Institutional Digest: Grayscale assets surpass $20bn as MicroStrategy buys 29,646 BTC

The cryptocurrency industry is drawing an increasing number of institutional players. This is reflected in both investments in infrastructure, and the growing focus that companies devote to Bitcoin as an asset class. The most important developments of the past weeks are in ForkLog’s overview.

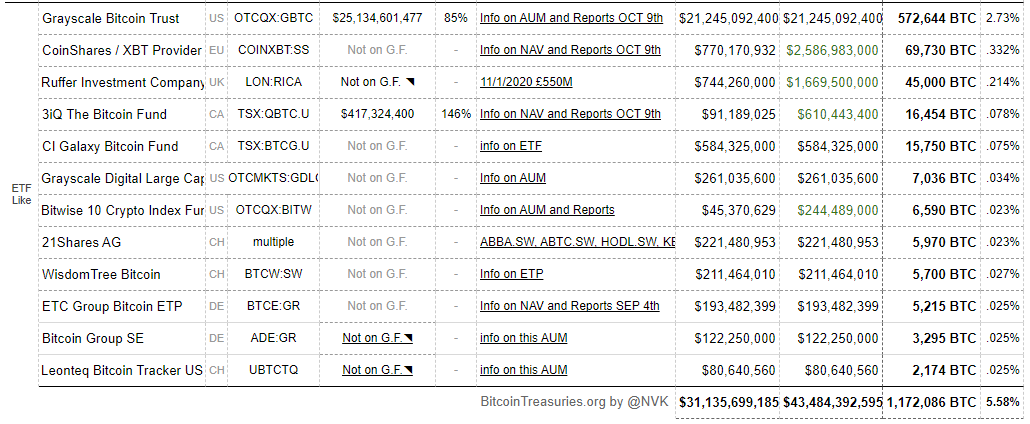

Institutional investors bought over 1 million BTC worth about $43.4bn

Major investors, including publicly traded MicroStrategy, Square and Grayscale, acquired more than 1 million BTC, worth $43.4bn. This represents 5.58% of the total supply of the first cryptocurrency.

One of the most active institutional investors in 2020 — Grayscale Investments, under whose management more than 570 000 BTC sits.

Data: Bitcoin Treasuries.

In Q4, the Grayscale Investments crypto funds attracted a record $3.26bn. For the full year 2020 the firm raised $5.7bn, which is 4.75 times the combined figure for 2013-2019 of $1.2bn.

Over the year, assets under management at Grayscale Investments rose from $2bn to $20.2bn. Institutional investors accounted for 93% of inflows in Q4 (87% attributed to GBTC).

Nasdaq-listed MicroStrategy is aggressive in investing in Bitcoin. In December the software provider added acquired 29 646 BTC for $650m. The funds for the Bitcoin purchase were raised through the issuance of convertible bonds.

In total MicroStrategy holds 70 470 BTC worth about $2.6bn.

The EOS project’s sponsor Block.one holds 140 000 BTC worth $5.2bn. At the time of writing the market cap of the EOS cryptocurrency stood at $2.6bn.

SkyBridge Capital launches Bitcoin fund with $310m in assets

The investment firm SkyBridge Capital launched a Bitcoin-based fund with assets of $310m.

SkyBridge Capital expects to improve its lacklustre financials through investments in new assets. In November last year the firm invested $25m in Bitcoin, and in December filed for registration of SkyBridge Bitcoin Fund L.P. for accredited investors.

By the end of December the company’s investments in the first cryptocurrency reached $182m.

Hong Kong’s GreenPro Capital invests $100m in Bitcoin

GreenPro Capital — another Nasdaq-listed company optimistic about Bitcoin’s prospects. The firm plans to spend $100m on the cryptocurrency in 2021.

To invest in Bitcoin, GreenPro Capital uses its subsidiary CryptoSX. This company is active in helping to create DeFi projects, organising STOs and forming the secondary market for security tokens.

Company representatives said they believe in the ongoing broad adoption of Bitcoin by banks, hedge funds, insurers and institutions.

Coinbase acquires Routefire, an institutionally focused startup

The largest American bitcoin exchange, Coinbase, acquired Routefire, a service specialising in executing large crypto trades.

The San Francisco-based startup Routefire develops institutional-investor oriented solutions that enable large orders to be executed quickly with minimal costs and little price impact.

With the new acquisition, Coinbase aims to expand the company’s brokerage business. The deal value was not disclosed.

Founded in 2017, the project previously attracted venture capital from Blockchain Capital, Hustle Fund and FJ Labs.

NYDIG acquires Digital Assets Data

The institutional crypto platform New York Digital Investment Group (NYDIG) acquired the analytics company Digital Assets Data.

NYDIG’s business spans custody and brokerage services for companies and large private clients. Assets under management exceed $4bn. NYDIG reported a tenfold increase in its client base in 2020.

With the acquisition of Digital Assets Data, the company aims to broaden its range of services for institutions, hedge funds, wealthy investors and banks seeking to unlock Bitcoin’s potential as an asset class.

Hashed raises $120m for blockchain startups and DeFi development

South Korean blockchain company Hashed raises $120m for a fund to back technology startups and DeFi projects.

What is decentralized finance (DeFi)?

Hashed Ventures will manage investment allocations. The firm said the fund was backed by major local IT firms, though names were not disclosed.

“We believe we are heading toward a society where people will work across different networks (protocols), not within single companies. Our mission is to identify the best networks,” said Hashed CEO Simon Kim.

According to the company site, Hashed has already invested in the payments startup Chai, the Vega platform, the Set investment startup and the DeFi project MakerDAO.

Swiss crypto bank SEBA raises $22.5m

The regulated crypto bank SEBA completed a Series B funding round, raising CHF 20m (~$22.5m).

The funds will be used to accelerate its growth strategy. This includes expanding its product and service offerings, boosting lending capacity for clients, and taking its Swiss hub to new markets.

Representatives also stated the intention to tokenise the shares from the latest funding round once Switzerland implements a regulatory framework for blockchain technology.

Follow ForkLog news on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!