Interest in Crypto Funds Revives After Record $942 Million Outflow

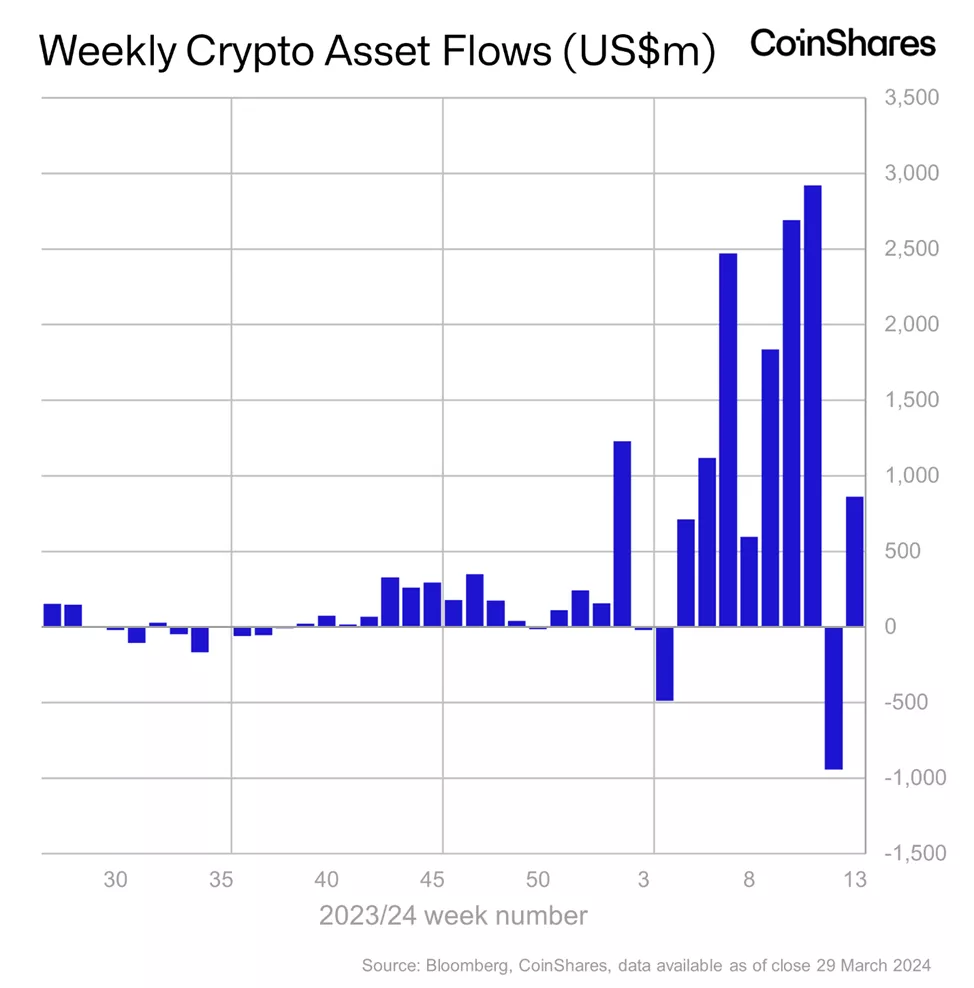

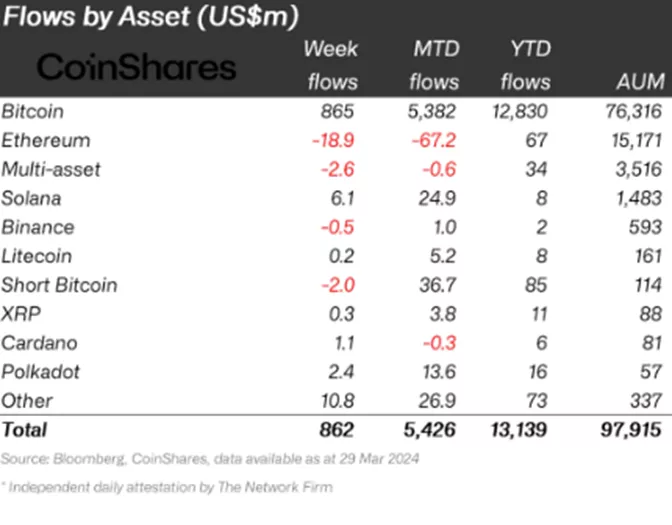

Cryptocurrency investment products saw inflows of $862 million from March 23 to March 29, following a $942 million outflow the previous week, according to CoinShares analysts.

A recovery for Bitcoin ETFs, with US$862m inflows last week pic.twitter.com/D1OWUSdGIU

— James Butterfill (@jbutterfill) April 1, 2024

Amid Bitcoin’s recovery to $70,000, assets under management increased from $88.2 billion to $97.9 billion.

The main activity remained focused on instruments related to digital gold. The current inflows ($865 million) almost completely offset the record $904 million outflow from the previous reporting period.

From structures allowing short positions on the leading cryptocurrency, clients withdrew $2 million after $3.7 million the previous week.

Outflows from Ethereum funds decreased from $34.2 million to $18.9 million.

Investors allocated $6.1 million, $2.4 million, and $1.1 million into Solana, Polkadot, and Cardano-based instruments, respectively.

CEO of Morgan Creek, Mark Yusko, has forecasted Bitcoin’s rise to $150,000 by the end of the year.

Earlier, analysts at Bernstein raised their price forecast for the leading cryptocurrency to $90,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!