Much Ado About Nothing: Why Bitcoin’s Environmental Impact Is Exaggerated

Discussions about Bitcoin mining’s impact on the environment have been underway for years. Recently, the level of debate has risen significantly. The catalyst was a seemingly innocent tweet by Elon Musk.

Tesla & Bitcoin pic.twitter.com/YSswJmVZhP

— Elon Musk (@elonmusk) May 12, 2021

«We are concerned about the rapid increase in the use of fossil fuels for Bitcoin mining and [processing — editor’s note] transactions, especially coal, which has the worst emissions among all fuels», the statement said.

Tesla suspended selling its products for Bitcoin. In the days following the tweet and the company’s statement, the price of the digital gold fell below $40,000.

The retreat from its all‑time high exceeded 40%. The price could not hold above the 200‑day moving average, seen by many technical analysts as a rough boundary between bull and bear markets.

How harmful is Bitcoin’s energy footprint to the environment? Are environmentalists and other critics overplaying Bitcoin? ForkLog examines these questions.

- Recent discussions about Bitcoin mining’s environmental impact have intensified.

- Opinion leaders tend to paint with broad strokes; their arguments are often exaggerated and manipulative.

- More miners are turning to renewable energy, whose costs are falling.

The Domino Effect

Tesla’s recent decision, in whose reserves there are 43,200 BTC worth about $1.5 billion, caused a stir in the community and well beyond. The implications of the announcement altered not only market sentiment but also many participants’ views of Musk. Greenpeace ceased accepting donations in the first cryptocurrency.

«The volumes of energy required to operate Bitcoin are becoming increasingly evident over time, so this policy no longer seems reasonable», said a Greenpeace spokesperson.

The organisation began accepting Bitcoin in 2014. At the time Greenpeace noted the environmental advantages of digital gold in terms of lower transaction-processing costs compared with banks.

Vice Premier Liu He stated that the authorities intend to take measures regarding cryptocurrency mining and Bitcoin trading, imposing tighter oversight. The price of the first cryptocurrency accelerated its decline.

According to journalist Colin Wu, Chinese senior officials first directly proposed banning cryptocurrency mining. He believes this may be linked to high energy consumption.

The official’s statement came a few days after three associations under the People’s Bank of China prohibited local companies from supporting a crypto-related business, and citizens were advised to refrain from investing in that class of financial instruments.

Shortly after, Huobi ceased hosting miners in mainland China, and the cryptocurrency exchange OKEx briefly halted trading of its native token OKB on the p2p platform for Chinese citizens.

A Concerned Public

According to a Nature Communications study, mining centers located in China will by 2024 consume more than 296.59 TWh of electricity and will surpass the Philippines in greenhouse-gas emissions.

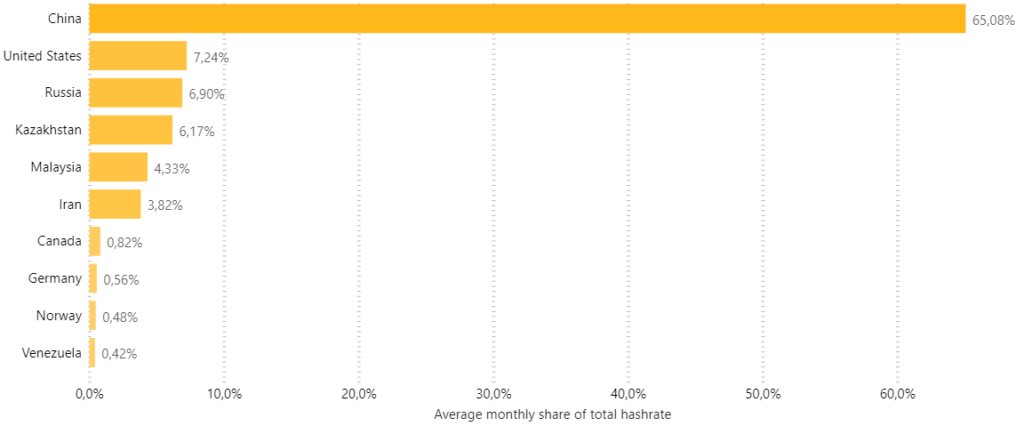

According to a group of Chinese and British economists, more than 78% of global mining capacity is located in China. However, the latest data on the CBECI site put the share at 65.08%.

“Bitcoin alone consumes as much electricity as a mid-sized European country,” stated Brian Lucey, professor at Trinity College Dublin. “That is a staggering figure. A dirty business, a dirty currency.”

According to the Cambridge Centre for Alternative Finance, the annual Bitcoin network energy expenditure stands at 116.56 TWh, surpassing the Philippines and the Netherlands.

That Bitcoin’s energy consumption exceeds that of many mid-sized economies was stated by Musk in the days that followed. He proposed that the ten largest mining firms publish audits of their share of renewable energy in their operations.

The European Central Bank recently published a report in which the environmental impact of cryptocurrency mining is described as a “cause for concern.” In a fresh study by Italy’s monetary regulator, it states that Bitcoin’s carbon footprint—40,000 times that of the Target Instant Payment Settlement (TIPS) benchmark—is not to be taken lightly.

British expert Nigel Topping, engaging with business circles ahead of the COP26 climate conference, said that Bitcoin-related questions are increasingly prominent “in broader political debates.”

«It [Bitcoin] is becoming one of the negative climate factors. Climate-aware people are somewhat puzzled. It’s simply a dumb idea. Proof-of-Work is fossil-fuel burning. All of this runs directly against what we are trying to achieve», said Topping.

Not to miss a critique, Vitalik Buterin, the Ethereum founder, expressed the view that Bitcoin must develop its technological base to improve energy efficiency. Otherwise, digital gold “risks being left behind.”

Buterin noted that Ethereum is moving to a more environmentally friendly Proof-of-Stake consensus, which is expected to markedly reduce energy consumption.

«I truly think these concerns are real. Resource use is certainly enormous. This isn’t something that will by itself destroy the world, but its substantial negative impact is obvious».

Experts’ Incompetence

Climate-focused journalist Eric Holthaus, in February, wrote an article arguing that at current growth in energy use, Bitcoin will never replace the global financial system.

«Currently Bitcoin, with its high fees, can process about 350,000 transactions per day. At current energy‑consumption rates, the cryptocurrency would need 14 world-scale energy productions to handle 1 billion card transactions that occur daily».

Holthaus argues that Bitcoin is not just inefficient — it actively undermines efficiency, making the world worse.

Coin Metrics co‑founder Nic Carter called Holthaus’s reasoning “deeply flawed.”

«Experts who repeat such logical chains are trapped in a web of misconceptions — largely because they refuse to engage with the topic», said the researcher.

Carter noted that Bitcoin can serve as a base for other payment networks, including the second‑layer solution Lightning Network, Target Instant Payment Settlement (TIPS), Liquid sidechains and Rootstock, and smart-contract platforms like Blockstack.

«One Bitcoin transaction, therefore, can imply thousands of off-chain transactions in any of these side networks. Exchanges and custodians can settle among themselves in a single day, aggregating hundreds of thousands of payments», Carter explained.

Attention should be paid to the metrics of the largest centralized payment systems Mastercard and Visa, often used as a benchmark by sceptics comparing them to the “inefficient” Bitcoin.

Mastercard’s workforce has grown steadily from 2017’s 13,400 employees to 21,000 in 2020 (+56%). Operational expenses exceed $7 billion a year.

Visa, which has a notably larger market share, shows a similar growth trajectory and comparable operating expenses.

Unlike Visa and Mastercard, Bitcoin is decentralised; it has no formal structure, ongoing operating costs, management, or thousands of employees. Anyone can join the open network, sending and receiving payments of any size without censorship. Moreover, the first cryptocurrency is more closely associated with digital gold than with a medium of exchange for ordinary purchases.

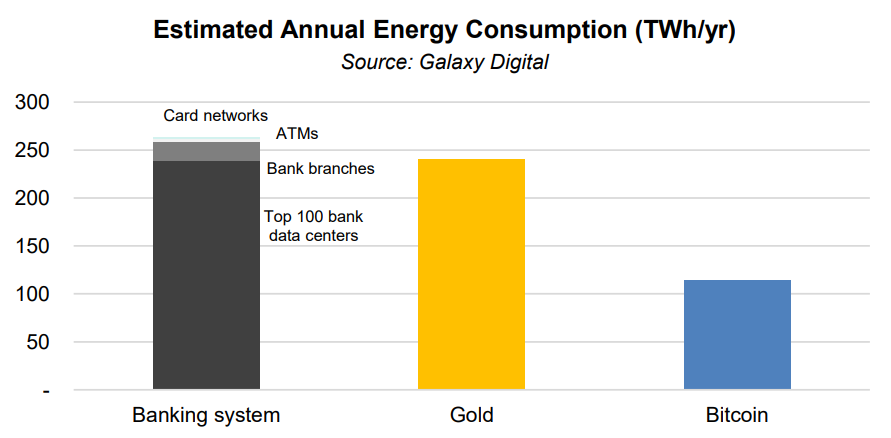

It is also instructive to compare with other sectors. In a Galaxy Digital report it states that annual energy costs for Bitcoin miners are 113.89 TWh, compared with 240.61 TWh for gold production and about 263.72 TWh for the banking sector.

Economist Saifedean Ammous, author of “The Bitcoin Standard: The Economic Case for Bitcoin,” noted the following:

«All attempts to compare Bitcoin’s energy use with banks, settlement systems, central banks, or gold miss the main point — real opportunity costs. Bitcoin does not replace them. They can coexist with Bitcoin.»

Galaxy Digital’s analysis also notes that Bitcoin miners’ energy costs are 12.1 times lower than the energy consumed by always-on devices in the United States. The figure rises to 19.4 when including energy losses from transmission and distribution (per World Bank and IEA estimates).

Carter noted that most of Bitcoin’s energy is tied to mining coins whose issuance halves every four years. As issuance slows and profits fall, miners’ incentives to expand capacity similarly diminish. In the long run, this should positively affect the environmental footprint of cryptocurrency mining.

In Nature Communications, Carter found a number of flaws. For instance, it lacks detail on the energy-use structure and relies on somewhat dated CBECI data.

«I expected the study to rely heavily on energy-structure data at the level of Chinese provinces,» tweeted Nic Carter, co‑founder of Coin Metrics. «But that is not present. They claim to have accounted for all of this… but it has not been demonstrated in the work (!). They merely assert that they quantified it.»

According to Carter, calculating the total energy use of miners is straightforward given the network’s total hash rate, the dominant miner models in the market, the hashing power of the latest hardware, and its power consumption. What is far harder is calculating the energy-use structure.

As anyone knows, if you want to understand bitcoin c02 impact, you need to 1. identify where it is being mined and 2. identify the energy mix that those miners are using. This paper doesn’t attempt to do either

— nic carter (@nic__carter) April 7, 2021

«If you want to understand Bitcoin’s impact in the CO2 context, you need to: 1) identify where it’s mined and 2) determine the energy mix used by those miners. This document does not attempt either».

Other questionable things: the authors naively assume Chinese hashrate is 70% of Bitcoin mining because of pool data from https://t.co/OVzSrWsDFX. Also a crazy assumption. Pools ≠ mining machines. More sloppy reasoning pic.twitter.com/S8OZQFbvpd

— nic carter (@nic__carter) April 7, 2021

«Other questionable things: the authors naively assume China generates 70% of Bitcoin’s hashrate. This is according to data from BTC.com pools. A wildly optimistic assumption. Pools ≠ mining devices».

Miners can connect to pools from anywhere in the world. For example, F2Pool is based in Beijing, but that does not mean it only serves local miners.

Carter added that halving does not guarantee price growth that correlates with hashrate and, ultimately, energy consumption.

Yep, they’re relying on the absolutely insane assumption that due to the halving, the bitcoin price will mechanically increase. This is a key cornerstone of the analysis, as they’re projecting Bitcoin emissions in the future. This is meant to be a scientific paper.

— nic carter (@nic__carter) April 7, 2021

«Yes, they rely on the utterly insane assumption that Bitcoin’s price will rise automatically due to halving. This is the cornerstone of their analysis, projecting future Bitcoin emissions. It was meant to be a scientific paper».

On CBECI’s map of mining, countries and Chinese regions with the largest share of Bitcoin’s hashrate are shown. The analysis uses data from BTC.com, ViaBTC, and Poolin, which together account for only about 35% of total hashrate.

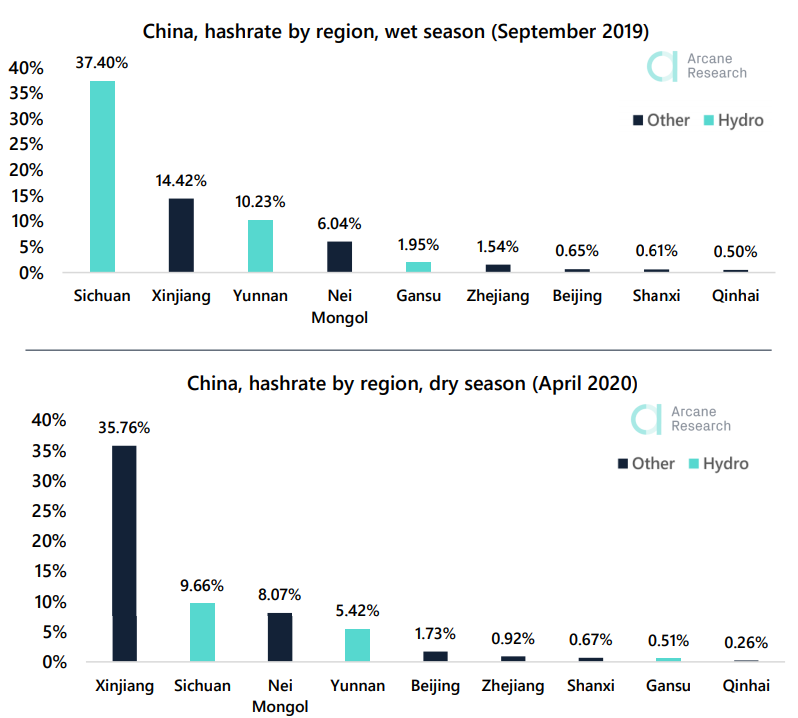

According to the map, Xinjiang and Inner Mongolia generate roughly 40% of global hashrate. In the electricity sectors of these regions, fossil fuels are predominant.

CBECI data has not been updated since April 2020, which calls their current relevance into question. Colin Wu reports that in March, Inner Mongolia officials proposed banning cryptocurrency mining in line with a carbon-reduction program. In May, provincial authorities began cracking down on illegal mining.

One should also note that during price rallies, older and “power-hungry” devices like the Antminer S9 can come back online.

All of the above factors should be taken into account, as they influence the energy-use structure on which Bitcoin’s real environmental impact depends.

Bitcoin as a Driver of Green Energy

To stay competitive and profitable, miners must seek cheaper energy sources.

«In some countries, and in particular in China, mining companies tend to relocate between regions due to seasonal fluctuations in renewable-energy generation», said the CBECI disclaimer on its site.

In the dry season, a substantial number of miners from Sichuan and Yunnan move north to Xinjiang or Inner Mongolia, where fossil fuels predominate. During the wet season, which runs from May to September, some miners return to the energy-rich south.

Estimates vary from 39% to more than 70% of miners’ energy consumption coming from renewables. Besides solar and wind, a promising avenue is the use of associated petroleum gas. Projects along these lines are pursued by Gazprom Neft and the Norwegian company Equinor Energy.

In 2018 a study in Nature Climate Change argued that Bitcoin mining could raise Earth’s temperature by 2°C. The study’s theses were cited by many outlets, including The New York Times.

Nicolás Carter argues this will never happen because Bitcoin’s energy structure is increasingly less carbon-dependent. He notes that in the United States there is a growing share of miners pursuing environmental, social, and governance (ESG) objectives. Against this backdrop, mining is less concentrated in coal‑heavy regions like Inner Mongolia.

Many industry participants have launched initiatives like the Crypto Climate Accord, intended to reduce the carbon footprint of Bitcoin mining and make the crypto sector more sustainable by 2030.

«As renewable energy becomes more efficient and suitable for crypto mining, Bitcoin may ultimately act as a significant catalyst for developing these technologies», Carter said.

A sizable portion of mining capacity is located in cooler climates. Iceland attracts miners not only for low temperatures but also for inexpensive geothermal power.

Canada hosts substantial mining capacity as well, where 67% of electricity is generated from renewable sources.

Prominent trader WhalePanda expressed the view that the industry stands to gain from China’s potential crackdown.

Let China actually ban Bitcoin and Bitcoin mining.

Mining would be more decentralized, black market for Bitcoin would thrive and the “China controls Bitcoin” false narrative would disappear.

— WhalePanda (@WhalePanda) May 21, 2021

A potential ban on mining in China would make Bitcoin mining more decentralised. It would be aided by a shift of hashrate toward more stable and “greener” jurisdictions, and the myth of Central China’s dominion over digital gold would fade away.

Researchers from Square and ARK Investment are convinced that Bitcoin stimulates the growth of renewable energy. One indicator is Greenidge Generation’s decision to neutralise its carbon footprint through carbon-offset purchases.

Greenidge Generation will direct funds to a portfolio of emissions-reduction projects. The company plans to devote part of its profits to building capacity for renewable-energy generation.

Similar measures are being undertaken by other firms. For example, Ninepoint Partners, the Toronto-listed Bitcoin ETF provider, will direct a portion of fee income to reducing its carbon footprint. Similar steps will be taken by hedge fund One River Asset Management.

Cryptocurrency exchanges FTX and BitMEX plan to donate a small percentage of transaction fees to organisations working on offsetting carbon emissions.

American mining company Marathon Digital Holdings announced plans to build a carbon‑neutral data centre in Texas with a capacity of 300 MW.

North American mining firms formed a Bitcoin Mining Council to reduce greenhouse gas emissions across the industry. They agreed at a meeting with Elon Musk; executives from Argo Blockchain, Blockcap, Core Scientific, Galaxy Digital, HIVE Blockchain, Hut8 Mining, Marathon, and Riot Blockchain participated in the discussion with the Tesla founder.

«We aim to explain how the Bitcoin network operates as a unique buyer of energy, capable of unlocking substantially more solar and wind capacity», said the foreword to the Square and ARK Investment document.

Researchers noted that over the past decade the normalized cost of solar and wind energy fell by about 90% and 71%, respectively (to around 3–4 cents per kWh for solar and 2–5 cents for wind). The corresponding figure for fossil energy lingers at around 5–7 cents per kWh.

Experts have suggested that renewables, particularly solar, will become even more affordable with time. They also foresee the development of new use cases, such as water desalination, carbon dioxide removal from the atmosphere, and green hydrogen.

***

Arguments from critics are often exaggerated or even manipulative. Many opinion leaders simply lack a deep understanding of how Bitcoin’s protocol works. There is a lack of up-to-date data on energy consumption structures, China’s role, and renewables’ share in the hashrate.

Undoubtedly, the Bitcoin network is not easy to label as energy-efficient — mining consumes colossal resources. Is such “gluttony” justified? Value is subjective, and so is the acceptability of costs to create goods that serve market participants. The latter may differ across contexts of time preference, motivation, beliefs about money, and risk tolerance.

For those who view cryptocurrencies as being used only in Ponzi schemes or for money laundering, Bitcoin will appear as an environmental catastrophe or an unsustainable payment system.

Yet all is relative— the petroleum-dollar, underpinned by the U.S. military,poses a greater threat to the environment than Bitcoin mining. In 2017, the U.S. military used up to 1 million barrels of oil daily. If the DoD were a country, that level of consumption would place it 55th in the world by CO2 emissions.

Strategic thinker Alex Glatstein and co-founder James McGinnis of David Energy describe Bitcoin’s energy intensity as a feature that “creates security.”

«From a technological perspective, this is exactly what makes Bitcoin so fantastic», said McGinnis.

Glatstein reminded that Bitcoin has an important moral argument in its favour:

«There are 1.2 billion people living under inflation. Inflation runs in the two- and three-digit ranges. There are 4.3 billion people living under autocracy. […] Let those who say Bitcoin has no social value use the Sudanese pound for a year, and then tell me that Bitcoin’s value is exaggerated or non-existent».

Indeed, for tens of millions, Bitcoin is a way to preserve funds for essential needs in hyperinflationary environments, and a means to circumvent capital controls. For them, Bitcoin’s energy intensity is more than justified, and comparing it to the Netherlands is hardly apt.

To stay in the game, miners will continue to minimize costs by turning to cheap renewables. Given this trend and China’s repressive measures toward the industry, a future of further decentralisation and a reduced share of “dirty” energy appears likely.

Subscribe to ForkLog’s channel on YouTube: YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!