How Ethereum Will Exit Staking After the Shapella Upgrade

On 13 April, around 01:27 (Kyiv/Moscow), the Ethereum blockchain will activate the Shapella hard fork. The update will enable withdrawals of ETH from staking — some validators have awaited this capability since the launch of Beacon Chain in 2020.

The upgrade’s implications for the ecosystem of the second-largest cryptocurrency by market capitalization—and, accordingly, its price—are a matter of lively debate in the community.

Some argue that withdrawals from the deposit contract will exert enough downward pressure on the price. Others point to growing investor interest in staking and a potential rally for the asset.

What is the Shapella upgrade on the Ethereum network?

In September 2022, in Ethereum activated The Merge upgrade, with which the blockchain moved to the consensus algorithm Proof-of-Stake. Participants in the mainnet gained access to staking—directly (validators) or through specialized protocols like Lido.

The Shapella hard fork includes changes for the execution layers (Shanghai) and the consensus (Capella) of the Ethereum blockchain. The most important of these is the ability to withdraw ETH from the Beacon Chain deposit contract.

The upgrade aims to reduce gas costs for certain types of transactions, optimise data storage, implement a number of EVM-related improvements and introduce new cryptographic primitives.

Shapella will be activated on slot #6 209 536 — first in epoch #194 048. At the time of writing the network is in epoch #193 874. The hard fork will take place on 13 April at 01:27 (Kyiv/Moscow).

How will the withdrawal of locked assets work?

Withdrawal from the deposit contract is available only to addresses with a 0x01 prefix, as only they can indicate the path for crediting the cryptocurrency. The developers added the corresponding data type in March 2021, so far not all validators have set it up — a little over 43%, according to Metrica.

Unlocking of cryptocurrency will not happen simultaneously. This dynamic process will take time and will depend on a number of factors.

Users have two withdrawal options:

- partial (assets above balance of 32 ETH) — the validator does not leave the Beacon Chain, continuing to participate in the consensus mechanism;

- full — the validator exits the network, ceasing to be a participant. The remainder (32 ETH and rewards) is unlocked.

In the first case, asset withdrawals will occur automatically “approximately once a week”. Within a single slot (every 12 seconds) 16 partial withdrawals are available — 115 200 iterations per day (7,200 slots).

In the second case, one must join the unlock queue.

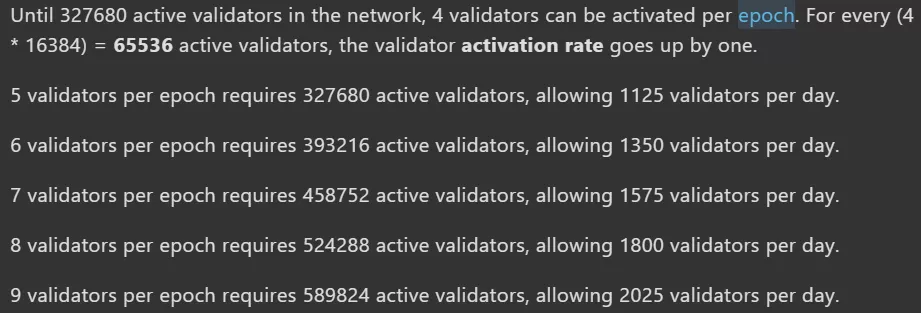

The size of the latter depends on the total number of validators. The higher it is, the more users will be able to fully withdraw their assets within a single epoch. By the developers’ own words, this approach should mitigate security risks and limit the impact of the process on Ethereum’s price.

How many Ethereum can be withdrawn from staking after activation of Shapella?

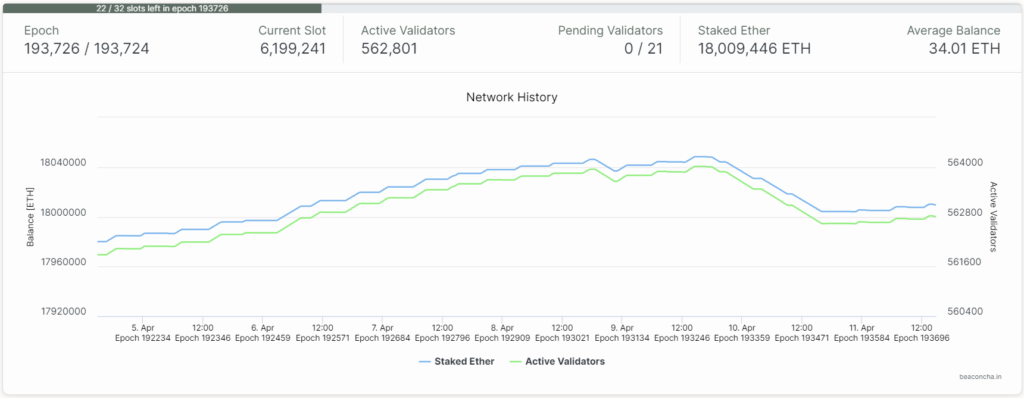

According to beaconcha.in, at the time of writing there are 562,801 validators active in the blockchain. The deposit contract holds over 18 million ETH, and the average validator balance is 34.01 ETH.

According to the project’s withdrawals FAQ documentation, under the above inputs full unlock is available for eight validators in the epoch (1800 per day). This means that within this procedure you can withdraw 57,600 ETH per day (~$110.47 million at the rate at the time of writing).

For comparison: according to CoinGecko, as of 11 April the daily trading volume in the ETH/USDT spot pair on Binance alone exceeds $975 million.

Addresses with the 0x01 prefix number around 242 005 validators. Even if these participants line up (a very unlikely scenario), releasing all their assets would take 135 days.

How will Shapella affect Ethereum’s price?

Galaxy Digital expects that validators may sell more than 500 000 ETH:

«If we conservatively assume that validators realise 50% of their staking rewards, we expect that 553,650 ETH will be sold. In seven-day terms, this amounts to roughly 1% of ETH’s daily selling volume (including spot and perpetual futures)».

Analysts say this amount could exert ‘insignificant or mildly bearish’ pressure on prices. They also note that, if the upgrade is successful, the hard fork could become a price driver.

In a conversation with The Block, Cronos Labs head Ken Timsit said that in the near term Shapella could trigger volatility in Ethereum’s market. However, in his words, the situation would later ‘ease’ because the event is already priced into the quotes.

The head of FRNT Financial’s investment desk Sam Andrew also believes the upgrade will not cause a ‘material’ move in price. Among the reasons he cited are the restrictions on withdrawals set by developers and validators’ desire to secure higher staking rewards while keeping the cryptocurrency on balance.

2/ Background: Shapella allows stakers to unstake their eth.

It’s a big deal.

Prior to 4/12/23 when Shappella goes live, stakers have not been able to unstake their eth.

Stakers have been staking for up to 2.5 years and can finally get their staked eth + rewards back.

— Sam Andrew (@samuelmandrew) April 11, 2023

Troubled firms such as Celsius may begin to withdraw and sell assets. There are also concerns about similar actions by the Kraken exchange. The latter is under the glare of U.S. regulators over its staking program.

However, regardless of near-term price action, one can expect a liquidity influx into the Ethereum DeFi ecosystem and growing investor interest in staking the cryptocurrency. In the long run, the activation of Shapella could, potentially, be positive for the asset’s price.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!