Mining pools in 2024: ViaBTC explains

According to Miningpoolstats, in 2024 the ViaBTC pool entered the top three by Bitcoin hashrate and mined the halving block #840,000, collecting 37.6256 BTC in fees.

With the help of ViaBTC and CoinEx CEO Haipo Yang, we discuss mining of digital gold and Kaspa (KAS) in 2024 and explain how to join a pool.

ViaBTC in brief

The founder of ViaBTC, Haipo Yang, wrote the pool’s code himself. He finished development in May 2016, and a month later ViaBTC mined its first block. On June 5, 2024, the pool marked its eighth birthday.

“Like most people, I initially considered the concept of bitcoin too fantastical, but over time I still realised its value. Since 2014 I have taken part in various projects to develop cryptocurrency mining hardware and software for mining pools,” notes Haipo Yang.

At launch, ViaBTC entered a competitive market: about 18 pools operated on the Bitcoin network.

After CoinEx went live in 2017, ViaBTC clients could automatically withdraw earnings to the exchange with zero fees. Thanks to auto-conversion support, the pool distributes proceeds every hour.

At present, ViaBTC supports ten cryptocurrencies: bitcoin (BTC), Bitcoin Cash (BCH), eCash (XEC), Litecoin (LTC), Ethereum Classic (ETC), Zcash (ZEC), Dash (DASH), Nervos Network (CKB) and Kaspa (KAS).

ViaBTC began mining the latter in 2024 and has already entered the top five pools for this asset. At the time of writing, ViaBTC’s computing power on Kaspa stands at almost 36 PH/s.

“Kaspa is one of the most interesting PoW cryptocurrencies on the market: over the past year the project’s value has risen by 600%. We have devoted a lot of time and resources to mining KAS, which has allowed us to take leading positions in mining this coin fairly quickly. Among the ten largest Kaspa pools we are the only one to offer the PPS+ payout model,” said Haipo Yang.

ViaBTC also pays referral rewards. Participants in the referral programme receive a rate of 10% for 12 months, while ambassadors earn 20% on a permanent basis.

The pool’s team explained how to become an ambassador in an article on ViaBTC’s website. For this and other issues, clients can contact the Russian-language support service on Telegram.

Why miners choose pools

There are two types of mining: solo and pooled. In the first case, bitcoins belong to the miner who finds the block; in the second, to pool participants who combine hashrate and split the reward.

In 2024 almost all bitcoins are mined by pools, with only occasional solo finds. Pools are popular because of:

- a low barrier to entry. Compared with solo mining, the upfront costs to create and maintain infrastructure are much lower;

- income stability. Pools distribute proceeds more frequently because clients combine their power and depend less on luck.

Since the launch of Slush Pool in 2010, more than 15 payout models have appeared. Among them:

- Pay Per Share (PPS) — instant fixed payments for each share even if no block is found. Miners are paid daily, minus the pool fee. Income in this mode is relatively stable;

- Pay Per Last N Share (PPLNS) — payments only when a block is mined; otherwise income is zero. The model is riskier, but the potential return is much higher than under PPS.

“When choosing a pool, consider hashrate, luck, operational stability, payout model and reputation. For example, ViaBTC has operated reliably for eight years, ranks third among Bitcoin pools with luck above 100%, and offers several payout models,” explains Haipo Yang.

According to him, pools most often use PPLNS and PPS+ today:

“ViaBTC introduced PPS+ in August 2016 as an improvement on PPS. It is a combination of two models: the block reward is calculated under PPS, while transaction fees and pool service fees follow PPLNS.”

ViaBTC also supports a solo (SOLO) mode, where a miner finds blocks independently. If successful, the miner keeps the entire reward; if not, nothing.

How to join a mining pool

The first step is to choose a cryptocurrency and suitable hardware, as blockchains use different mining algorithms.

ViaBTC regularly updates a miner profitability ranking listing hashrate, power and daily profit metrics for different models.

“Beyond the miners, you will need a stable internet connection, a power supply and cooling devices,” notes Haipo Yang.

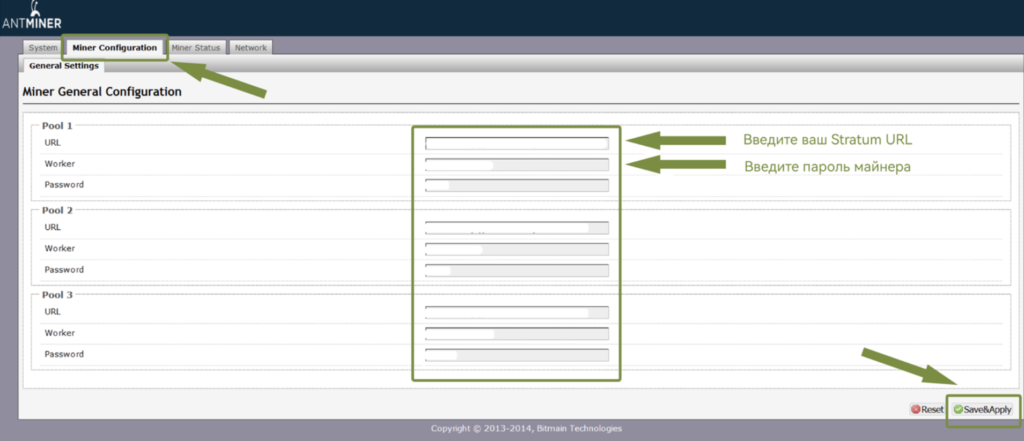

To start mining, download specialised software, choose a payout model (PPS+, PPLNS or SOLO) and set up your miner parameters: the Stratum URL, password and device ID.

After connecting to a pool, you can check your hardware status and profitability, and choose one of four withdrawal options on the ViaBTC website:

- daily auto-withdrawal (no fee);

- transfer to an external wallet (with fee);

- internal transfer without making an on-chain transaction (no fee);

- transfer to CoinEx (no fee).

The ViaBTC team has published detailed guides on mining different cryptocurrencies on the pool’s website.

Conclusions

In June, Upstream Data client manager Adam Ortolf spoke of a “fight for survival” among Bitcoin miners after the April halving. By the end of last month, however, CryptoQuant specialists recorded an easing of miner selling.

According to Haipo Yang, the market is in a “post-halving consolidation” phase: the reduced block reward forced inefficient players to switch off equipment and sell bitcoin holdings to cover costs.

He is confident that after the market “cleans up” and absorbs the selling pressure, conditions will be in place for a renewed bitcoin rally.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!