Grayscale Predicts Thousandfold Growth in RWA Sector

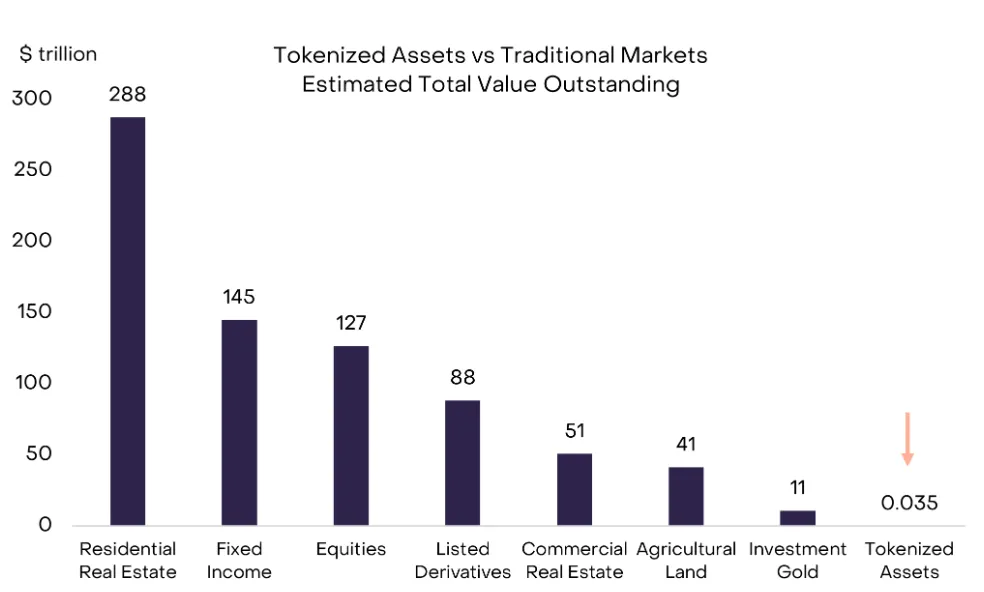

Grayscale predicts RWA sector to grow 1000x by 2030, now just 0.01% of global stocks and bonds.

Grayscale analysts have forecasted a thousandfold increase in the RWA sector by 2030. Currently, tokenized instruments account for a mere 0.01% of the global market for stocks and bonds.

Experts linked the prospects of RWA to the technological maturity of the industry and regulatory clarity.

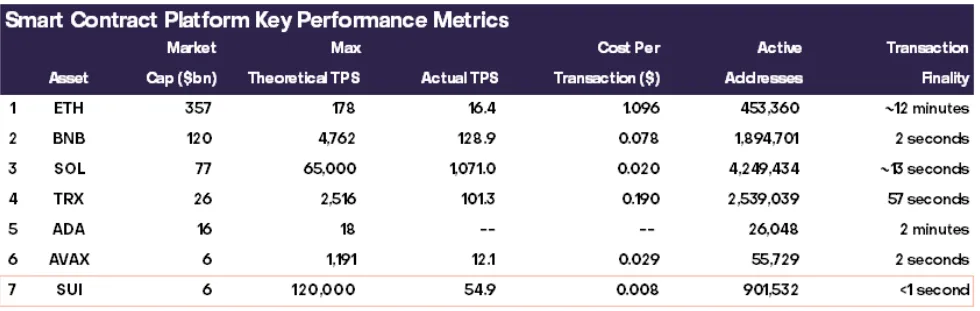

The development of this direction will enhance the value of networks processing transactions. The main beneficiaries, according to analysts, are Ethereum, BNB Chain, and Solana, with Chainlink identified as a key infrastructure element.

Besides RWA, market drivers will include stablecoins and DeFi. Legislative initiatives in the US are expected to accelerate the adoption of “stable coins” in international settlements. In the decentralized finance sector, liquidity is likely to consolidate on leading platforms such as Aave and Uniswap.

The report also highlighted the importance of next-generation blockchains. High network performance is necessary for micropayments in AI, gaming, and high-frequency trading. Grayscale considers Sui a technological favorite in this category. Projects like Monad, MegaETH, and NEAR also show potential.

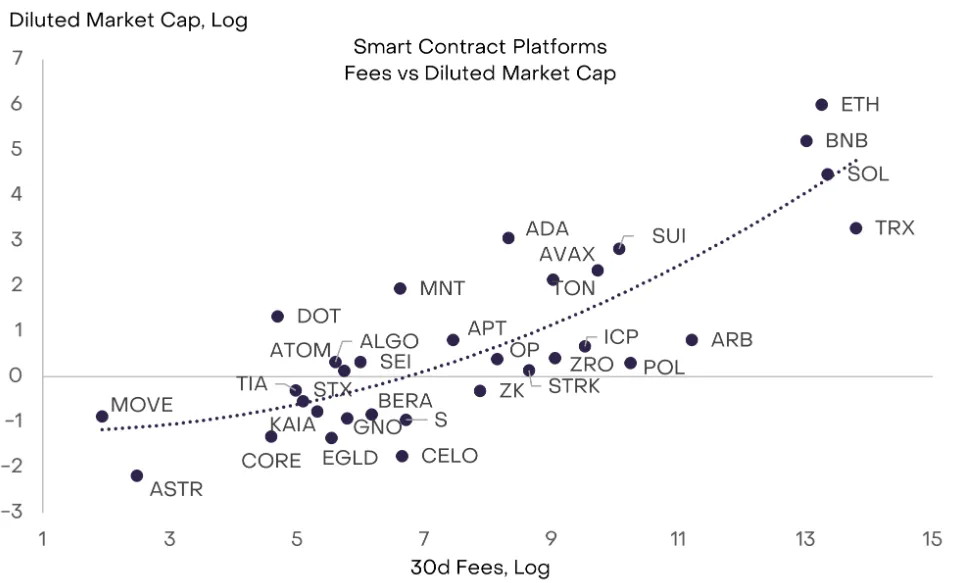

When assessing fundamental indicators, institutional investors will focus on transaction fees. Analysts consider this metric the most objective indicator of success, comparable to revenue in traditional business.

Among smart contract platforms, TRON, Solana, Ethereum, and BNB Chain lead in generating fees. In the application sector, Hyperliquid and Pump.fun show strong results.

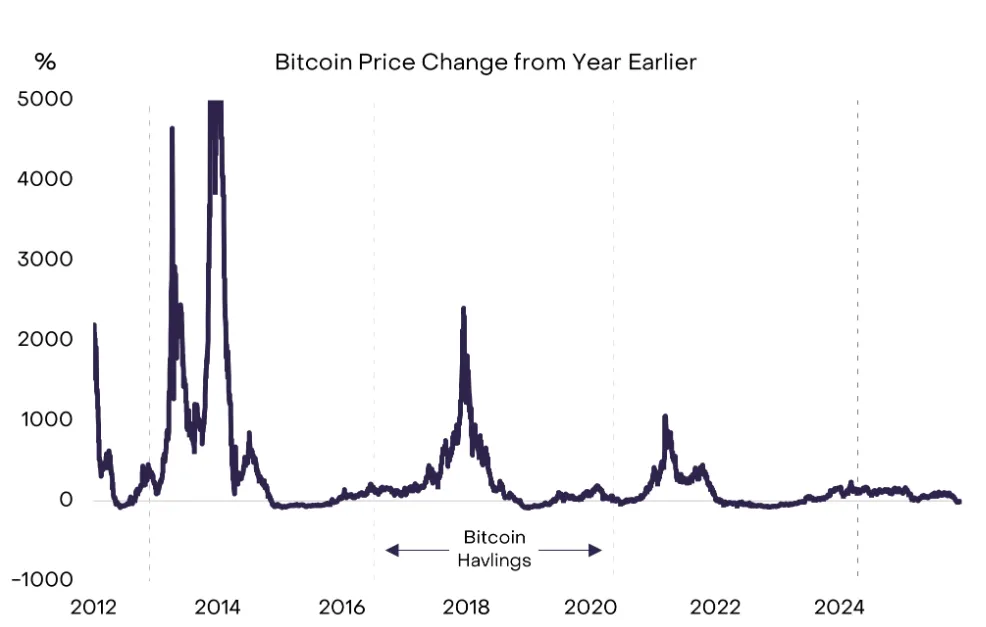

End of Four-Year Cycles

Grayscale believes that 2026 will mark the beginning of a mature market phase. The theory of four-year cycles, tied to Bitcoin’s halving, is losing relevance. Previously, dynamics were driven by retail excitement with sharp price jumps of 1000%, but now the focus is shifting towards steady institutional purchases.

This paradigm shift is confirmed by statistics: the annual growth of the first cryptocurrency by March 2024 was about 240%, indicating reduced volatility.

Analysts have predicted a new all-time high for Bitcoin’s price in the first half of 2026. Growth will be supported by two factors:

- Macroeconomics: Rising US government debt and inflation risks increase demand for alternative savings;

- Regulation: Court victories and the launch of spot ETPs have already attracted $87 billion to the industry since early 2024. The expected easing of the Fed‘s policy will create a favorable environment for risky assets.

The company also urged to ignore “distractions.” The threat of quantum computers to blockchain and the impact of corporate crypto reserves on the market in 2026 are expected to be minimal.

Back in October, Standard Chartered analysts estimated the RWA segment’s capitalization at $2 trillion by 2028.

In November, the Bank for International Settlements warned that tokenized money market funds and their integration with DeFi pose a threat to the entire financial system.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!