JPMorgan: DeFi ‘infection’ from Curve incident has ceased

The implications for the DeFi ecosystem from the recent attack on Curve Finance appear to be localized. JPMorgan analysts arrived at this conclusion, The Block reports.

“While the decline in CRV price has caused some ‘contagion’ to platforms using these tokens as collateral, the consequences remain contained for now. Overall the sector remains in ‘contraction’ or ‘standstill’ mode,” they wrote.

The Curve attack jeopardised the liquidation of the founder’s loans secured by project tokens. Such a development could put pressure on other DeFi protocols due to CRV’s role as a trading pair in various liquidity pools, the analysts noted.

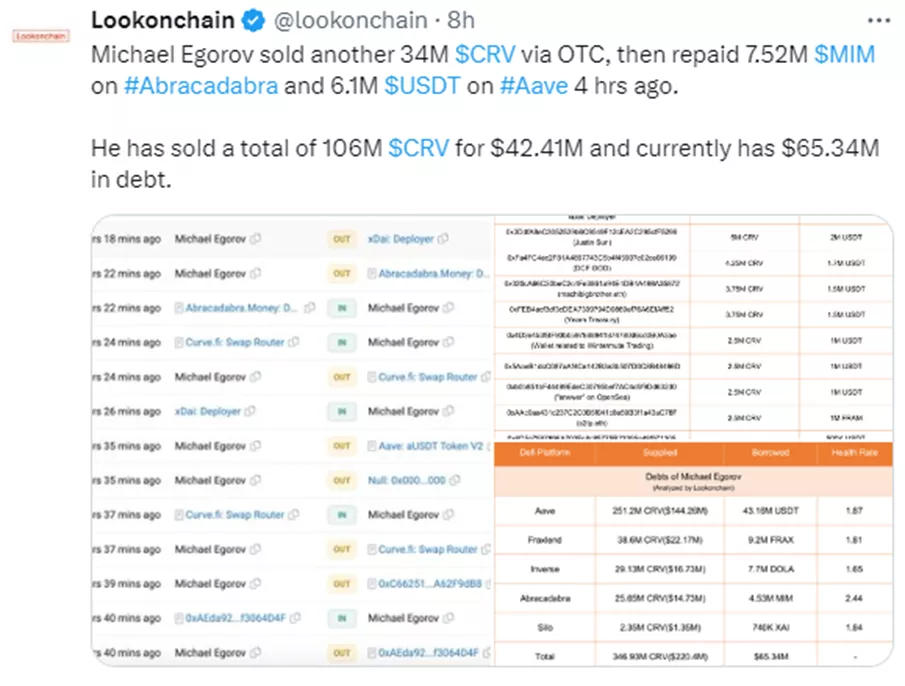

According to Lookonchain experts, in recent days 19 different entities and investors, including Tron head Justin Sun, purchased from Egorov more than 106 million CRV for $42.4 million.

According to JPMorgan analysts, this ‘coordination’ has limited the contagion effect.

Egorov’s outstanding debt to five platforms amounts to $65.34 million, with collateral totaling $220.4 million in CRV. The ‘health factor’ ranges from 1.81 to 2.44. This points to no material risks—the liquidation occurs at a health factor of 1.

According to JPMorgan, the growth of the DeFi ecosystem broadly stalled after the crashes of Terra and FTX, tightening of regulation in the US and hacks.

“This has undermined investor confidence and led to outflows of funds and user exits,” the analysts explained.

They drew attention to L2-solutions Arbitrium and Optimism, TVL of which has grown recently due to more competitive fees.

BNB Chain noted a significant rise in the number of verified smart contracts on the cited blockchains.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!