Glassnode notes continued Bitcoin accumulation trend among whales

Last week the trend of Bitcoin accumulation among market participants continued. Institutional investors, retail investors, and entities such as the Luna Foundation Guard and MicroStrategy were among those driving demand.

The #Bitcoin network has mined the 19 millionth $BTC, whilst accumulation by Shrimps alone surpass 1.7x daily issuance.

This week also saw an influx of buying from Luna Foundation Guard, inflows into Purpose ETF, and 1k+ $BTC Whales.

Read our analysis👇https://t.co/o0S5AsYPYO

— glassnode (@glassnode) April 4, 2022

Considering that miners have mined 19 million coins out of the 21 million programmed by the protocol, and that accumulation has vastly outpaced issuance, the perception of Bitcoin as a scarce asset may again become relevant, analysts warned.

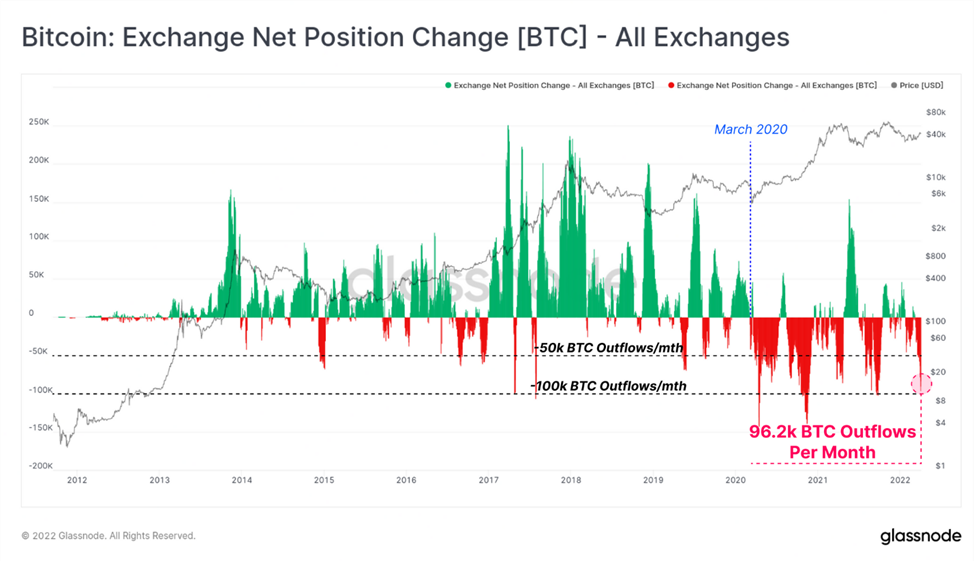

The pace of coin withdrawals from centralized platforms accelerated to 96,200 BTC per month, a pace rarely seen in historical terms. Exchange balances fell to August 2018 levels, breaking the plateau observed since September 2021. The trend was also characteristic of platforms that have recorded substantial inflows over the last 12-24 months.

The number of coins on Bitcoin addresses prone to accumulation rose by 217,000 BTC between December 4 and now, to a record 2,854,000 BTC. Analysts in this sample excluded exchange addresses and miners but included custodians and corporations such as Luna Foundation Guard and MicroStrategy.

Based on the calculations, the daily growth rate stands at about 1,800 BTC. It more than doubles the issuance pace, while the market during this period was in a downward trend and only returned to pre-crisis levels in the previous three weeks.

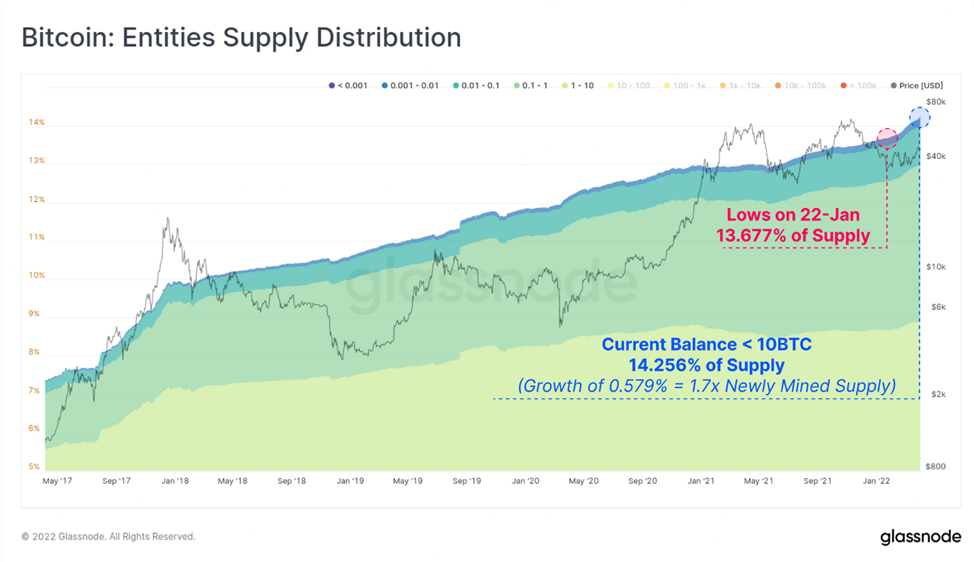

Analysts also noted that so-called “shrimp” addresses (balances under 1 BTC, excluding retail platform clients) contributed to the accumulation. Since the low on January 22, they have accumulated 0.58% of the market supply, bringing their share to 14.26%. The pace exceeded issuance by 1.7 times.

Beyond retail investors, whales with balances above 1000 BTC contributed significantly, notably the Luna Foundation Guard, which accumulated 30,727 BTC.

The BitGo custodian wallet, for issuing a wrapped version of digital gold, was topped up by 12,500 BTC, bringing it to 275 236 BTC.

Analysts also recorded inflows into the Purpose Bitcoin ETF totaling 5,521 BTC since the end of January 2022. A similar trend is seen in other Canadian spot Bitcoin ETFs. In total, sector inflows reached 6,594 BTC, bringing the total to 69,000 BTC.

Back in March, the price of the first cryptocurrency reached the $47,650 mark—the highest since the start of 2022.

Earlier, Glassnode analysts warned of an upcoming spike in Bitcoin volatility.

Subscribe to ForkLog news on Telegram: ForkLog Feed — all the news, ForkLog — the most important news, infographics and opinions

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!