Institutional Demand for Bitcoin Surpasses Supply Threefold

Since the beginning of the year, corporate treasuries and funds have acquired 371,111 BTC, a figure 3.75 times greater than the volume mined by miners over the same period. This was highlighted by André Dragosch from Bitwise.

📌UPDATE: In 2025, Bitcoin Treasury Companies have already bought 371,111 $BTC which is equivalent to

*checks notes*

3.75 x times the new supply of bitcoins. pic.twitter.com/eAoUXh2VYk

— André Dragosch, PhD⚡ (@Andre_Dragosch) August 8, 2025

“There won’t be enough bitcoins for everyone if institutions continue to accumulate cryptocurrency at this rate,” he also noted.

Public companies continue to increase their “digital reserves,” following the strategy of Michael Saylor. Major ETFs have accumulated a significant portion of the circulating supply.

According to SoSoValue, exchange-traded funds manage bitcoins worth nearly $151 billion — 6.47% of the total issuance of digital gold.

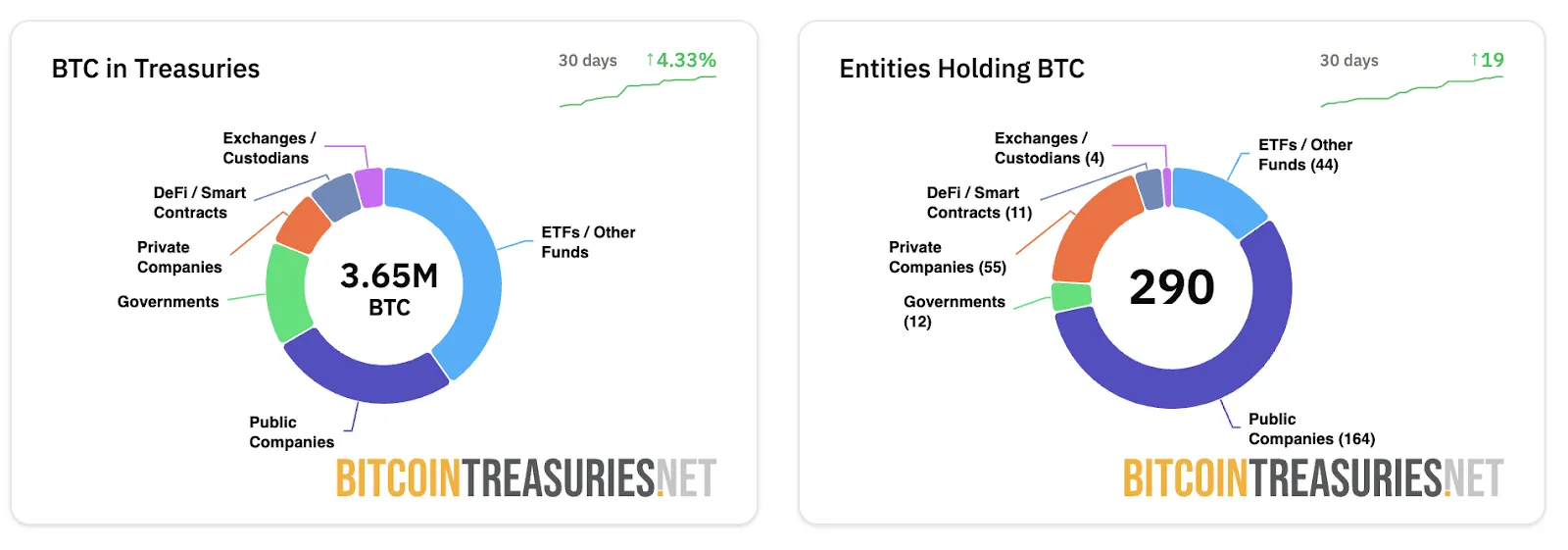

According to BitcoinTreasuries, 197 public and private companies have already added the first cryptocurrency to their reserves. The combined holdings exceed 1254 BTC, valued at over $146 billion, accounting for about 16% of the total supply of the first cryptocurrency.

Analysts at Glassnode noted that retail investors have also shifted to accumulation. According to their data, wallets with balances up to 100 BTC are purchasing about 17,000 BTC monthly, exceeding the current issuance of 13,850 BTC.

“Supply Shock” Approaches

The situation is exacerbated by the rapid decline in liquidity on OTC platforms, where large players traditionally conduct transactions. Only 155,000 BTC remain on these platforms — a record low, noted a trader under the pseudonym Bedlam Capital Pres.

$MSTR buys most of its BTC from OTC trade desks.

MSTR bought 182,391 BTC YTD.

OTC trade desks’ collective balances are down to around 155,000 BTC.

As the OTC desks run low, the demand on the public exchanges will increase, and that is what will uncork BTC’s price. pic.twitter.com/MYkOMcCp3u

— Bedlam Capital Pres (@BedlamPres) August 6, 2025

“As OTC platform reserves deplete, demand on exchanges will rise, and this is what will trigger a sharp increase in bitcoin’s price,” wrote the expert.

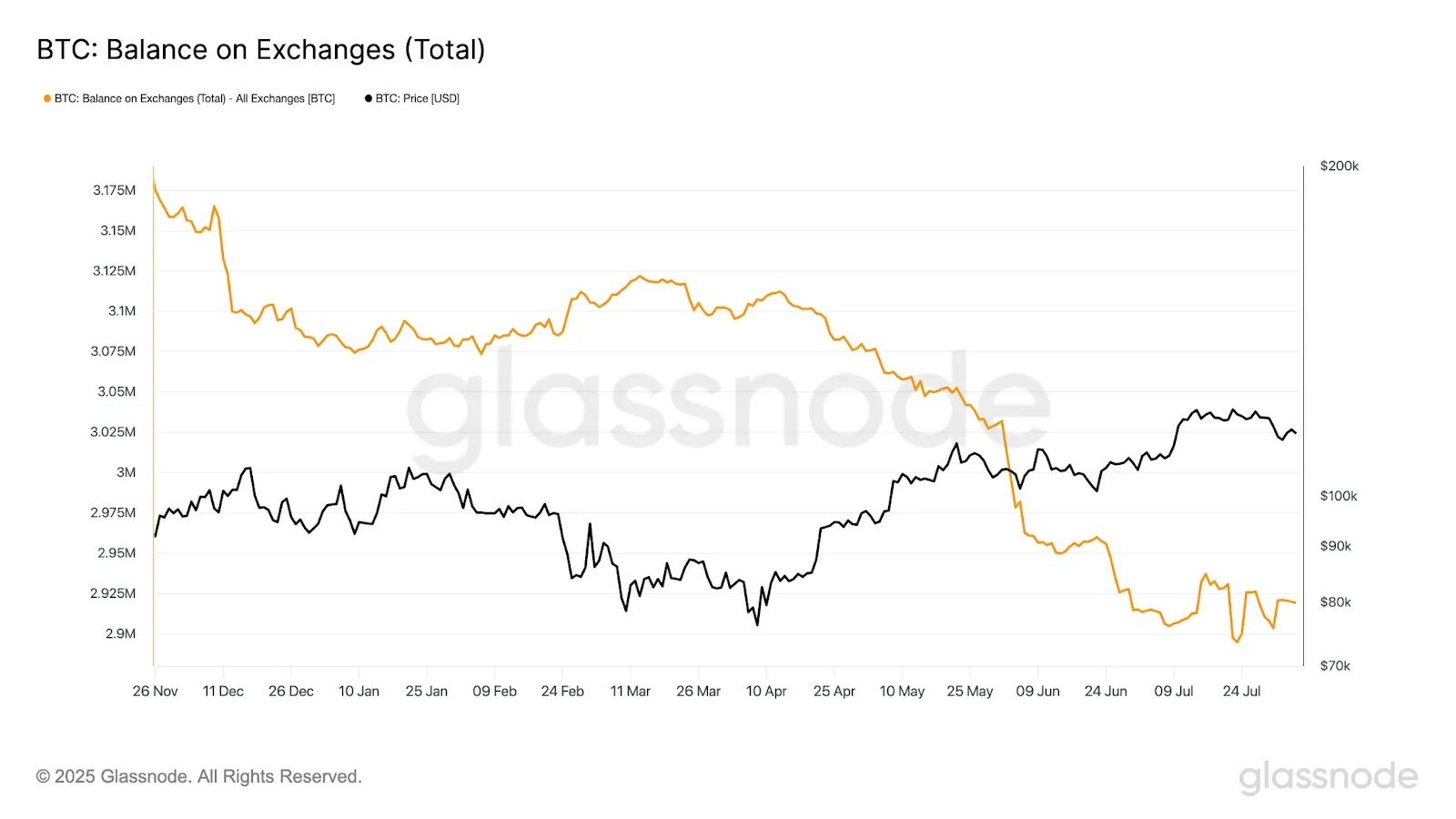

Reserves on trading platforms have also reached minimal levels. According to Glassnode, exchanges hold 2.919 million BTC.

“Investors have shifted from euphoria to caution, with oversold conditions and seller exhaustion indicating a potential rebound. Yet vulnerability is growing — the market could still suffer from external shocks or if demand does not recover in time,” emphasized analysts.

At the time of writing, bitcoin is trading at $116,740.

Analysts at CryptoQuant stated that bitcoin has entered a phase of “bullish pause.” Previously, they also pointed out a fundamental shift in capital distribution in the market.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!