Moody’s Highlights Risks of Stablecoin Boom

Moody’s warns of stablecoin risks to financial stability in developing countries.

The rapid expansion of cryptocurrency use, including stablecoins, in developing countries poses risks to monetary sovereignty and financial stability, according to a report by the rating agency Moody’s.

The spread of fiat-pegged coins could weaken central banks’ control over interest rates and exchange rate stability, the agency’s experts warned, dubbing this trend as “cryptocurrencisation.”

In this context, banks may face a reduction in deposits if private depositors transfer savings into “stablecoins or crypto wallets.”

Moody’s noted that fragmented regulation remains a major issue in this area. Less than a third of countries have implemented comprehensive rules for digital assets.

Significant progress has been made by the world’s largest economies, the US and the EU, which have respectively adopted the GENIUS Act and the MiCA regulation. In these regions, cryptocurrencies are primarily viewed as investment tools.

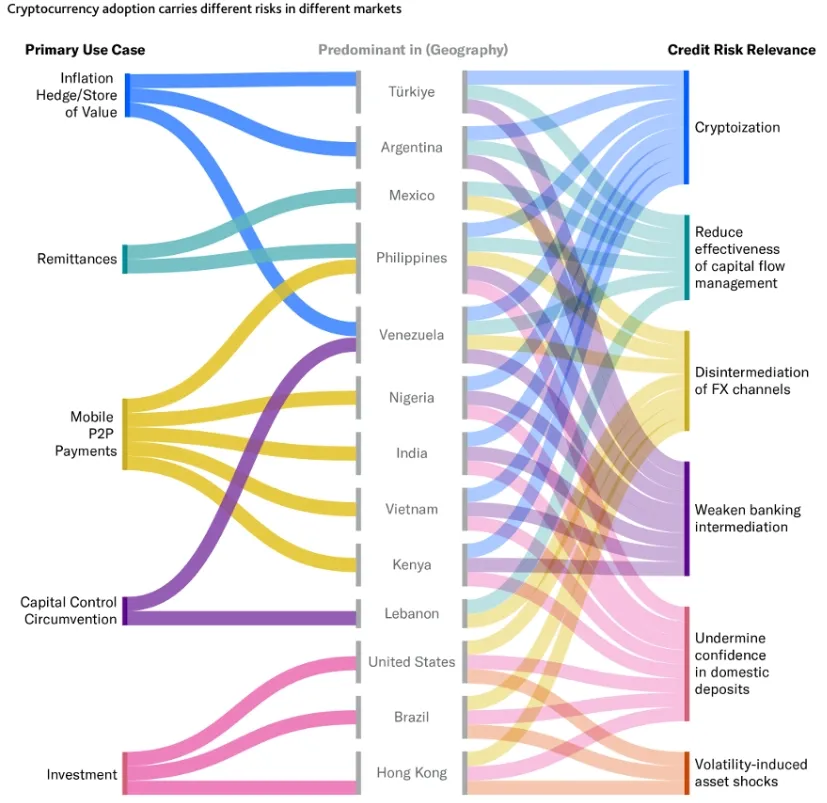

In developing countries, digital assets are widely used to enhance financial service accessibility, for remittances, mobile payments, and as a hedge against inflation.

“The lack of a comprehensive regulatory framework increases exposure to financial instability, especially in jurisdictions with rapid growth and high levels of digital currency penetration,” the agency’s experts warned.

The expansion of stablecoin use, despite their supposed safety, carries systemic vulnerabilities, Moody’s emphasized.

“Insufficient oversight could trigger a reserve run and force governments to undertake costly rescue measures in the event of a peg collapse,” the report’s authors believe.

Earlier, JPMorgan concluded that the anticipated wave of stablecoin launches in the US could turn into a zero-sum competition.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!