Glassnode Warns of Potential Bitcoin Sales by Miners Amid Correction Risks

Bitcoin miners remain confident in the prospects of digital gold due to the rising hash rate, yet they may increase sales if further corrections occur. This is possible due to a general reduction in risk appetite, according to Glassnode.

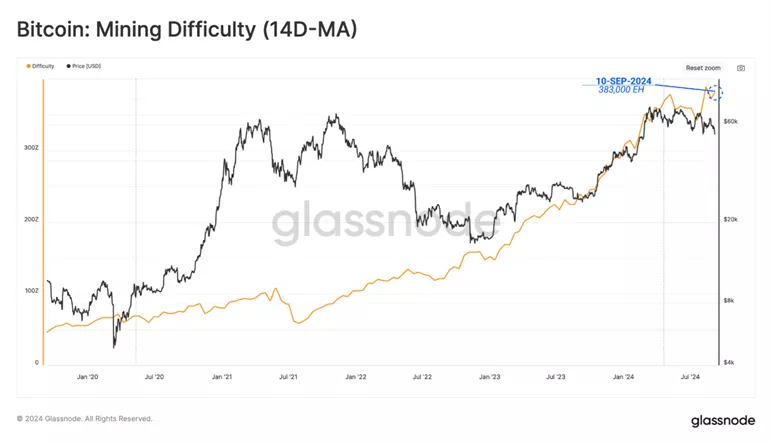

The competitiveness of the Mining landscape and their conviction in the #Bitcoin Network continues to rise, with the Hash Rate blasting towards new ATHs.

However, investors remain unconvinced in the short term, with exchange-related onchain volumes beginning to languish.… pic.twitter.com/MQBsKh6QeF

— glassnode (@glassnode) September 10, 2024

As computational power increases to 666.4 EH/s (14 DMA), just 1% below the ATH, mining difficulty also rises. According to experts’ calculations, on September 10, the volume of hashes required to create a block rose to 338,000 EH — the second-highest in history.

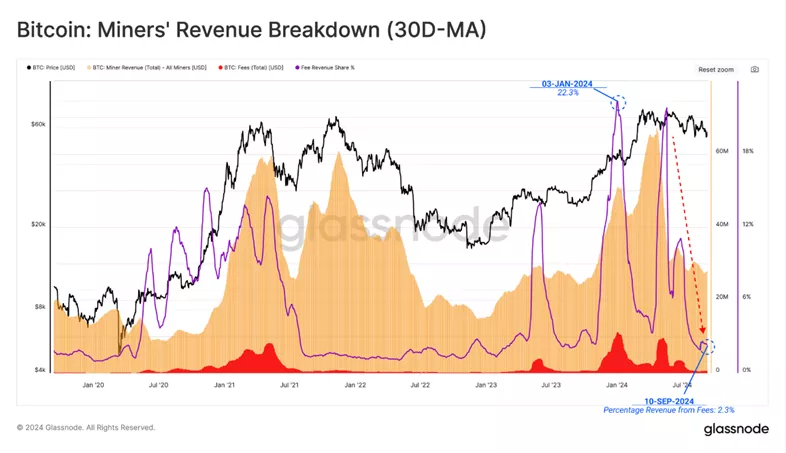

Increased competition and the recent halving have led to a decline in miners’ revenues. The reduction in fee income also played a role, with its share plummeting from 22.3% in January to the current 2.3%. Experts noted that the driving force behind the decline was reduced demand for transfers and a weakening of activity related to Runes and “inscriptions.”

As a result, daily fee volume dropped to $20.3 million, and the reward for a found block fell to $824 million.

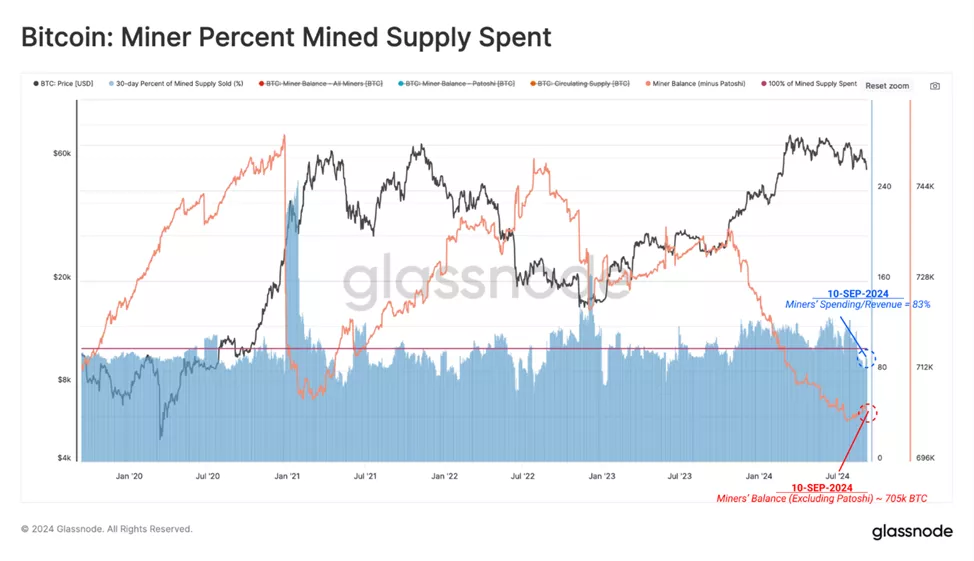

Analysts noted that the aforementioned operating environment could negatively impact miners’ profitability. They reminded that this group of participants tends to be pro-cyclical, acting as sellers during downturns and hodlers during uptrends.

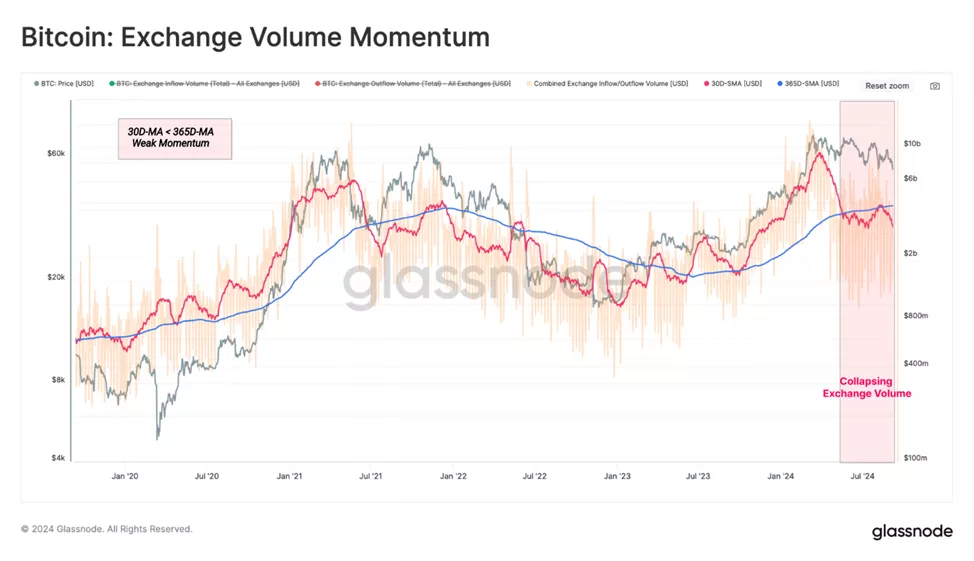

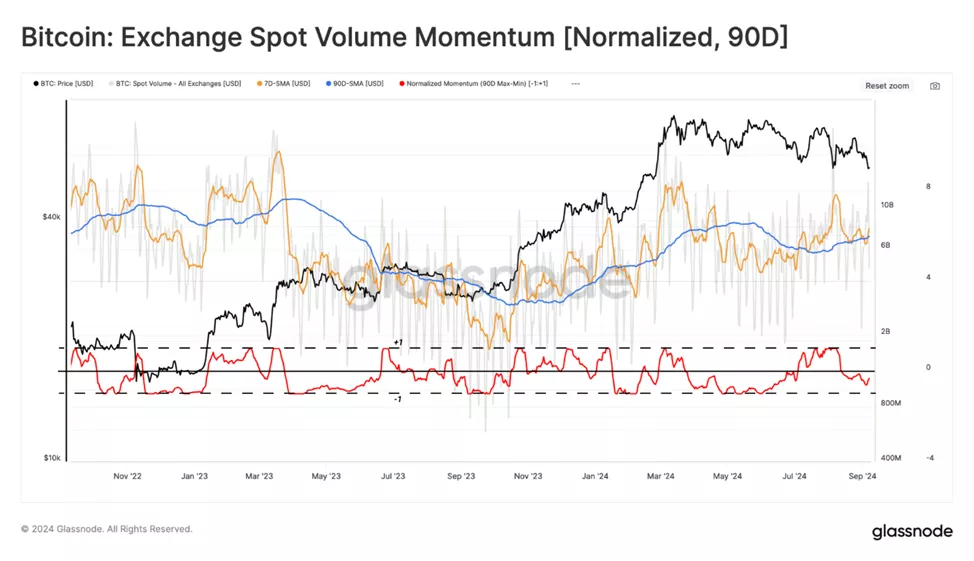

As a next step, experts evaluated aggregated onchain volumes on CEX as an indirect indicator of trading activity and speculative appetite.

According to their observations, the average monthly inflow/outflow figure fell below the annual level. This indicates a decrease in investor demand and a reduction in speculative transactions within the current price range, experts explained.

A similar conclusion is drawn from the 90-day normalized spot turnover indicator. Meanwhile, according to the CVD metric, analysts recorded an increase in selling pressure, reflected in a downward price trend.

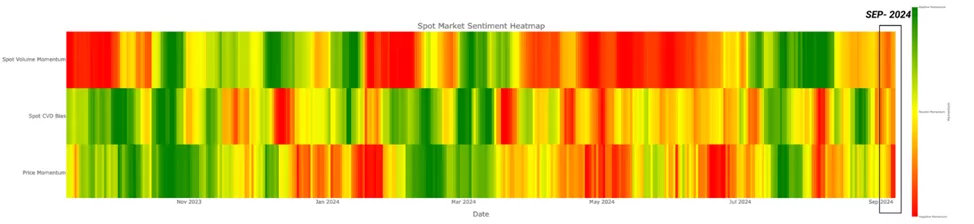

By combining MinMax transformations for trading volume, CVD, and Price Action, experts created a sentiment heatmap where feature values range from 1 to -1:

? Values of 1 indicate high risk;

? Values of 0 indicate moderate risk;

? Values of -1 suggest low risk.

All three indicators suggest that the market is entering a low-risk zone compared to the last 90 days. Such a structure may be susceptible to external forces and potentially result in a sharp price jump in either direction, specialists noted.

Earlier, QCP Capital reported that implied volatilities of Bitcoin options remain elevated. Traders expect significant price fluctuations in light of the Trump-Harris debates and consumer inflation data.

Previously, analyst and MN Trading founder Michaël van de Poppe predicted “final corrections” before a bull run.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!