Lightning Network: faster, cheaper bitcoin transactions

Key points

- Lightning Network (LN) is a layer-two solution for the bitcoin blockchain. It is a network of payment channels between users and open-source software.

- The project is designed to scale bitcoin and can offer faster, cheaper transactions than the base mainnet. A Lightning transfer costs 1 satoshi (0.00000001 BTC).

- Critics fault the project for weak economic incentives to maintain the network and lower user anonymity than bitcoin’s base layer.

What Lightning Network is for

Bitcoin’s throughput is about seven transactions per second (TPS), and the time between blocks is roughly ten minutes. These relatively low figures reflect how bitcoin’s creator balanced the the blockchain trilemma of decentralisation, security and performance.

Current performance leaves bitcoin unable to compete with centralised payment systems such as Visa, which can process 65,000 TPS, or with modern blockchains such as Solana, capable of up to 400,000 TPS.

Hence a layer-two solution such as Lightning Network is a necessary compromise to preserve decentralisation and security on the base layer by adding a faster, cheaper second layer.

According to data for 30 September 2022, the average daily on-chain bitcoin fee has not exceeded $5 per transaction since summer 2021. In Lightning, the transfer fee is 1 satoshi (0.00000001 BTC)—$0.0001 when bitcoin trades at $20,000.

Lightning’s scalability is theoretically unbounded. According to a post by Lightning Network developer Joe Kendzicky, LN’s upper limit runs to millions of operations per second.

How Lightning Network works

The key principle is the use of payment channels. These are multisignature (multisig) wallets holding a set amount of bitcoin. Either party, or both, can fund them.

A channel is opened with a regular bitcoin transaction. Its data are recorded on-chain, and the coins are “locked” for LN. Thereafter, transactions within the channel occur directly between participants, off-chain. The maximum transfer inside a channel cannot exceed the locked amount.

A Lightning Network channel is akin to a safe that holds money accessible to a defined group of people. Instead of a combination, LN uses private keys.

An example of using Lightning Network

Consider a practical case. Anatoly’s favourite coffee shop announces it now accepts bitcoin. Paying for each cup in BTC on-chain is costly because of fees. Confirmations also take time.

LN helps. Anatoly opens a payment channel with the cafe and funds it with 0.001 BTC for future coffees. At creation his balance shows 0.001 BTC; the cafe’s shows 0 BTC.

Suppose a cup costs 0.0003 BTC. After the first order Anatoly’s LN balance is 0.0007 BTC and the cafe’s is 0.0003 BTC. He can keep ordering until his balance reaches zero or he decides to close the channel. With each transaction, Anatoly and the cafe sign an updated contract reflecting how many coins belong to each side. Nothing is written to bitcoin’s blockchain; instead each party stores its copy of the contract.

Lightning Network is, by design, a network. Anatoly need not have a direct channel with the cafe; they can be connected through other channels. Users can transact with any others reachable through nodes that connect their networks of payment channels.

The financial incentive for running such routing nodes is the small fee earned whenever a transaction is routed through one of their channels.

Thanks to smart contracts, the architecture is trustless: funds either reach the recipient through intermediaries or return to the sender if, for any reason, an indirect route is unavailable.

Which bitcoin wallets support Lightning Network

By autumn 2022 the crypto market already offered a range of bitcoin wallets that let users open channels and transact via LN.

For beginners, options include Blue Wallet, Wallet of Satoshi and Nicehash. The latter is available for Android or iOS. More advanced users may prefer Muun, Breez, Phoenix or Zap.

History of Lightning Network’s development

The concept of payment channels was proposed by Satoshi Nakamoto in 2009, with a code sketch suggesting special channels between users. In 2013 the bitcoin developer Mike Hearn published a letter from Satoshi detailing these mechanisms.

In February 2015 the bitcoin developers Joseph Poon and Thaddeus Dryja published the first draft LN white paper, “The Bitcoin Lightning Network”. In early 2016 the main version of the paper was released.

Because LN development is decentralised and involves many independent teams, the community had to agree common implementation standards. The basis for “standardisation” was laid at a summit in Milan in October 2016.

In August 2017 bitcoin activated the Segregated Witness soft fork, an upgrade needed for Lightning’s roll-out.

Lightning Labs released a test version of its LN client in March 2018. At that time the network already had over 1,000 nodes and 1,863 channels.

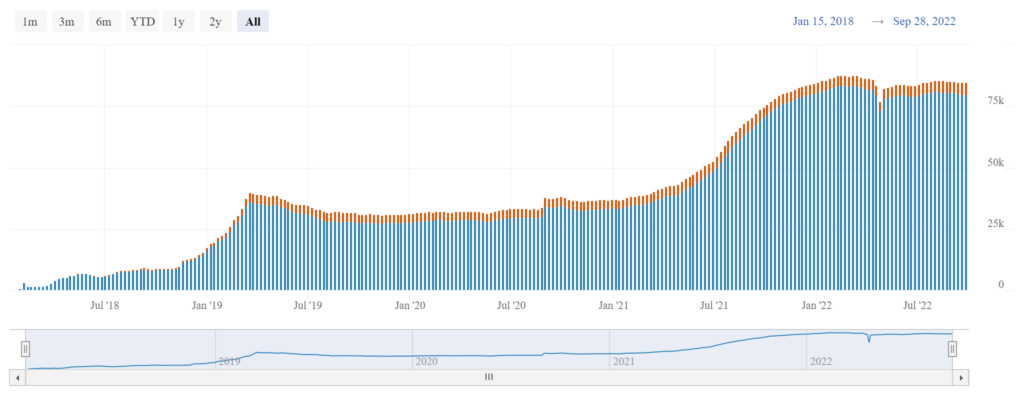

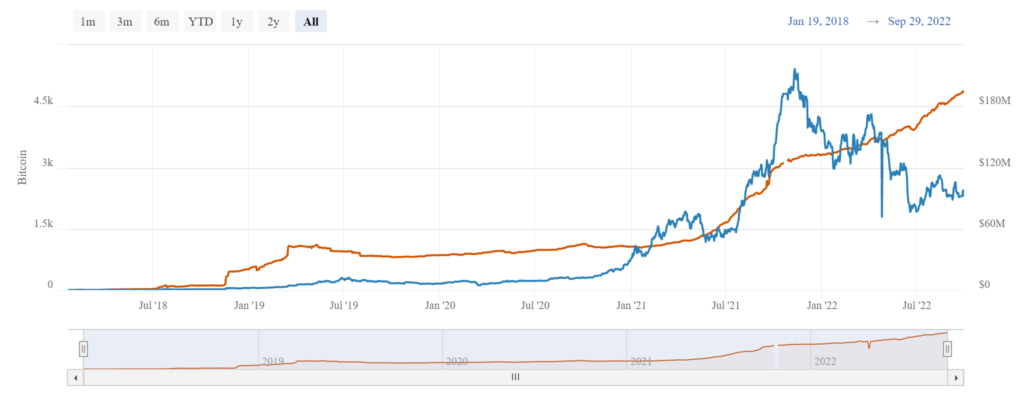

As of 29 September 2022, according to the 1ml service, LN had 17,829 nodes and 86,282 payment channels, with total network capacity above 4,900 BTC (about $94.6m).

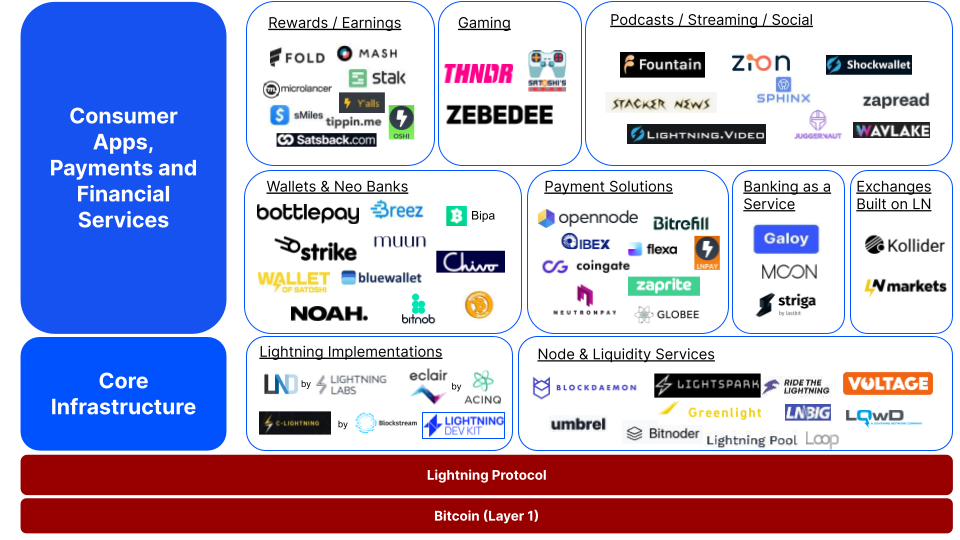

The Lightning Network ecosystem

In 2021 analysts at Arcane Research noted exponential growth in the LN ecosystem after El Salvador legalised bitcoin and adopted the Chivo wallet, which is compatible with the protocol. In February 2022 the authorities relaunched Chivo, improving the app’s user interface, fixing bugs and adding enhanced LN support.

Lightning transfers are supported by many centralised crypto exchanges, including Kraken, Bitfinex, OKX and OKCoin.

Payment solutions built on LN have drawn venture interest. Strike, operator of a Lightning-based payments app, raised $80m in September 2022. The startup is developing an app for buying bitcoin over LN and making transfers within the network.

Analytics firms are taking note, too. In February 2022 Chainalysis added Lightning support to its transaction-tracking suite.

Financial firms are gradually integrating LN into their services. In spring 2022 the online broker Robinhood announced plans to integrate LN, and MicroStrategy said it would develop a wallet, server and authentication options using Lightning.

There are projects to tokenise assets and even issue stablecoins for use in LN-based applications. In September 2022 the Lightning Labs team announced such an initiative, unveiling an alpha version of the Taro protocol.

Why Lightning Network is criticised

Experts point to a number of issues and potential vulnerabilities in the LN protocol. One of them in 2020 was discovered by the bitcoin developer Joost Jager: some payment channels could not process more than 483 micro‑payments and then locked BTC for up to two weeks. In addition, the Lightning Network has described opportunities for fraud with payment channels.

In the view of the technical expert Shinobi, Lightning’s architecture has serious flaws: the network cannot develop because it lacks meaningful economic incentives. Routing fees collected by LN nodes, he says, are too small.

An analyst writing under the pseudonym “Zem” argued that anonymity is a key hurdle to adoption. The researcher also believes the technology does not fit financial regulations, making it hard for LN-based solutions to win approval from organisations such as America’s Financial Crimes Enforcement Network (FinCEN).

LN has also drawn criticism from parts of the Ethereum community. Anthony Sassano, co-founder of the ETHhub project, likened it to last century’s fax machines, calling the rollups used to scale Ethereum the better approach.

Further reading

Which bitcoin wallet should you choose?

What types of bitcoin addresses are there?

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!