Lighter Airdrop Becomes Crypto’s 10th Largest

Lighter’s $675m LIT airdrop joins crypto’s ten largest, says CoinGecko.

perp DEX Lighter held an airdrop of LIT tokens worth $675m. The event ranked among the ten largest token distributions in crypto history, according to CoinGecko.

By dollar value, Lighter’s airdrop edged past 1inch ($671m) to take tenth place overall. Uniswap remains the outright leader, having distributed $6.43bn of tokens in 2020.

Most recipients did not sell. Analyst Arndxt noted that 75% of users kept their tokens, and 7% bought more on the open market.

shedding some $LIT airdrop stats

people are not selling their airdrops (75% still holding) and some have been accumulating $LIT instead.

price have been holding up $2.5 to $2.7 very strongly

the perp meta is not dead but going to get more competitive from here on pic.twitter.com/MDu3KunVyS

— arndxt (@arndxt_xo) December 31, 2025

Some investors voiced concerns over the project’s tokenomics. Half of the entire LIT supply is reserved for the team and investors, with a one-year lock-up followed by multi‑year vesting.

50% to team??? What the rug is this??

— CocoFusion Labs (@CocoFusionLabs) December 30, 2025

Market participants called the share excessively high for a DeFi protocol. Some compared the model with that of rival platform Hyperliquid.

At the time of writing, LIT trades at $2.66 (-18.1% on the day). The token’s market capitalisation is $692.9m, according to CoinGecko.

The crypto investor known as Casa warned that buying at current levels may be attractive only in the short term.

I think most people are trading for re-pricing of $LIT towards 5B-6B FDV, which is justifiable given that $ASTER is trading around there.

Aster and Lighter should be more comparable at this point, I mean if you cannot even pass $ASTER then no need to compare w/ HYPE yet.

So… pic.twitter.com/vGE0wFFkLs— casa (@coin_casanova) December 30, 2025

Sustained growth will require meaningfully higher trading volumes and durable user retention.

Perp-DEX boom

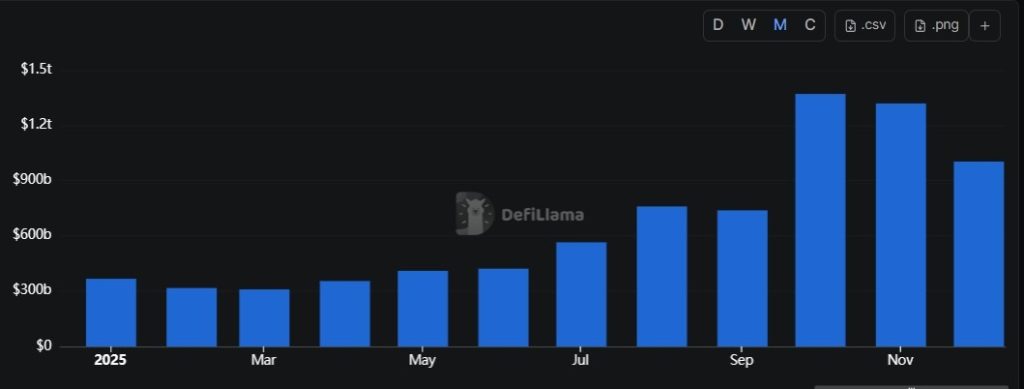

Lighter’s token distribution came amid a blistering expansion in perp-DEX activity. By end-2025, cumulative sector volumes reached $12.09trn, up from $4.1trn at the start of the year.

Year 2025 alone accounted for $7.9trn, or 65% of all-time trading on such venues.

Activity peaked in the second half. Volumes were $2.1trn in the first six months and $5.74trn in the second (73% of the annual total). Since October, monthly turnover has consistently topped $1trn. The fourth quarter outstripped the entire first half.

Rising liquidity and better order execution have turned perp-DEXs from alternative venues into primary destinations for margin trading.

The end of Hyperliquid’s monopoly

The segment began to take shape in 2021 with dYdX and Perpetual Protocol, but received a strong impulse in 2023 after Hyperliquid’s launch.

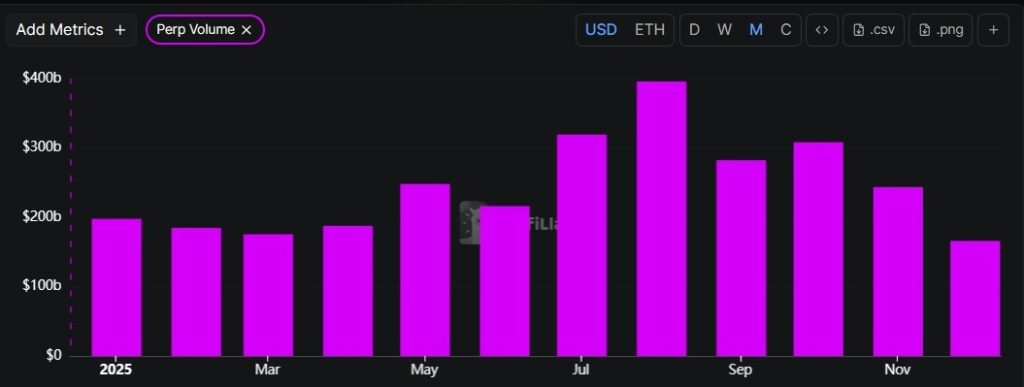

In the first half of 2025, Hyperliquid dominated with monthly volumes of $175bn–$248bn. Competitors, including Aster and Lighter, lagged well behind.

The picture shifted mid-year. Lighter scaled monthly volumes from under $50bn to over $100bn by the third quarter. Aster posted explosive growth late in the year, reaching $259bn in October and November.

The numbers point to a market in transition: from single‑platform dominance to a competitive ecosystem with several large players.

In October, Lighter launched its layer-2 mainnet based on the EVM. In December, the platform added spot trading.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!