Liquidity in Mantle Network’s L2 ecosystem exceeds $40 million

TVL second-layer solutions on the Ethereum-based Mantle Network topped $40 million shortly after the mainnet launch.

The alpha version of the mainnet went live on July 17. The same time, a $200 million ecosystem-support fund was created.

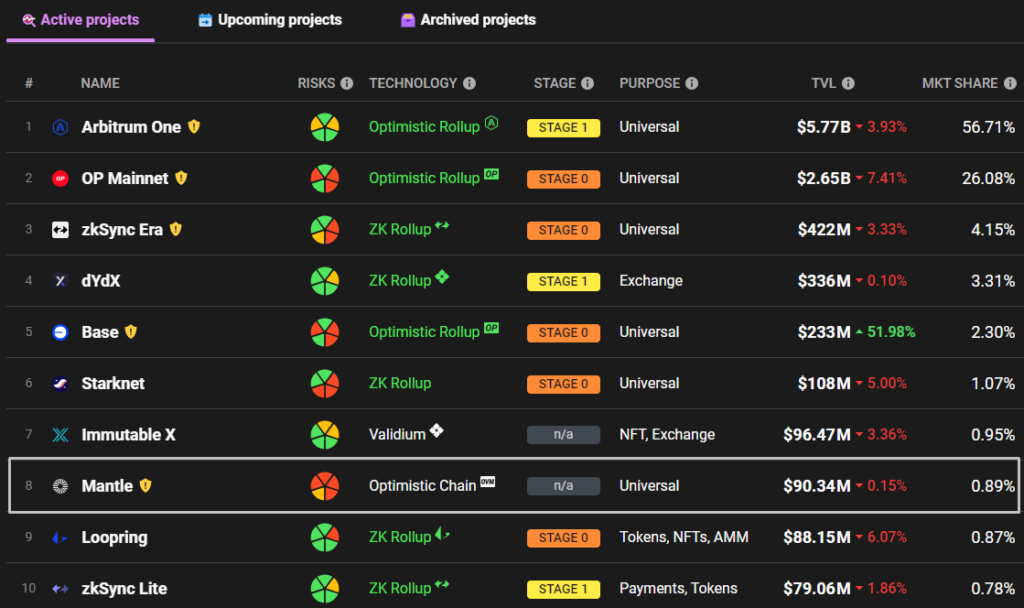

Soon the project reached the eighth place in L2BEAT’s ranking, competing with Starknet, Immutable X, Loopring, and zkSync Lite.

Among Mantle projects, the decentralized exchange Agni Finance leads in TVL with a figure of ~$23.22 million.

According to a Nansen report, around 5,000 unique addresses transferred about ~$56 million via the official cross-chain bridge. Researcher Sandra Leow explained the liquidity growth in the Mantle Network ecosystem by the popularity of second-layer solutions and “capital rotation from the Ethereum mainnet.”

“Mantle Network boasts one of the largest on-chain treasuries (BitDAO underwent a rebranding and merged with Mantle) with $3.2 billion in liquid assets, most of which are in ecosystem tokens and stablecoins,” she noted.

The L2 platform combines a modular architecture with the security and decentralised features of Ethereum’s blockchain. A hallmark of such an approach is the separation of execution, data availability, and consensus across different layers.

Mantle uses Optimistic Rollups and interacts with the EigenLayer restaking protocol.

According to Mantle representatives, the development of second-layer solutions opens new use cases such as “advanced blockchain games” and DeFi services with low fees.

Earlier in July, the volume of cross-chain swaps on the Symbiosis liquidity protocol surpassed $500 million.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!