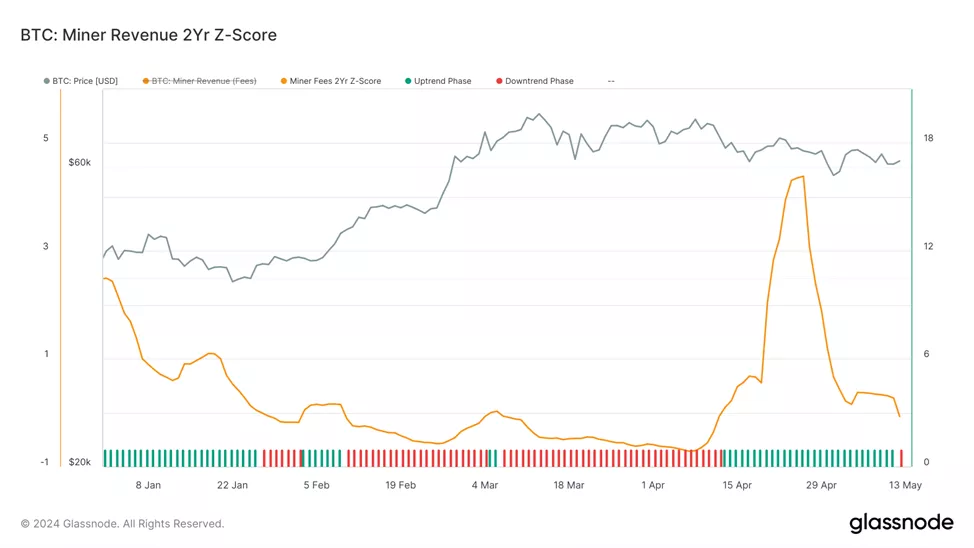

Two-Year Miner Revenue Z-Score

Following the halving, there was a notable surge in miner revenues as competition for block space intensified, especially concerning transactions with Runes.

By the end of April, the earnings level of the first cryptocurrency’s miners remained above historical norms. However, recently the Z-Score entered a stage of negative dynamics for the first time in a month, indicating a decrease in demand for block space.

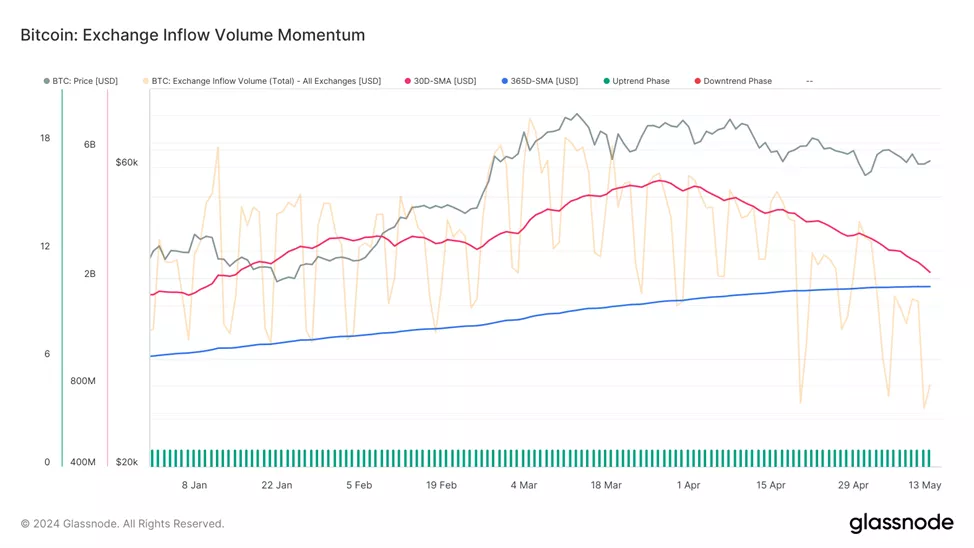

Exchange Inflow Volume

The indicator peaked at the end of March and has since entered a steady downward trend. Thus, the positive dynamics of inflows to CEX is slowing and may soon fade, indicating a weakening of buyer pressure.

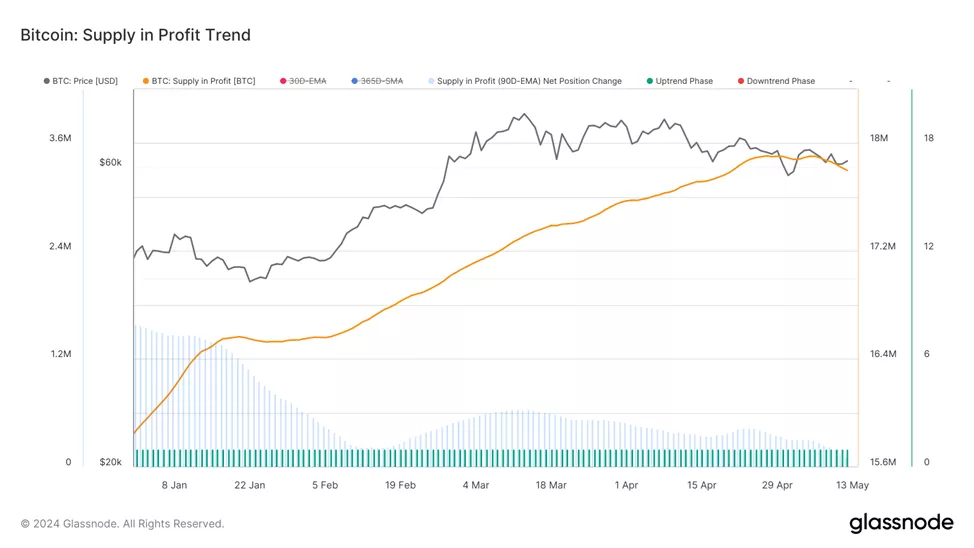

Trend of “Profitable” Coins Supply

Despite positive dynamics, the indicator has begun to show signs of reversal both in absolute terms and as a EMA over 90 days. Although this metric remains in an upward trend phase, it indicates that fewer holders are in a profit position, which could affect market sentiment.

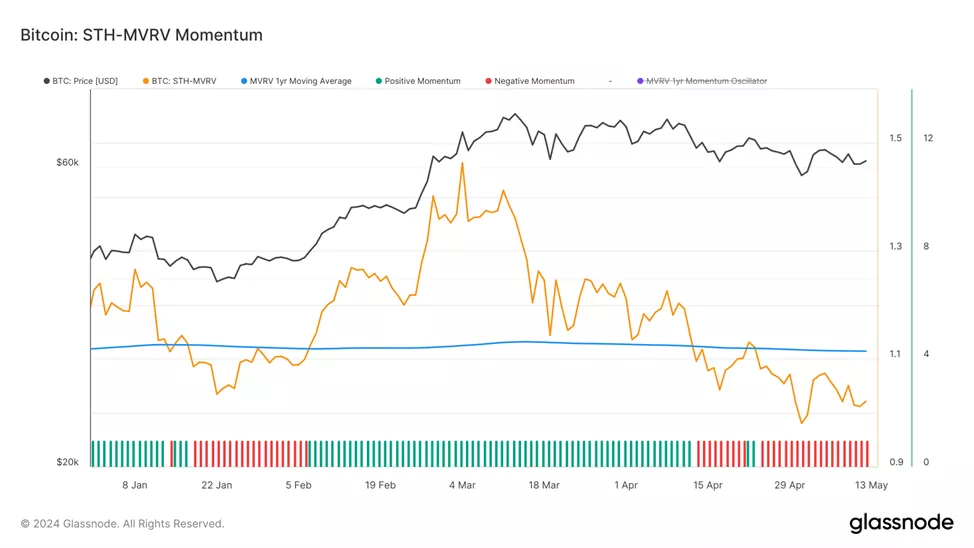

MVRV

The indicator remains above the annual average — the market valuation of coins is still higher than their cost. At the same time, MVRV concerning speculators now tends to decline. This suggests that active participants are beginning to earn less profit, which could increase selling pressure.

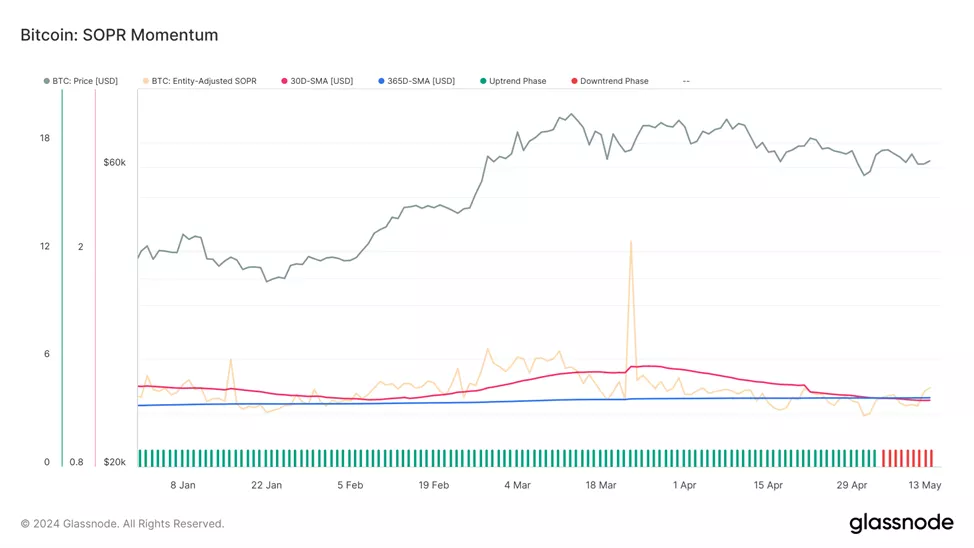

SOPR

The indicator tends to decrease, with the monthly average recently falling below the annual average. The trend has not yet gained momentum but signals that the profitability of operations is declining, which could lead to more cautious trader behavior.

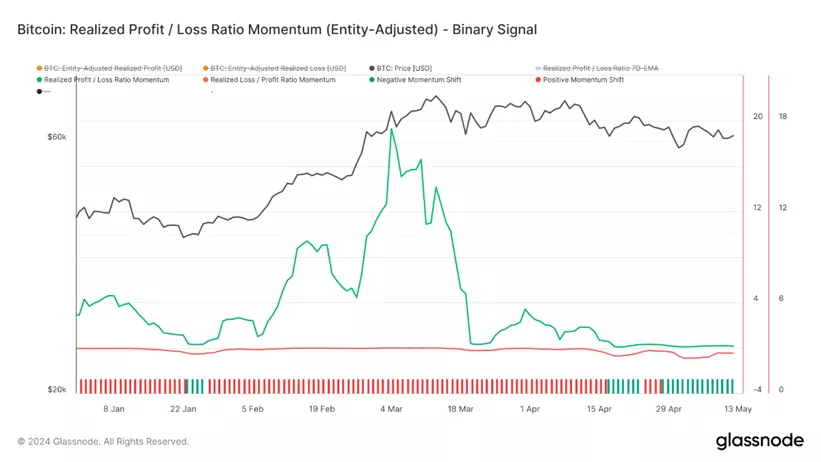

Realized Profit/Loss Ratio

A shift towards negative momentum in the metric indicates that realized losses have intensified during recent pullbacks. Such an increase in losses for recent coin buyers could trigger a panic sell-off if the market continues to correct.

Earlier, FxPro trader Alex Kuptsikevich warned of panic selling if the price of the first cryptocurrency settles below $60,000.

Previously, Standard Chartered stated that the first cryptocurrency had already formed a low at $56,500, confirming a target of $150,000 by the end of the year and $200,000 by the end of 2025.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!