How to Earn on Stablecoins and Synthetic Stocks in the Terra Ecosystem (Part 1)

The DeFi segment is continually evolving — new protocols and platforms are emerging, along with broad opportunities for passive income.

Many believe that investments in cryptocurrency are fraught with high risk due to volatility, but in recent years popular services and even ecosystems have emerged, with stablecoins at their core.

In December the Terra fell to second place by total value locked (TVL), trailing only Ethereum. This happened largely thanks to the success of Anchor — the ecosystem’s largest project, offering about 19.47% APY on deposits in the stablecoin UST.

Terra also has the synthetic-assets service Mirror Protocol and many other tools for a range of investment strategies.

Earlier ForkLog looked at opportunities for passive income in the networks BNB Chain and Fantom. In this article we discuss Terra.

- The Terra ecosystem is growing rapidly thanks to fast and inexpensive transactions, and the stability of the UST peg.

- The largest ecosystem project is the Anchor lending service. With an intuitive interface, it lets you deposit UST at around 19.5% APY in a few clicks.

- The Mirror Protocol platform offers the ability to trade and earn passively on synthetic assets, including using advanced strategies.

Getting started

The TVL of the Terra ecosystem exceeds $16 billion, according to DeFi Llama. More than half comes from Anchor.

The central element, Anchor, is the most popular algorithmic stablecoin UST. Its market capitalization has grown from $400 million to almost $12 billion in a year.

UST outpaces Maker’s decentralized stablecoin Dai in the CoinGecko ranking by several notches.

In the summer of 2021 there was a significant surge in demand for UST amid growing popularity of Anchor. This led to active burning of LUNA and, in turn, a rise in the price of the cryptocurrency.

Another driver of demand for UST was the popularity of the Degenbox $UST-$MIM strategy on Abracadabra. In addition, many new protocols launched shortly after the Columbus 5 upgrade, which took place in late September. Against this backdrop, the price of LUNA prеvaled above $100.

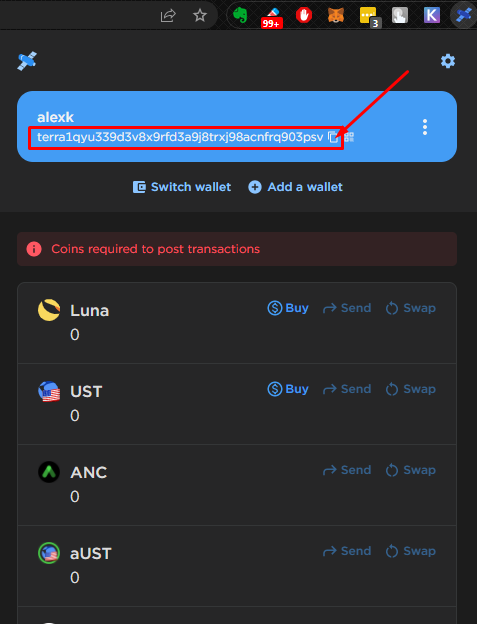

The Terra ecosystem counts more than 70 protocols. To work with it you will need the Terra Station wallet, available as a browser extension or apps for iOS, Android, Windows and Linux.

Before you start with the wallet you will need to write down a secret phrase. Then you need to create a login and password for entry, and also obtain some UST to pay fees. You can buy stablecoins on an exchange like Binance, and then transfer them to your Terra Station address.

Using the Add a wallet option, the app lets you create multiple wallet accounts from a single seed phrase. The Switch wallet function allows you to switch between wallets. With the Add tokens button you can add various assets to display in Terra Station.

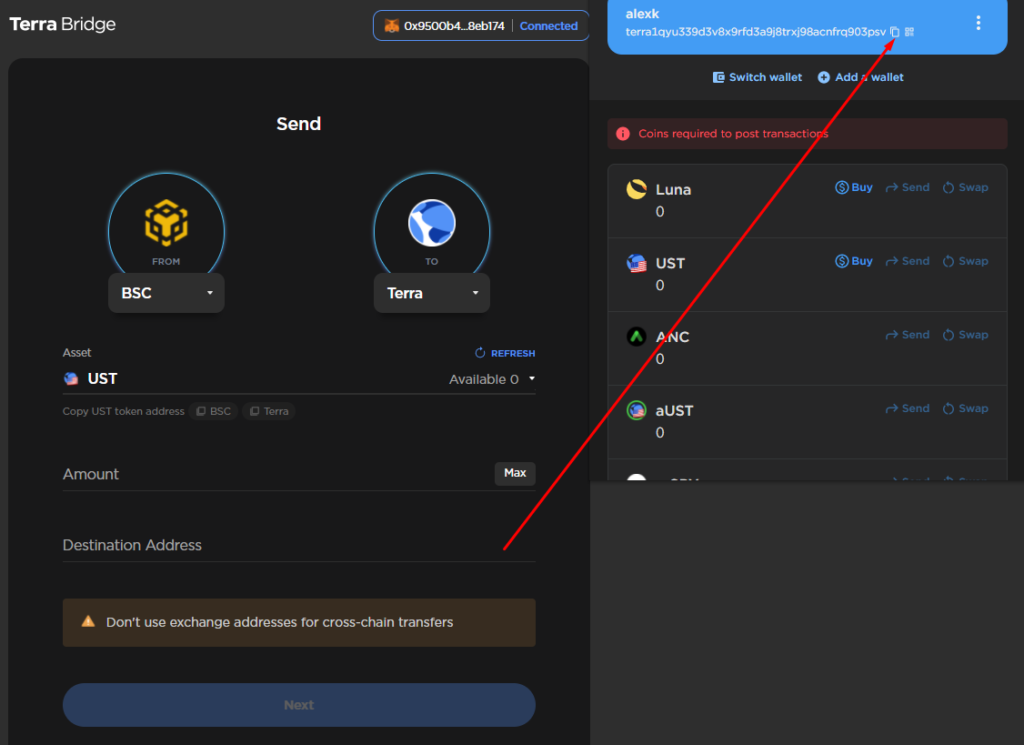

The cross-chain bridge Terra Bridge enables transferring assets into the Terra ecosystem from other blockchains, including Ethereum, Binance Smart Chain (BSC) and Harmony.

For example, you can withdraw part of liquidity from the UST-BUSD pool on PancakeSwap, where APR stands at 8.77%, to then deposit the stablecoins into Anchor earning around 19.5% (as of 13.02.2022). There is a Twitter thread explaining the platform’s business model and where such high yield comes from.

I’ve written a few guides on how to earn high interest on your stablecoins using #DeFi.

By far, the easiest and most passive (but also high yield) way is @anchor_protocol, which currently pays out ~19.5% APY in UST.

Let’s see how that works. 🧶 🪡 👇 pic.twitter.com/GnbhvNf4o9

— shivsak.eth (@shivsakhuja) December 25, 2021

On PancakeSwap, funds in pools are allocated in a 50/50 ratio. So roughly half of the withdrawn amount will be BUSD. This stablecoin can be sold on the same PancakeSwap into UST.

After that you need to:

- go to the Terra Bridge website;

- in the From field select BSC, in the To field Terra;

- in the Asset field specify UST, and in the Amount field — the amount;

- as Destination Address, enter the Terra Station wallet address copied from Terra Station;

- click Next.

After confirmation, cross-chain transfers are credited quickly — in a matter of minutes.

Anchor

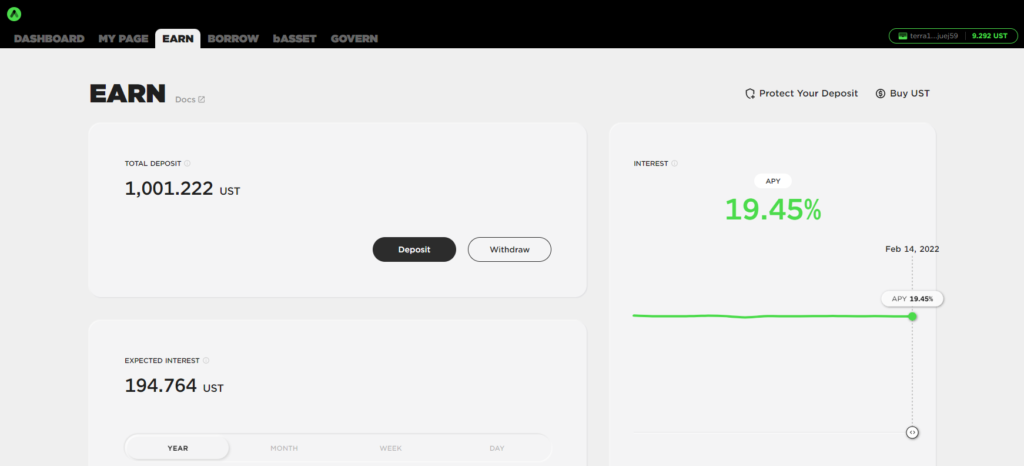

As already noted, Anchor is the largest protocol in the Terra network by TVL. Besides the high APY (~19.5%), its intuitive interface is among the advantages.

The Earn section is minimalist — Deposit and Withdraw buttons, an indicator of the current yield, and a switch showing the expected return over different time horizons (year, month, week, day).

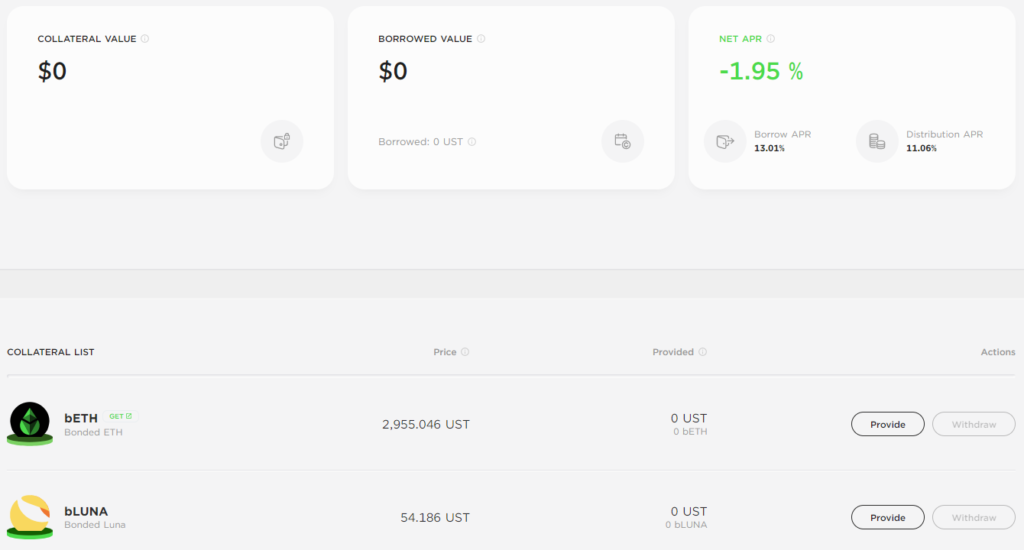

As with any lending platform, Anchor also offers the option to borrow funds secured by crypto assets. Collateral can include bETH and bLUNA.

ETH can be converted to bETH (Bonded ETH) via the converter on the Lido project site. bLUNA can be bought with UST on TerraSwap. Anchor also offers the possibility to convert LUNA to bLUNA.

In the right-hand side of the screenshot above you can see the parameters of collateralised loans:

- Borrow APR — 13.01% (loan interest rate);

- Distribution APR — 11.06% (yield rate at which borrowers are rewarded with native ANC tokens);

- Net APR — -1.95% (the difference between the first two parameters).

Sometimes the Distribution APR is higher than the Borrow APR. In such periods the service effectively subsidises borrowers.

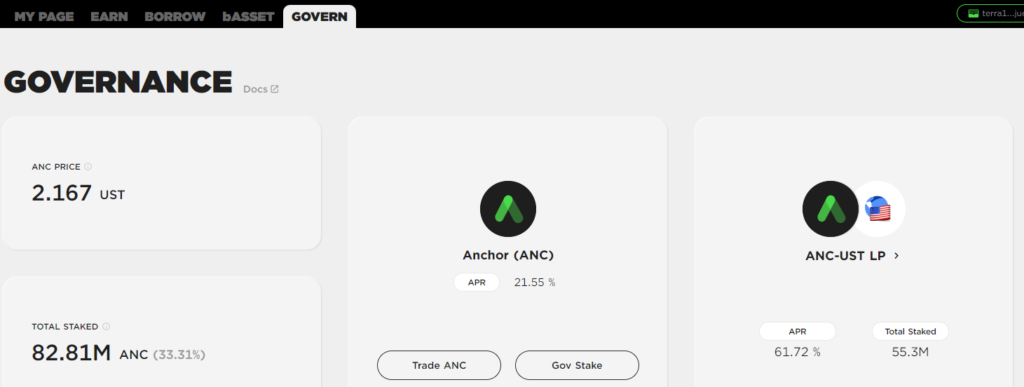

In the Govern tab you can stake earned or purchased ANC tokens, or farm them in a pool with the stablecoin UST.

In the first case, APR is 21.55%, in the second — 61.72% (as of 14.02.2022).

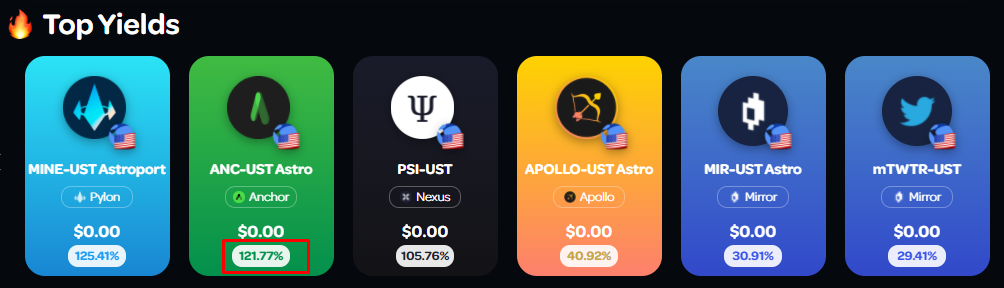

Yield for the ANC-UST pair in the corresponding Vault on Apollo DAO is almost twice as high.

Mirror Protocol

The service is designed for the issuance and trading of synthetic assets. The instruments offered on Mirror Protocol, with the help of oracles, track the prices of popular stocks, ETFs, as well as Bitcoin and Ethereum.

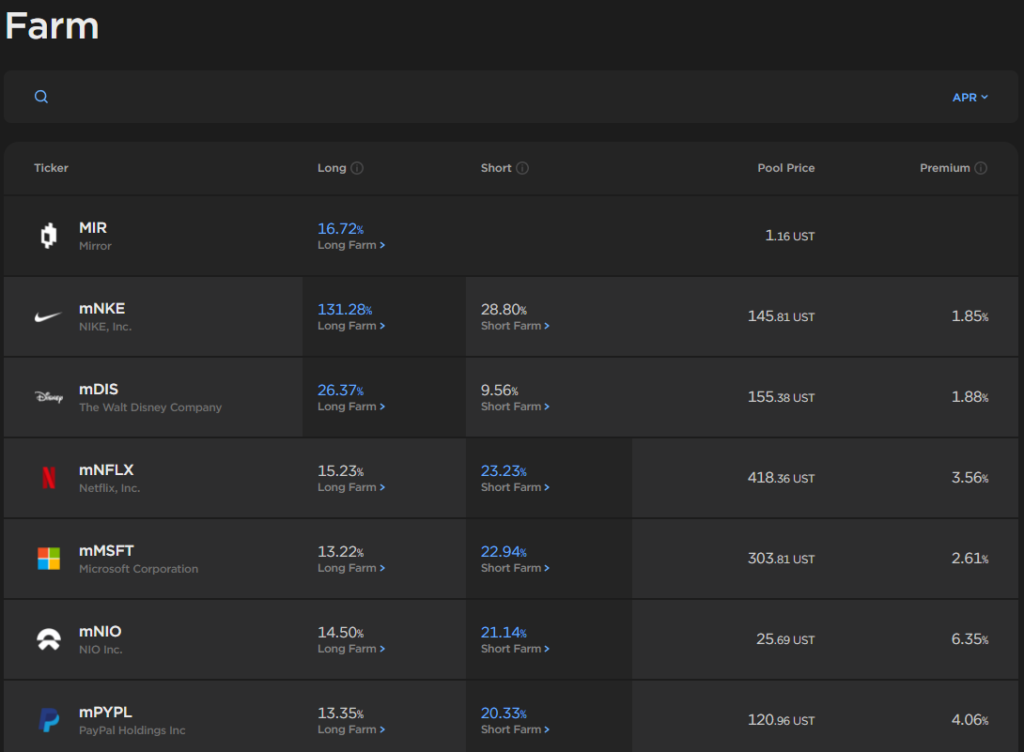

In the Trade section, synthetic assets can be bought and sold, including via limit orders. They can also be farmed in pools with UST, choosing a long or short position. Yields on long and short positions are usually markedly different.

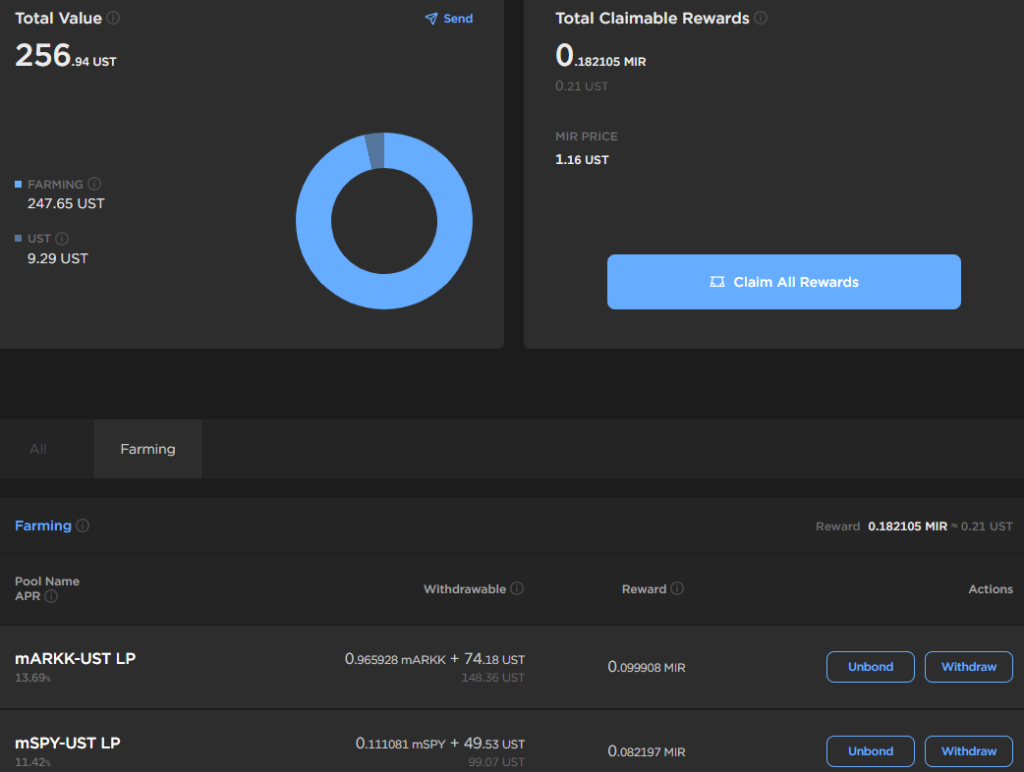

In the screenshot below you can see open long positions on instruments based on ARKK and SPY. The annual yield of the first position is 13.69%, the second 11.42%.

The Total Value shown to the left at the top displays the total value of assets, collateral, liquidity available for withdrawal, rewards, and those involved in staking MIR and UST.

How to earn more by pairing Anchor and Mirror Protocol

DeFi expert going by the nickname Route 2 FI proposed a strategy to maximise yields on deposited UST using the Terra protocols described above.

According to him, you can raise APY from the standard 19.5% to 50-140%. The approach is relatively risky, since it involves using borrowed funds. It also requires periodic monitoring of the debt-to-value ratio (Loan-to-Value Ratio, LTV).

“This is an active strategy, which means you must monitor it daily,” writes Route 2 FI. “You should always monitor higher-risk strategies.”

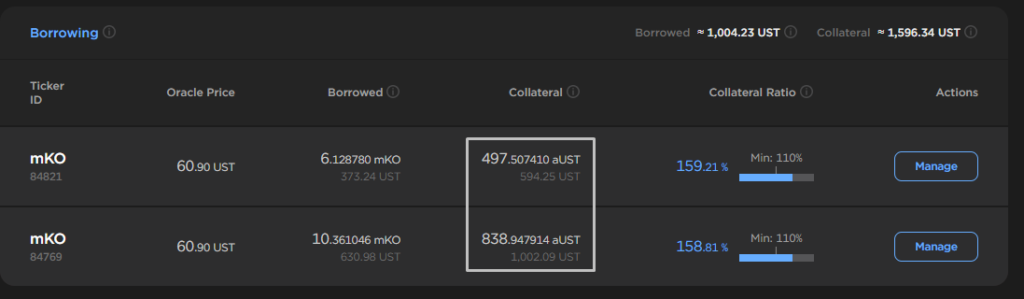

The author recommends testing the proposed approach with small amounts. So for our example we’ll use 1,000 UST, which corresponds to about 838 aUST.

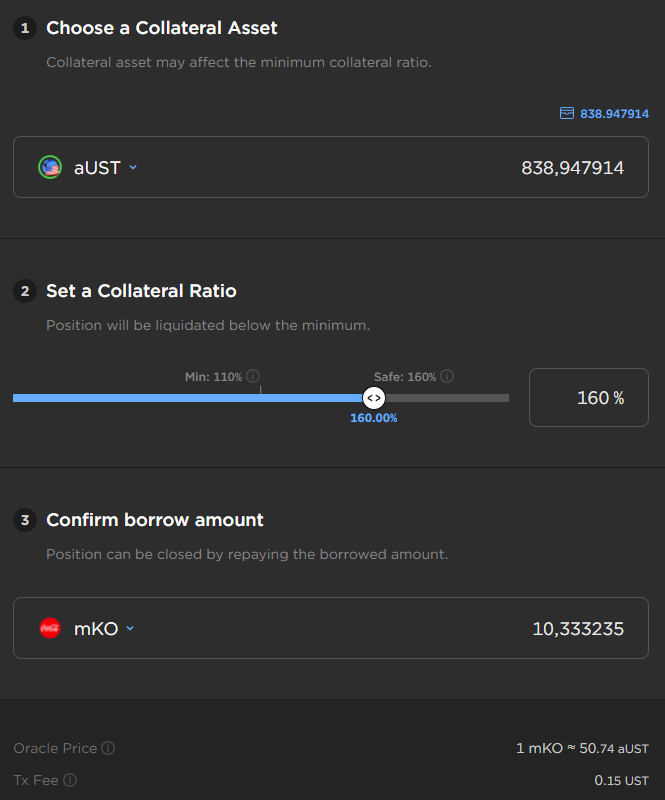

In the first step we deposit funds into Anchor. Then we go to the Mirror Protocol Borrow section and select aUST as collateral, and mKO as the borrowed asset.

Input the maximum value in the Choose a Collateral Asset field (in our case this is 838.947914 aUST). The strategy author suggests setting the Collateral Ratio to 130%. For safety, we’ll choose 160%, since the position is liquidated if the parameter falls below 110%.

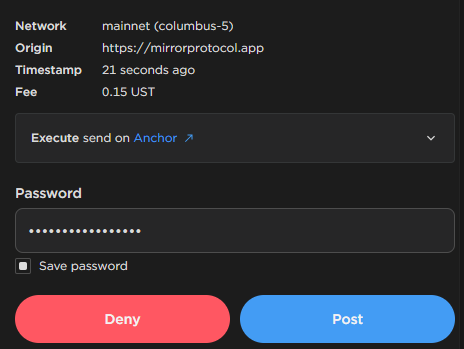

Such a Conservative setup allows borrowing a little over 10 mKO. After clicking Borrow, Terra Station opens. It shows a transaction fee of 0.15 UST.

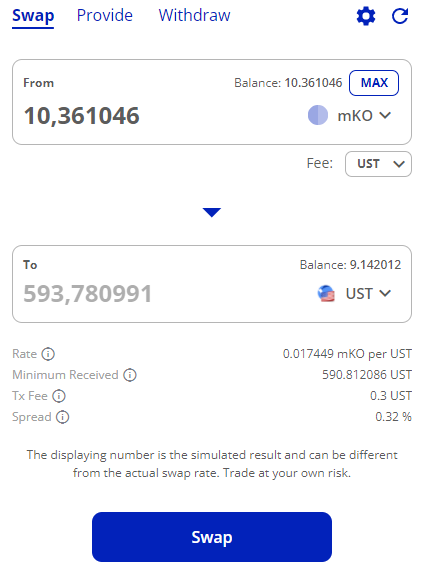

After pressing Post and submitting the transaction, you need to go to TerraSwap and swap 10.36 mKO for 593.78 UST.

The screenshot shows a fee of 0.3 UST and a spread of 0.32%. According to Route 2 FI’s calculations, a spread above 0.6% is unacceptable.

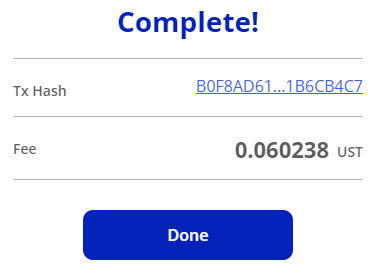

As a result, the transaction fee turned out to be lower than forecast — only 0.6 UST:

Then we redeposit the obtained 593.78 UST back into Anchor. Then we repeat the actions described above.

With each iteration of this cycle, the total amount of aUST grows, and its value increases by roughly 19.5% per year.

The video below explains the essence and features of aUST.

The next screenshot shows that as a result of operations on Anchor and Mirror Protocol the total value of assets in collateral has exceeded the initial deposit of ~1000 UST.

If you repeat several such cycles, the amount of aUST in the Mirror loan collateral in mKO and its value in UST will grow even more.

To close positions on Mirror, you simply buy the corresponding amount of mKO shares and click Close (Manage — Close). This can be done during Nasdaq’s trading session.

The protocol fee for such operations is 1.5% — this is worth considering. Moreover, the price of The Coca-Cola Company’s stock may rise, and you may have to pay more.

After closing the position, the collateral aUST will be released. Their value in UST will be slightly higher than the initial one, since the price of aUST gradually rises.

Conclusions

A multitude of ecosystems and DeFi protocols yields a wealth of yield-maximising strategies, including those with leverage. However, one should not forget that using borrowed funds typically carries heightened risk. Complex strategies often require periodic user engagement and payment of multiple fees.

Do not allocate a large share of funds to complex and sometimes opaque schemes. Also remember the principle of risk diversification. It means you should not concentrate all assets in a single pool, strategy, protocol or ecosystem, even if a high future return is anticipated.

Subscribe to ForkLog news on Telegram: ForkLog Feed — full news feed, ForkLog — the most important news, infographics and opinions.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!