Institutional Digest: Jack Dorsey’s Square buys Bitcoin and Grayscale posts record inflows

In a traditional digest, we have gathered the most significant events of the past weeks in the cryptocurrency industry, related to investments and other institutional activity.

Square Invests $50 Million in Bitcoin

Square acquired $50 million worth of Bitcoin.

“Given the rapid evolution of cryptocurrency and the unprecedented uncertainty from macroeconomic and monetary regimes, we believe that now is the right time to expand our USD-denominated balance sheet and make meaningful investments in Bitcoin,” — is said in a Square statement.

Investments in BTC amounted to about 1% of Square’s total assets at the end of Q2 2020.

The company deemed it important to disclose how the deal to buy approximately 4,709 BTC was executed, as other firms are also considering similar investments.

To preserve confidentiality and reduce the cost of the purchase, Square acquired Bitcoin on the over-the-counter market through a liquidity provider used for trading cryptocurrency in the Cash App.

The firm arranged with an OTC broker a spread above the public Bitcoin index. The parties used a volume-weighted average price over the agreed 24-hour period.

For cold storage of Bitcoin, the company uses its own SubZero solution with a hardware security module, introduced in 2018.

The World’s Largest Sovereign Wealth Fund with Assets Over $1 Trillion Becomes Indirect Owner of Bitcoin

The Government Pension Fund of Norway, with assets worth more than $1 trillion, became an indirect owner of 577.6 BTC.

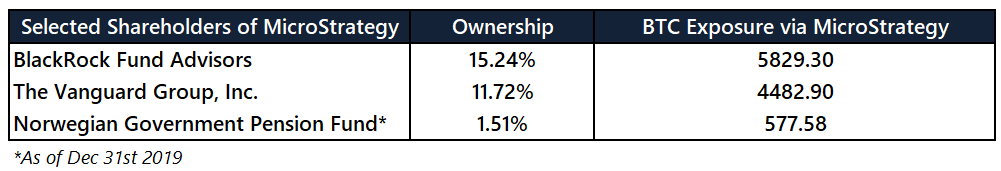

The Bitcoin holder, the world’s largest sovereign wealth fund, also known as the Oil Fund, became indirect owner thanks to its 1.51% stake in MicroStrategy.

The Nasdaq-listed analytics software provider bought 21 454 BTC (~$250 million at the rate at the time of the deal), becoming the first public company to invest part of its capital in Bitcoin. In September the company further bought 16 796 BTC for $175 million.

The largest stakes in MicroStrategy are held by the largest investment firms Vanguard ($6.2 trillion under management) and BlackRock ($7.43 trillion).

Source: Arcane Research.

CEO MicroStrategy Michael Saylor expressed confidence that other private firms will follow their lead and in the coming months move part of their capital into Bitcoin.

“Most likely, private companies will be the first to move, because they do not have such inertia. Public companies of our size, then mid-sized firms,” — he added.

In the Third Quarter Grayscale crypto funds attracted a record $1.05 Billion

In the third quarter inflows into Grayscale Investments’ crypto funds amounted to a record $1.05 billion.

In the previous quarter inflows reached $905.8 million. Year to date, inflows have totaled $2.4 billion, more than double the total for 2013-2019 combined.

On average per week, new investments totaled $80.5 million, of which $55.3 million went to Grayscale Bitcoin Trust (GBTC), and $15.6 million to Grayscale Ethereum Trust. The latter’s share rose from 15% to 19.4%.

Total assets under management by Grayscale Investments reached $6.3 billion.

Grayscale Ethereum Trust became a company under the US Securities and Exchange Commission (SEC). This is the second Grayscale fund to receive such status — the first was the Grayscale Bitcoin Trust, the most popular with investors.

DeFi Project Aave Raised $25 Million for Institutional Lending Development

The lending protocol Aave raised $25 million in investments from Blockchain Capital, Standard Crypto, Blockchain.com and a number of other companies.

“Aave received funds from strategic investors to bring DeFi closer to institutional use cases and expand the team to support growth in Asian markets,” said CEO Stani Kulechov.

He added that the new investors will participate in staking and governance of the protocol.

Peter Thiel’s Fund Led Bitpanda’s $52 Million Financing Round

The European cryptocurrency broker Bitpanda announced the completion of a Series A financing round, which raised $52 million.

The round was led by Valar Ventures, the fund associated with PayPal cofounder Peter Thiel.

Bitpanda plans to use the funds to scale headcount to 300 employees and to develop new products.

Together with the latest round, total invested capital comes to around $100 million, the company said.

Bitcoin Exchange Operator EQUOS Secured Nasdaq Listing

Hong Kong-based blockchain company Diginex became the first crypto exchange operator whose shares are listed on Nasdaq.

Trading under the ticker “EQOS” began on October 1.

Diginex went public via reverse merger with 8i Enterprises Acquisition Corp, whose shares were already listed on Nasdaq. The deal was first announced in July of last year, with closing planned for March but postponed indefinitely.

In late July, Diginex and 8i returned to this idea, targeting a close by the end of September. On September 15, shareholders approved the deal at an extraordinary meeting.

CEO of Diginex Richard Byworth called the Nasdaq listing a milestone for the industry as a whole.

SBI Holdings Acquired the TaoTao Crypto Exchange

Japan’s financial conglomerate SBI Holdings became the owner of the TaoTao crypto exchange. It has joined SBI Liquidity Market as a subsidiary.

Beyond TaoTao, the group controls the VC Trade platform. In a statement, SBI Holdings said the purchase would raise the quality of crypto services offered.

The day before the announcement, reports surfaced that the talks between Binance and TaoTao to form a joint venture serving Japanese traders had fallen through. The deal had been discussed since January. The parties did not disclose the reasons for ending the negotiations.

The Dutch Central Bank Registers the First Cryptocurrency Company

Amsterdam Digital Asset Exchange (AMDAX) became the first cryptocurrency company licensed by the Dutch central bank.

The registration will allow the service to process cryptocurrency payments and provide custodial services in accordance with the EU’s Fifth Anti-Money Laundering Directive (5AMLD EU).

Earlier, due to tightening EU regulation, the Netherlands’ crypto business faced existential risk. However AMDAX co-founder Valentino Cremona called the regulatory requirements for startups “quite justified.” In his view, the market needs clear legal frameworks.

Media: Bitcoin Exchange Bithumb Re-listed for Sale

South Korean cryptocurrency exchange Bithumb is seeking a buyer again. The deal is being led by Samjong KPMG, Herald Corporation said, citing sources.

Valuation ranges for the platform are between $430 million and $600 million. Sources say foreign investors and local private equity funds have expressed interest.

The article noted that a real buyer would face a tough process given Bithumb’s current problems.

In September, Bithumb CEO Lee Jung-hoon was summoned for questioning in a case involving fraud around the native token BXA. Prosecutors say he raised about 30 billion won (~$25 million) in a pre-sale but did not list the token.

Earlier, Seoul police carried out several searches at Bithumb’s offices and seized some shares of Bithumb Holdings, owned by Bithumb Korea’s director Kim Ben-gen.

In late 2019, the tax authorities demanded 80 billion won ($68.9 million at the time) in profits tax from Bithumb’ s foreign-user investments. The company is seeking to appeal the decision in court.

In October, the tax authority stated the legality of its demands, following support for Bithumb from Pak Hyeong-su, a member of the National Assembly’s Planning and Finance Committee.

In 2018 the exchange was put up for sale at $350 million. At the time, Singapore’s BK Global Consortium showed interest; a year later reports surfaced of the deal falling through.

ForkLog also wrote:

- Research: 90% of institutional investors plan to buy more Bitcoin.

- Assets under management of the Bitwise Bitcoin fund reached $9 million.

- Paradigm led an investment round of $3 million for the Sia and Skynet developer.

- Dune Analytics attracted $2 million in a seed round of financing.

- Tim Draper’s company led a $3.5 million round for the Unocoin exchange.

Subscribe to Forklog’s channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!