Glassnode Analysts Observe Bitcoin Speculator Capitulation

Glassnode suggests a "market reset" due to low NUPL values among short-term holders.

Researchers at the analytics firm Glassnode have suggested a “market reset,” given the low values of the NUPL indicator in the context of short-term holders of the leading cryptocurrency.

#Bitcoin short-term holder NUPL has rolled into loss territory, signaling stress among recent buyers.

STH capitulation events have historically marked periods of market reset, often laying groundwork for renewed accumulation.

🔗https://t.co/Jz7M1I1b7e pic.twitter.com/PKBlULo8hM— glassnode (@glassnode) September 29, 2025

The indicator has fallen into the “loss zone,” signaling “stress among recent buyers.”

“Short-term investor capitulation has historically coincided with phases of market reset and often laid the foundation for new waves of accumulation,” explained the specialists.

Is the Correction Ending?

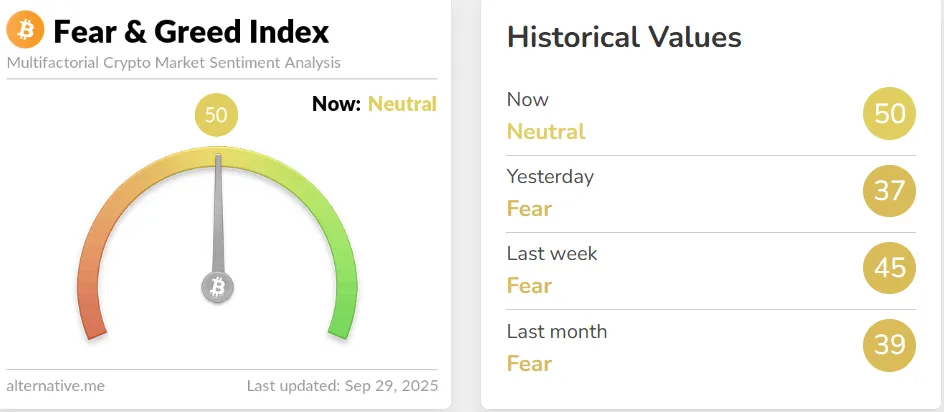

CryptoQuant contributor known as Darkfost believes the correction is nearing its end. According to his observations, when the Fear and Greed Index falls below 35, the market often finds itself at a local bottom.

We’re now approaching extreme Fear, and that’s where things start to get interesting

💥 Historically, whenever the Fear & Greed Index dropped below 35, we’ve been close to a local bottom.

In this cycle, that scenario has played out perfectly every single time.

If we get one… pic.twitter.com/wfpUmXh9D6— Darkfost (@Darkfost_Coc) September 28, 2025

On September 28, the popular market sentiment indicator fell to 37, and shortly before that — to 28. By the time of publication, the metric had recovered to neutral values around 50.

According to Darkfost, in the current cycle, the aforementioned scenario “has played out more than once.”

“If another drop occurs, leading short-term holders to losses and the index falls below 25, I will unhesitatingly increase my bitcoin position as part of a long-term strategy,” the researcher emphasized.

The analyst also noted that 36% of the digital gold supply held by this group of investors remains profitable:

“The value may seem modest. But in this cycle, each correction was accompanied by an almost complete reset of STH profits — the indicator consistently fell below 5%.”

Darkfost added that during such periods, digital gold usually trades below the realized price of short-term holders. At the time of publication, it stands at ~$112,100.

“This leaves room for another decline, which could push almost all of them into losses,” the expert stressed.

On the other hand, when nearly all bitcoin held by short-term holders is “in profit,” the market often approaches a local peak. This is confirmed by the rise in realized profits of STH, noted the technical analyst.

Five Stages of Market Maturity

CryptoQuant author Axel Adler Jr. stated that the market is evolving, so one should not expect exact repetitions of past patterns.

Don’t expect the market to repeat itself,times change and so does perception.

The market has already gone through five stages:

1. Early wild volatility

2. Double peaks of the young cycle (stepwise distribution)

3. Plateau of a mature bullish impulse

4. Pendulum with shocks… pic.twitter.com/eW4vXWr9cI— Axel 💎🙌 Adler Jr (@AxelAdlerJr) September 29, 2025

The expert identified five stages of the crypto industry’s evolution:

- “Wild” volatility of early periods.

- Double peaks of the “young cycle” (stepwise distribution).

- Plateau of a mature bullish impulse.

- “Pendulum” with shocks (COVID-19 and China’s mining ban).

- Range compression by institutions (ETF mode).

“Just hodl,” advised the analyst.

Earlier, experts at 21st Capital predicted bitcoin’s rise to $200,000 after overcoming key resistance at $130,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!