Jamie Dimon calls Bitcoin worthless, and his stance unpopular

JPMorgan Chase Chief Executive Jamie Dimon again criticised the leading cryptocurrency, but conceded that the firm’s clients think otherwise. Bloomberg reports.

During the Institute of International Finance’s annual meeting, JPMorgan’s CEO stated that cryptocurrencies will come under regulation, as concerns rise in Washington about stablecoins and the broader asset class.

“I personally believe Bitcoin is worthless. Our clients are adults; they disagree. That’s what makes markets. So if they want to have the ability to buy BTC, we can’t hold it, but we can provide them with legal and as transparent access,” Dimon said.

Previously, the JPMorgan CEO repeatedly criticised cryptocurrencies, vowed to fire employees trading digital assets, and called Bitcoin holders fools.

In May 2021, Dimon acknowledged the clients’ interest in the first cryptocurrency, but reminded of his negative stance toward the asset. Later he recommended staying away from cryptocurrencies.

In September, the bank’s CEO allowed Bitcoin’s price to rise tenfold over the next five years, but ruled out the possibility of buying it.

Analyst Ryan Selkis, founder of Messari, published the core theses from Dimon’s views on Bitcoin dating back to 2014 and compared them with price movements.

Jamie Dimon on BTC:

2014: “terrible store of value”

2015: “will not survive” “will be stopped”

2016: «going nowhere»

2017: «a fraud»

2018: «don’t really give a shit»

2019: [JPMCoin launch]

2020: “not my cup of tea”

2021: “I have no interest in it” “fool’s gold” “worthless”BTC: pic.twitter.com/ya6ZeDgqrr

— Ryan Selkis (@twobitidiot) October 11, 2021

Analyst Joseph Young noted that “it’s not a Bitcoin bull market without Jamie Dimon, who said that it is worth nothing”.

It’s not a Bitcoin bull market without Jamie Dimon saying it’s worthless.

— Joseph Young (@iamjosephyoung) October 11, 2021

Galaxy Digital founder Mike Novogratz expressed surprise at Dimon’s position.

“So strange. For a man who has done a brilliant job running a giant bank, his answers around Bitcoin sound superficial, and he keeps doubling down on them. I pray I stay open minded my whole life”, — wrote Novogratz.

So strange. For a man who has done a brilliant job running a giant bank, his answers around $BTC are sophomoric and he keeps doubling down on them. I pray I stay open minded my whole life. https://t.co/d4rJpUFGKH

— Mike Novogratz (@novogratz) October 11, 2021

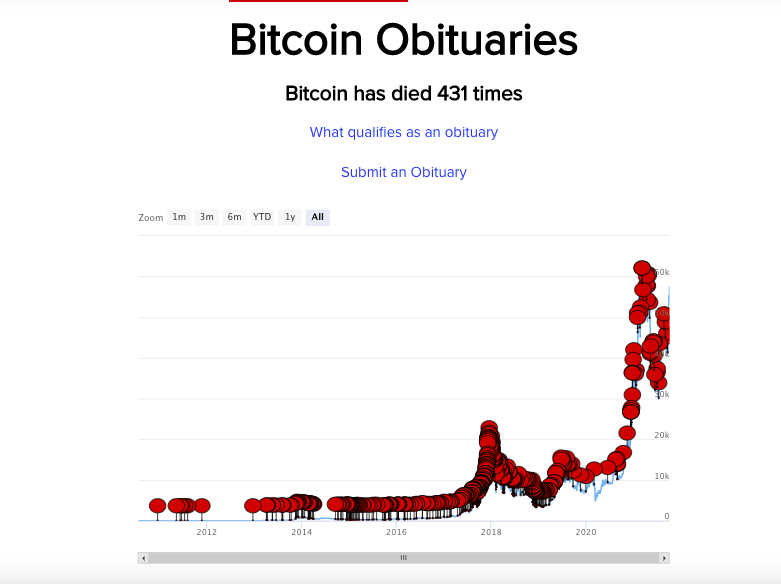

The site 99 Bitcoins has compiled negative forecasts about Bitcoin’s future — over 11 years the asset was predicted dead 431 times. The earliest date is December 15, 2010, and the most pessimistic statements (124) were heard most often in 2017.

In August, JPMorgan, together with NYDIG, launched a fund based on the first cryptocurrency for wealthy clients, according to media.

Earlier it was reported that the group opened access to three Grayscale Investments funds and the Osprey Bitcoin Trust for subscribers of the asset management unit’s services.

Subscribe to the ForkLog channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!