New records for Bitcoin and Ethereum, Belarus internet shutdown, and other events of the week

As the week draws to a close, we recall Bitcoin and Ethereum’s renewed highs in 2020, new records in the DeFi sector, the internet outage in protest-hit Belarus, and other key events.

Bitcoin price

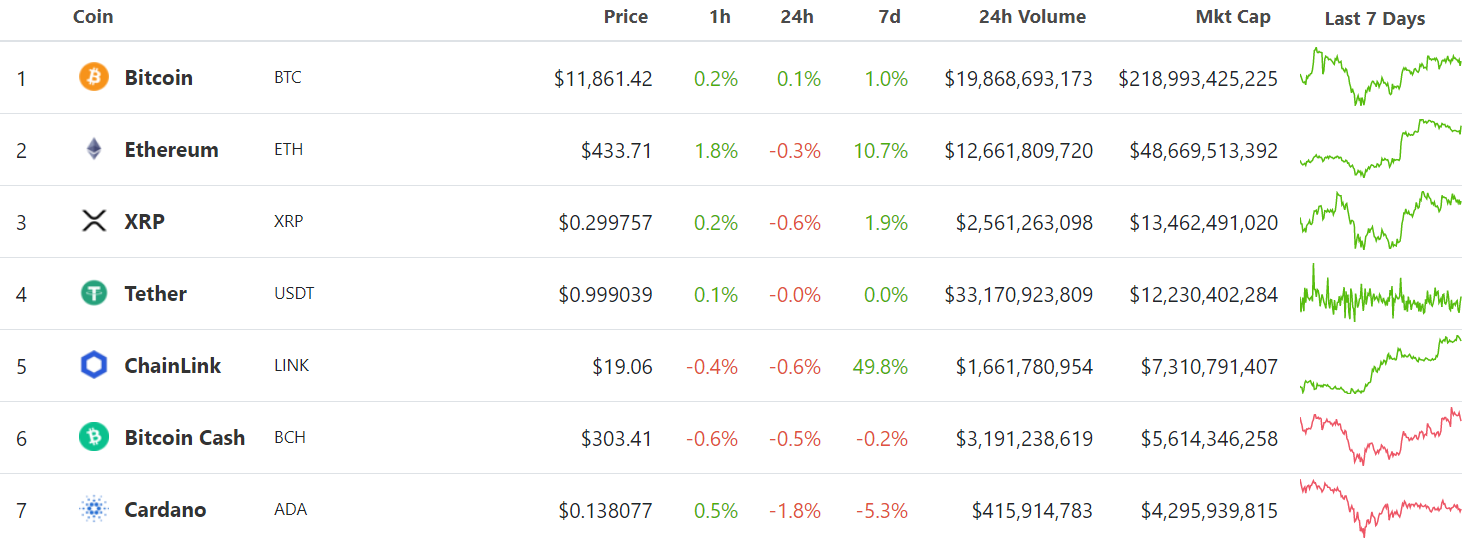

On Monday, August 10, Bitcoin, the leading cryptocurrency, for the second time in the month hit a new yearly high, briefly touching the $12,100 level. During the rally, Bitcoin also closed the weekly candle at its highest level since January 2018.

The subsequent rally, however, did not materialize: by Tuesday the price had slipped to around $11,100. In the following days, bullish sentiment nevertheless returned, and Bitcoin approached $12,000 several times, but could not break through this psychological barrier.

Nevertheless, many market participants remained optimistic. Among them were Kraken analysts, forecasting a 50-200% rise in Bitcoin price in the coming months.

As of publication, Bitcoin was trading around $11,860, with a market capitalization of about $382 billion.

Ethereum rose to a 25-month high

In the early hours of Friday, August 14, the second-largest cryptocurrency Ethereum rose above $400 for the first time since August 2018, briefly touching the 25-month high of $445. After a subsequent correction the asset fell below $420, but at the time of writing trades above $430.

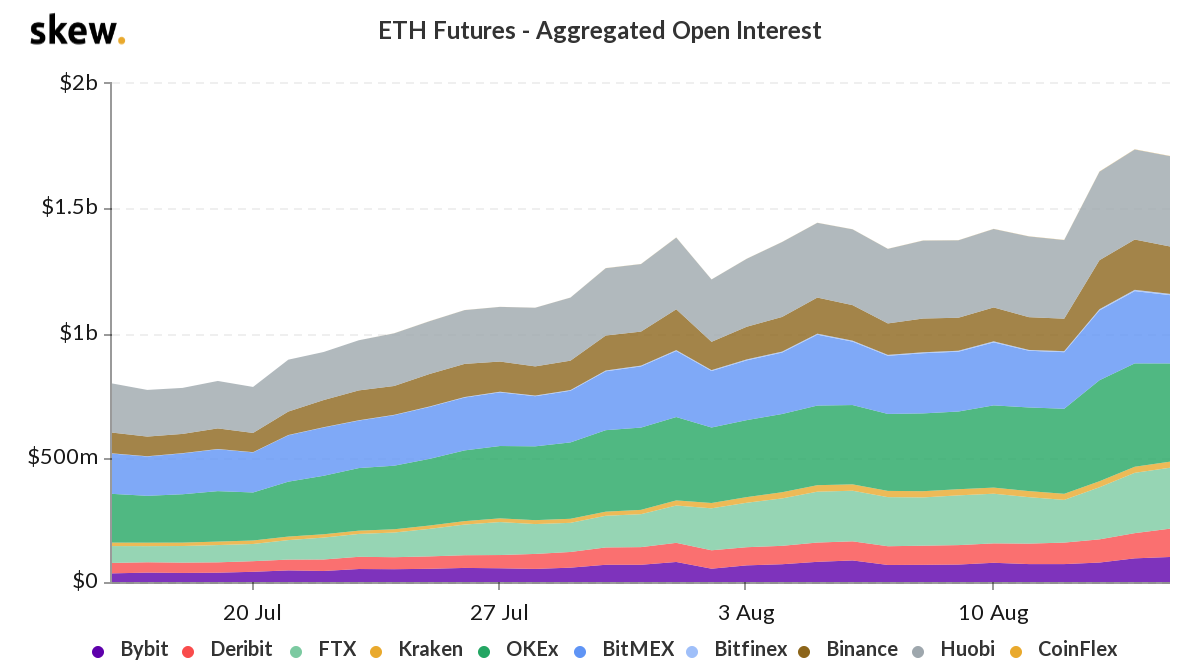

Against the backdrop of ETH’s rally, activity on derivatives markets surged. According to Skew, on Friday the total open interest (OI) in Ethereum futures set a new all-time high at $1.73 billion. The previous record of $1.5 billion lasted only one day. Since the start of the year this figure has risen by 300%. In addition, the notional amount of active positions in Ethereum options reached a new high of $454 million.

As CoinDesk notes, the rise in open interest is typically viewed as inflows of new money to the market, and together with the price rally – as a solid foundation for an uptrend. The futures price also trades above the spot rate, confirming market participants’ expectations.

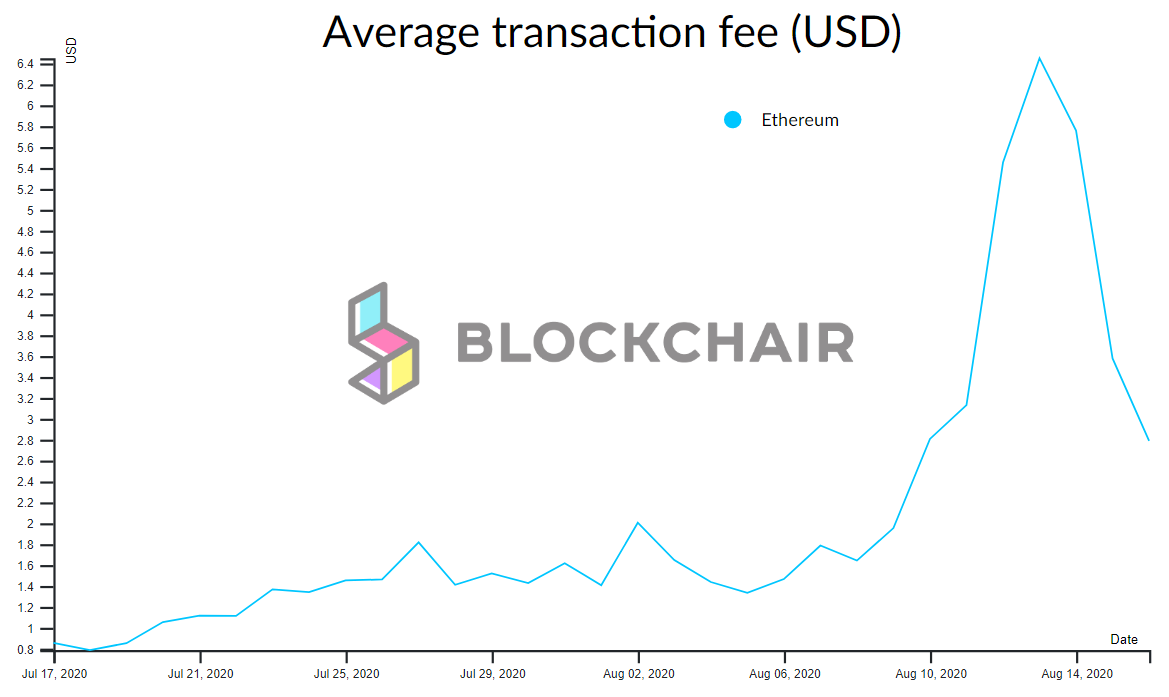

Positive trader sentiment was somewhat offset by rising Ethereum network transaction fees. On August 13, this metric hit an all-time high of $7.4, with some users noting fees amounted to up to half the value of the transfer.

Although by Sunday morning this figure had fallen to $2.78, for the week Ethereum’s total fees surpassed Bitcoin’s by 283% – $34.5m vs $9m.

DeFi volumes and TVL

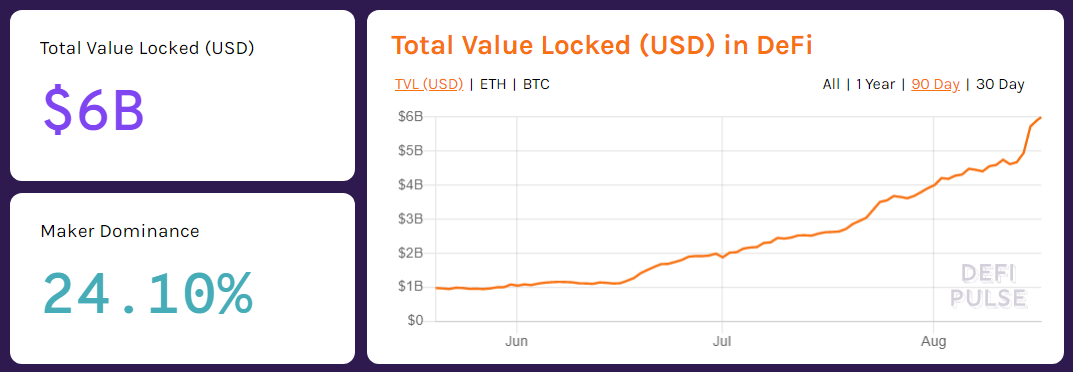

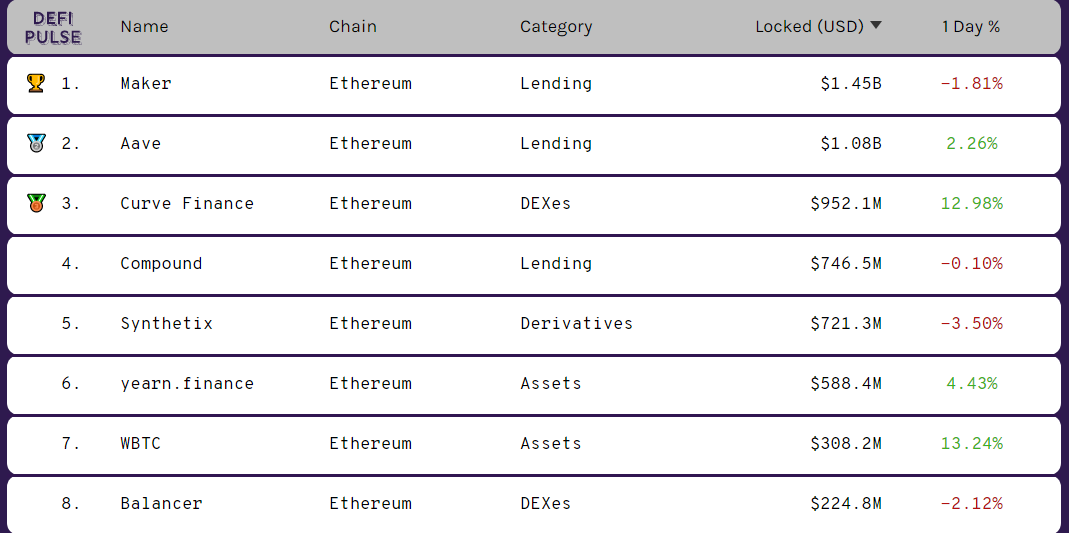

The value locked in DeFi protocols reached $6 billion on Sunday, August 16. The market had surpassed $5 billion on Friday, August 14.

Leading the DeFi Pulse rankings remains the MakerDAO project, its dominance index at 24.01%. Second place now belongs to the Aave protocol. The amount of funds locked on its smart contracts has surpassed $1 billion.

Also note the new price record for the yEarn Finance token (YFI). On Monday, August 10, its price, amid listing on Binance, rose to $6,941.

The community’s attention was also drawn to the Yam project: in a single day the token price of this “experimental” protocol plunged 99%. The collapse followed the discovery of a bug causing excessive token issuance, which was subsequently sent to the YAM Reserves contract address. This threatened the ability of token holders to govern the protocol going forward.

As a result of the failed upgrade, YAM token holders lost full control of the protocol, after which the developers conceded defeat. Nevertheless, they plan to launch a new version of the protocol.

Chainlink entered the top-5 by market cap

In the night of August 13, Chainlink rose to the fifth spot in the crypto market-cap rankings, leaving Bitcoin Cash behind. The market capitalization rose above $6.6 billion, helped by another price record at $17.59.

However, the rally did not stop there: on Sunday, August 16, LINK reached a new all-time high, climbing to $19.83.

In July, LINK was mentioned among coins that could lead the nascent altcoin season.

Grayscale Investments’ cryptocurrency trusts advertising on American TV

The digital assets management firm Grayscale Investments launched this week a new advertising campaign aimed at promoting its products offering investments in Bitcoin and other cryptocurrencies.

In a 30-second spot, shown by the company’s CEO Michael Sonnenshein, the evolution of money over the last few thousand years—from shells to its current digital form—is depicted.

Go digital. #GoGrayscale. pic.twitter.com/dnE2bC3H7O

— Michael Sonnenshein (@Sonnenshein) August 10, 2020

The campaign leverages the meme “Money printer go BRRR”, hinting at the Fed’s money-printing machine working overtime during the crisis following the COVID-19 outbreak. Grayscale Investments aims to bring this message to a broad audience.

On Friday Grayscale Investments CEO Barry Silbert spoke of record inflows into the firm’s funds — $217 million for the week.

Likely following Grayscale’s lead, Mike Novogratz’s Galaxy Digital launched an advertising campaign in the form of a Financial Times feature.

According to latest figures, Grayscale Investments’ assets under management total $5.9 billion.

Internet outage in Belarus

Ahead of the protests related to the Belarus presidential election, residents were cut off from the internet for several days. Authorities blamed DDoS attacks and foreign interference, but experts say the shutdown was imposed by state providers — Beltelecom and the National Center for Incident Response.

Periods of connectivity issues were observed on the day of voting itself. Throughout the election day, access to sites, messaging apps and mobile services were problematic. These problems were reported not only in Belarus; local sites were unavailable in other countries as well.

The incumbent president Alexander Lukashenko attributed the connectivity issues to foreign interference. Beltelecom said the outages were caused by foreign traffic in large volumes, while the National Center for Computer Incidents responded to DDoS attacks on the BY-NET infrastructure.

Lost economic activity due to the Belarus internet shutdown was estimated at more than $56 million per day. The Bell reported the outages lasted 61 hours. In that scenario losses could reach $141 million.

Nevertheless, experts believe that foreign interference is unlikely the culprit, and the DDoS theory could be plausible if context is ignored. One theory suggests that problems with internet service could have resulted from government use of equipment with deep packet inspection (DPI) for blocks.

If DPI was indeed used to block “non-friendly” resources, it could not be fully contained, but many areas of activity were affected. Belarus residents used the Psiphon anonymizer and Telegram to access services. Pavel Durov stated that the messenger enabled anti-censorship tools for users in Belarus, but noted that internet in the country “sometimes disappears completely.”

Human rights groups called the situation a “state internet shutdown” and an assault on free speech. More than 30 organizations issued an urgent appeal to UN Special Rapporteurs on freedom of expression, assembly, and human rights in Belarus.

Earlier this week, more than 500 leaders, founders and developers of Belarusian IT companies signed an open letter urging to stop violence against peaceful residents, release political prisoners, hold new elections, and provide citizens with free access to information.

For how to bypass blocks and protect the fundamental right to access the internet, read ForkLog’s exclusive feature:

Following the Belarus internet shutdown: how to bypass blocks and when it’s not possible

In Russia, prototype of a system to track cryptocurrency transactions developed

There were reports this week that Rosfinmonitoring is developing a system to analyze cryptocurrency transactions. It is named “Transparent Blockchain” and uses artificial intelligence (AI) and the Bitcoin blockchain. The prototype has been developed in collaboration with the Lebedev Physical Institute.

The system is expected to enable tracing the movement of digital financial assets, partially de-anonymize participants by classifying them into common transaction profiles, and conduct investigations related to illegal circulation of digital assets.

The need to track cryptocurrency transactions is explained by their use in criminal activity. Potential users of the system include government authorities, the Bank of Russia, and financial institutions.

Experts consulted by ForkLog criticized the initiative, arguing that authorities are reinventing the wheel, as similar solutions already exist and function successfully.

Public company invested a portion of capital in Bitcoin for the first time

Nasdaq-listed analytics software provider MicroStrategy acquired 21,454 BTC (~$250 million at the time of the deal), becoming the first publicly traded company to invest part of its capital in Bitcoin.

“Bitcoin investments are part of our new capital-allocation strategy aimed at maximizing long-term value for our investors,” said MicroStrategy CEO Michael Saylor, adding that the company views Bitcoin as a more reliable alternative to a depreciating U.S. dollar.

Where exactly MicroStrategy bought the bitcoins and how it plans to store them was not disclosed.

At present, MicroStrategy’s market capitalization exceeds $1.3 billion. Following the announcement, the company’s shares surged by 14.6%.

What else to read and watch?

This week, ForkLog published an in-depth feature telling the rise and fall story of the German fintech startup Wirecard, whose problems regulators for years failed to notice.

Also for ForkLog, co-founder and CEO of Aximetria, Alex Axelrod explained why banks, Visa and Mastercard push crypto services to processors like Wirecard, and why this approach should be abandoned.

Finally, don’t miss our video on Dogecoin’s explosive July rise, a result of a pump-challenge on the popular Chinese social network Tik Tok:

Subscribe to Forklog on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!