Glassnode Records Doubling of New Ethereum User Growth

Glassnode reports a surge in new Ethereum users, with activity retention doubling.

Glassnode researchers observed a doubling in Ethereum’s activity-retention metric.

Ethereum’s Month-over-Month Activity Retention shows a sharp spike in the “New” cohort, indicating a surge in first-time interacting addresses over the past 30 days.

This reflects a notable influx of new wallets engaging with the Ethereum network, rather than activity being… pic.twitter.com/h8Zw7hXOSX— glassnode (@glassnode) January 15, 2026

Analysts linked the shift to a substantial influx of new users rather than the actions of long-time market participants. The number of addresses that interacted with the blockchain for the first time over the past 30 days jumped from 4 million to 8 million.

The retention metric separates regular users from one-off transactors. The current rise suggests newcomers continue using the network after their first transaction.

On-chain activity

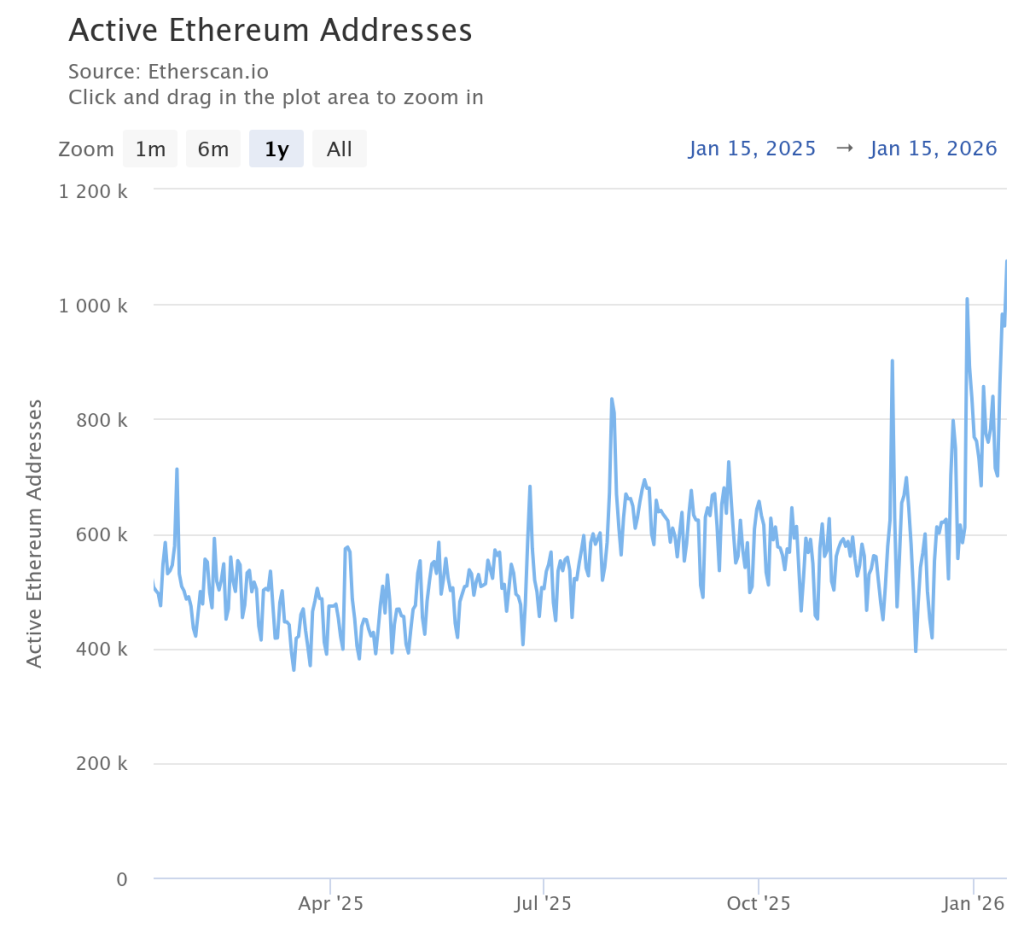

User activity on Ethereum is hitting records. According to Etherscan, on January 15 the number of active addresses in the network crossed 1 million—more than double last year’s 410,000.

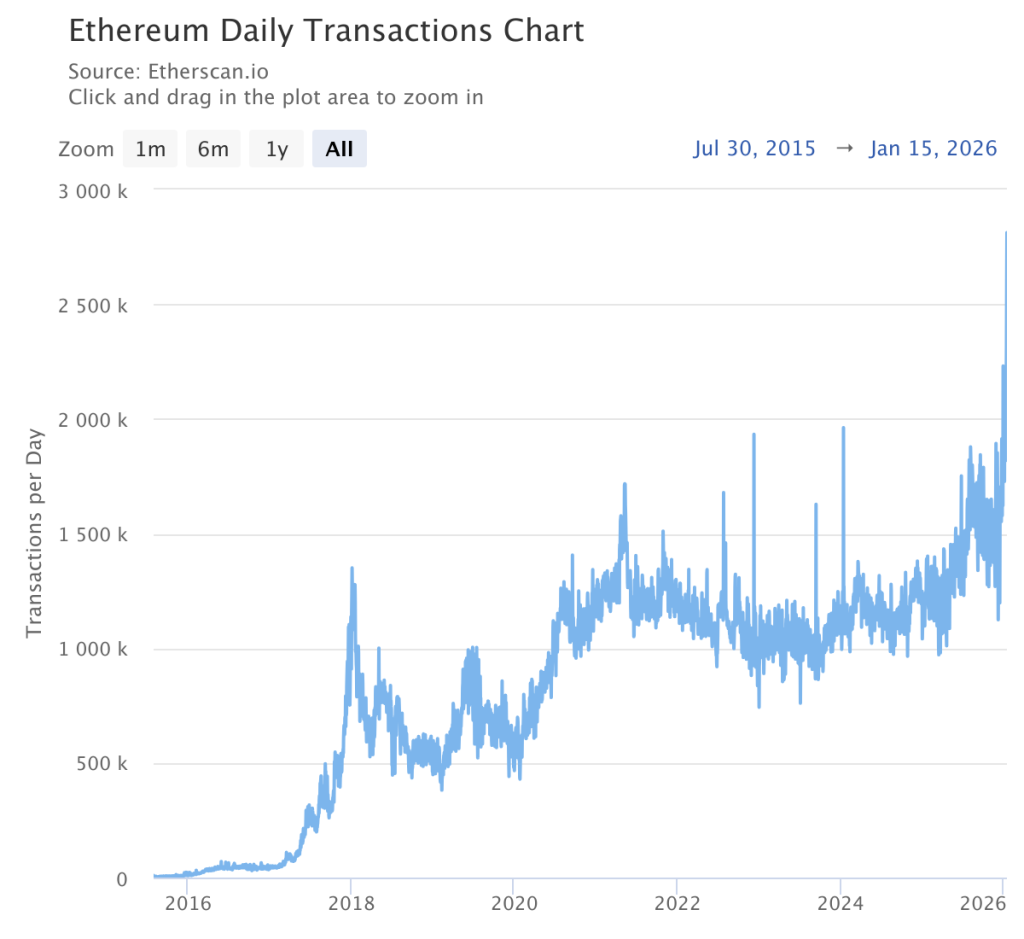

A new peak in daily transactions—2.8 million—was recorded. The year-on-year increase is 125%. Milk Road analysts explained the trend by lower transaction costs, which spurred the use of stablecoins.

“This is the result of shifting execution to layer-two (L2) solutions while preserving settlement security on the base layer (L1). This is what scalable financial infrastructure looks like,” the experts stressed.

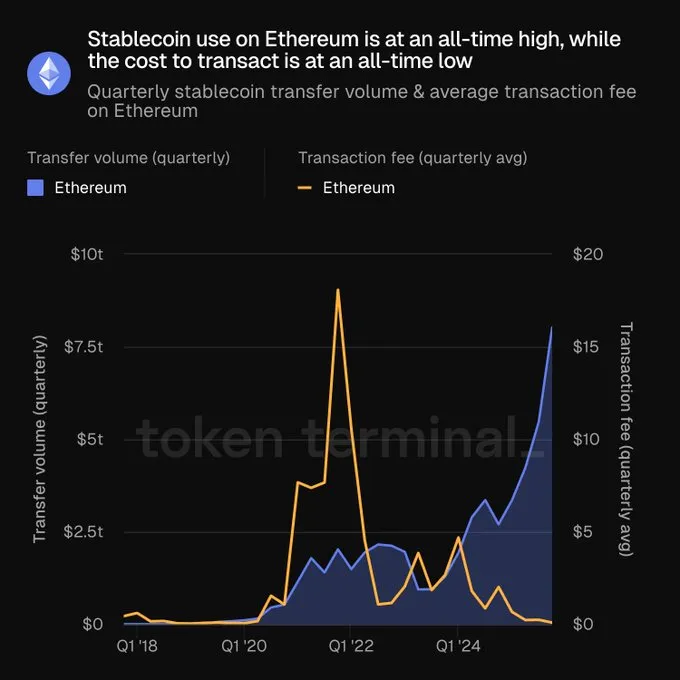

The chart below shows record stablecoin usage on Ethereum amid extremely low transaction fees:

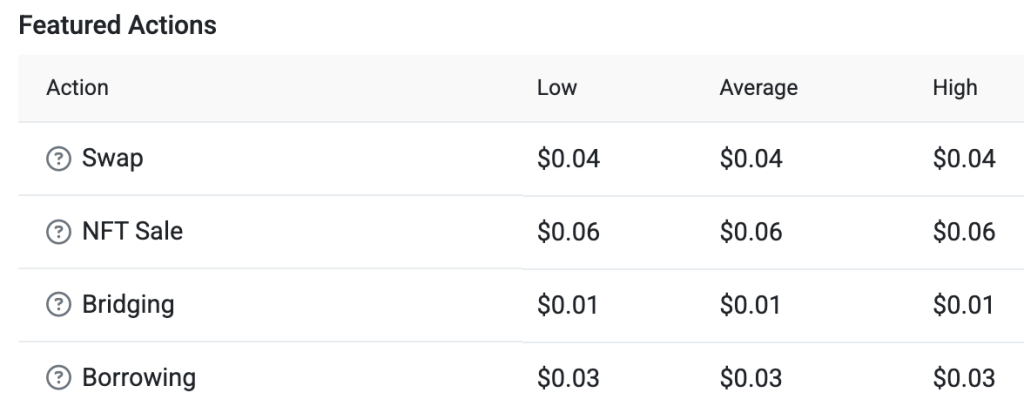

Swapping tokens on the network costs $0.04; a cross-chain transfer, $0.01. A transaction on a DeFi lending service costs $0.03.

Reasons for optimism

Many analysts note improving market sentiment and positive signals across technical and fundamental analysis.

“Short-term indicators have exited oversold territory and point to upside potential. The drivers are inflows into ETFs, stablecoins and native protocols,” — said Arctic Digital researcher Justin d’Anethan in a comment to Cointelegraph.

On-chain, daily transactions exceeded 2.5 million, and the amount of coins in staking is about 36 million ETH.

“Strong on-chain metrics, steady inflows into ETFs and optimism among ecosystem participants are creating the conditions to break through current resistance levels,” said LVRG Research director Nik Rak.

In his view, the asset’s position is strengthened by a liquidity shortage driven by high institutional demand. Additional support comes from upgrades that increase the network’s scalability and lower fees.

MN Fund founder Michaël van de Poppe also remains upbeat, noting the potential for gains:

There’s a lot of compression taking place with $ETH and that’s likely to break out in the coming week.

That’s a great sign for the markets, as $ETH holding above the 21-Day MA against Bitcoin would signal that there’s more risk appetite flowing towards the #Altcoin markets. pic.twitter.com/yTYwm5KCRQ

— Michaël van de Poppe (@CryptoMichNL) January 15, 2026

“There is a lot of compression taking place in Ethereum; a breakout is likely next week,” the technical analyst wrote.

At the time of writing, ether trades around $3300. Over the past seven days the asset has risen 6.1%, according to CoinGecko.

Earlier in 2026, the share of ETH locked in staking reached a record 30%.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!