Institutions push Bitcoin price toward May highs

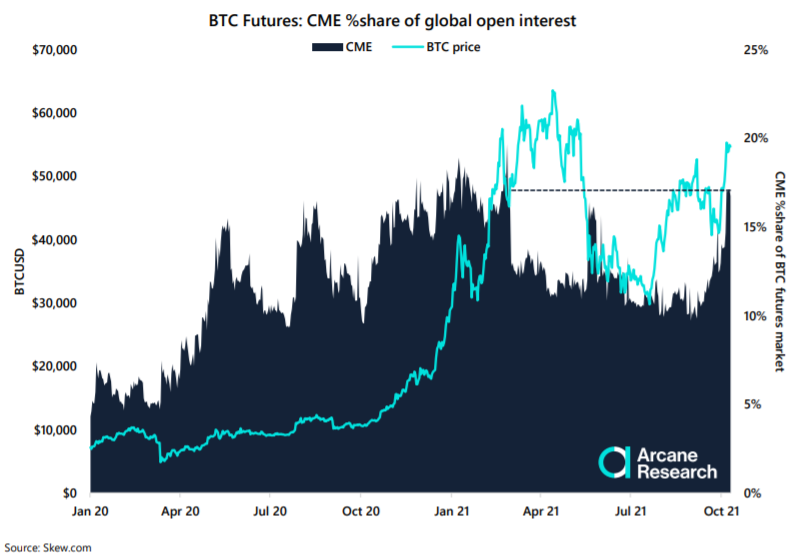

The share of CME in total open interest (OI) on Bitcoin futures over the past two weeks rose from 12% to a record 17% since February 2021, according to Arcane Research.

The Weekly Update — Week 40

🔹#Bitcoin continues to outperform altcoins. Has bitcoin’s time to shine finally arrived?

🔹Institutions are piling into the CME futures, betting on a futures-backed ETF approval

🔹Mining profitability surges in Octoberhttps://t.co/97Q8xqhfdn— Arcane Research (@ArcaneResearch) October 12, 2021

This explains one of the main reasons for the current Bitcoin rally to May highs.

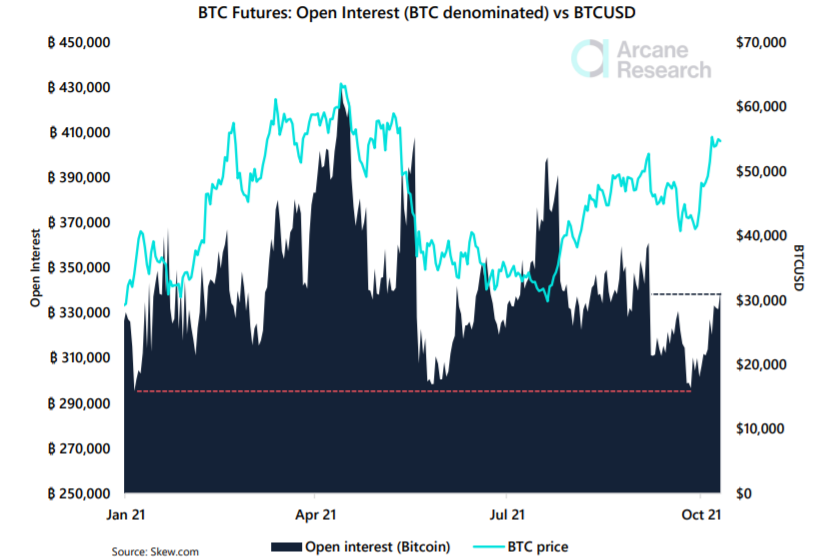

Experts noted that open interest rose to 340,000 BTC in the period from September 26 to October 10, marking the fastest pace since July. That period was also accompanied by increased buying activity. The largest contribution came from CME traders — the figure rose from $1.5 billion to $3.3 billion.

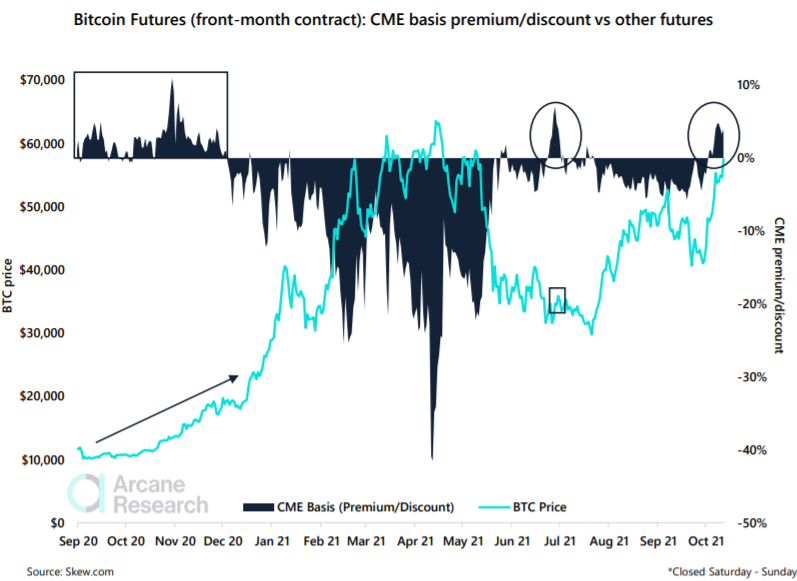

In the context of basis relative to unregulated venues, CME futures began trading at a premium in October, something last seen in July, and for the year 2021 overall it was rare.

Analysts saw this as a signal of a more ‘healthy’ rise in the price of the first cryptocurrency. They cited a bullish forecast by CME traders regarding the chances of the US SEC approving a Bitcoin ETF.

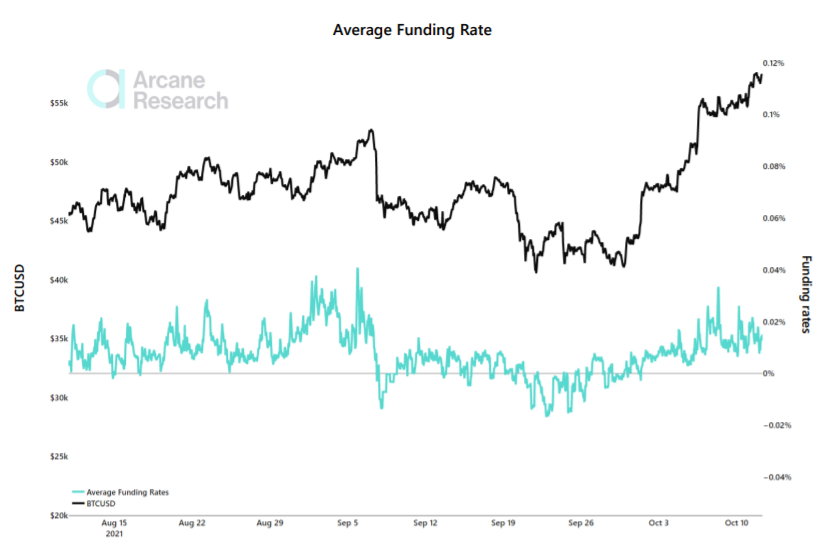

On the perpetual-contracts market, the funding rate remained in positive territory (in the range of 0.01–0.03%), signaling maintained positive price expectations. The metric did not reach March–April levels (0.1%), preceding Bitcoin’s historic high.

Glassnode analysts noted that Bitcoin’s return to May highs is accompanied by positive trends in accumulation, hodler behavior and rising on-chain activity.

Earlier, Pantera Capital CEO Dan Morehead did not rule out that the launch of a Bitcoin ETF could end the bull market.

Subscribe to ForkLog news on Telegram: ForkLog Feed — all the news, ForkLog — the most important news, infographics and opinions

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!