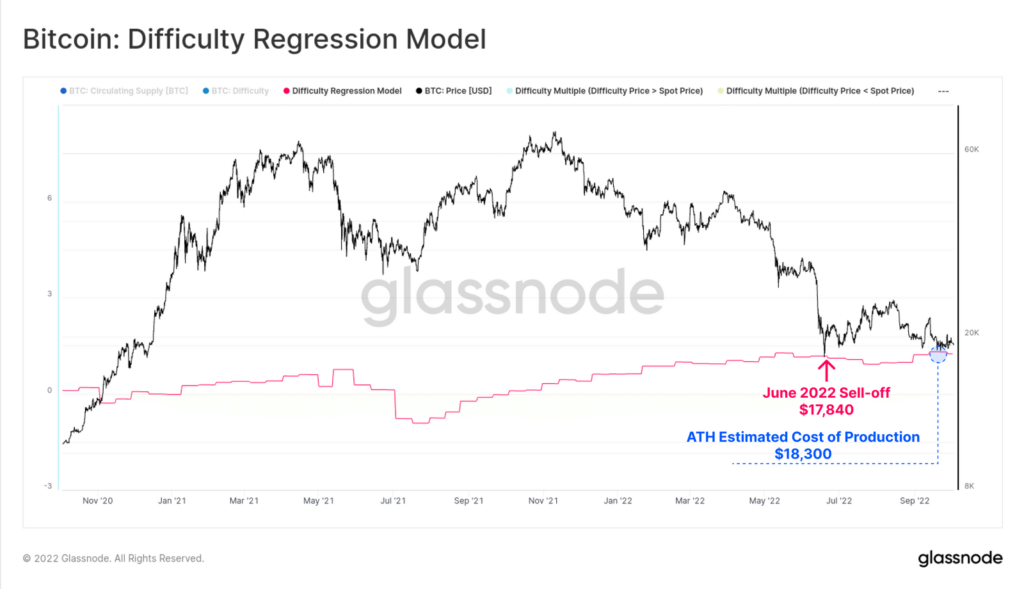

Analysts peg miners’ ‘pain threshold’ at $18,300

78,400 BTC could be at risk of liquidation if Bitcoin’s price falls below $18,300, a level implied by a regression model of mining difficulty. Such estimates were obtained by Glassnode analysts.

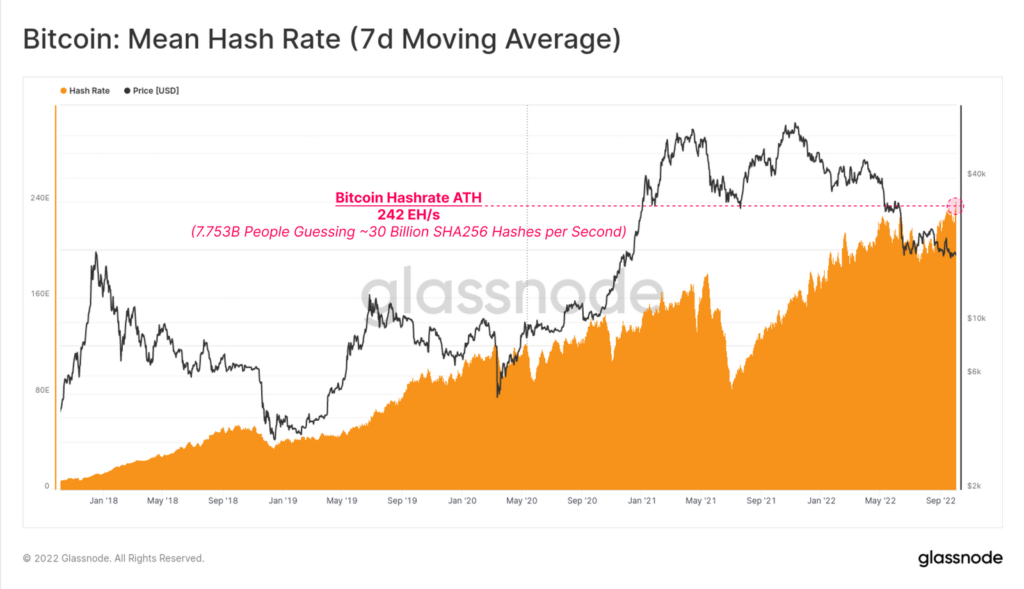

As global equity and bond markets continue to tread challenging ground, #Bitcoin hashrate defies the odds, pushing to yet another all-time high.

This week, we deep dive into $BTC mining to assess if the worst of the capitulation is over, or not.https://t.co/Lv9ObN5XO6

— glassnode (@glassnode) October 3, 2022

Experts noted an increasing likelihood of heightened volatility after a prolonged period of consolidation in the $18,000-$20,000 range. The latter has historically been atypical for the leading cryptocurrency.

Against price stability, metrics related tomining have improved, signaling a brighter conjuncture in the coming months. In particular, the hashrate reached a record 242 EH/s. The figure equates to roughly 7.753 billion people hashing SHA-256 at once, according to the analysts.

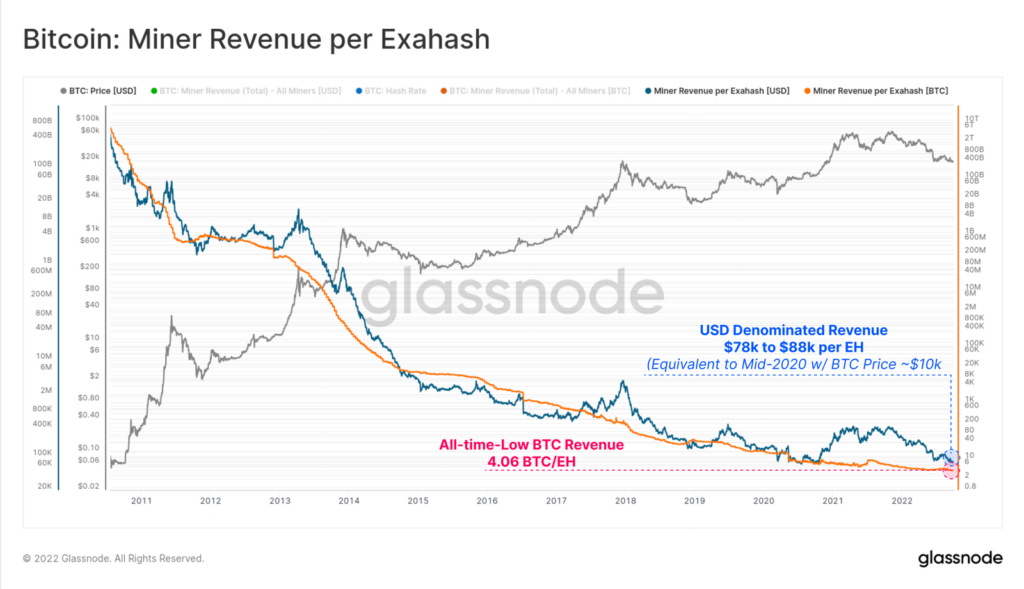

Growth in computing power is driven by the deployment of the most efficient ASIC devices. This is reflected in the revenue per EH/s (4.06 BTC).

In dollar terms, it ranges from $78,000 to $88,000. The last time such values were observed was after the halving in October 2020, when Bitcoin traded about half as high as today (around $10,000).

The logarithmic regression between difficulty and market capitalisation, with an R-squared of 0.944, shows that the sector-wide breakeven level for Bitcoin mining stands at $18,300. The figure is only marginally above the June low of $17,840.

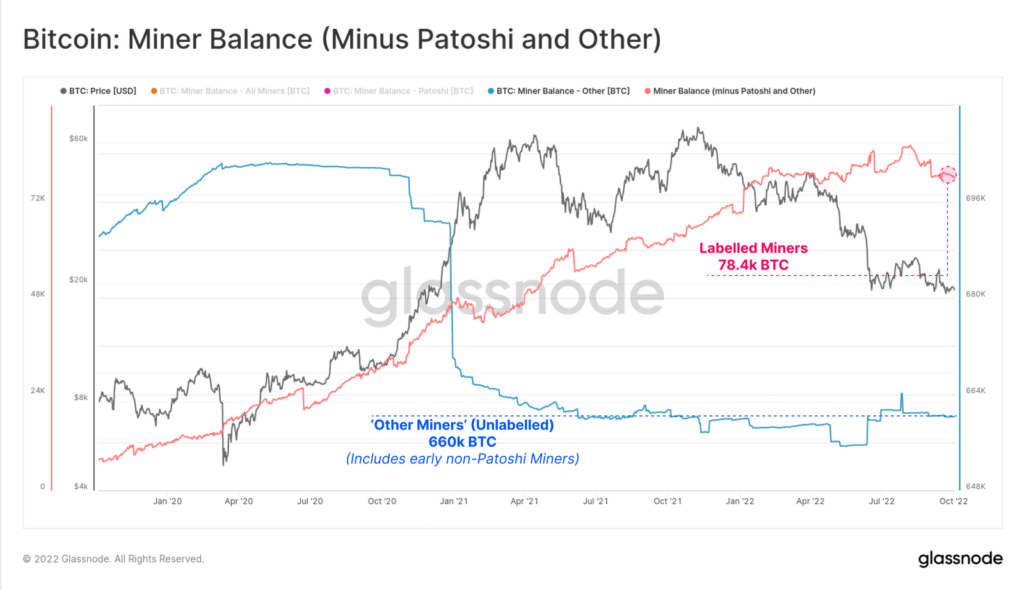

On miners’ balance sheets, which account for 96% of the current hashrate, 78,400 BTC are concentrated — the maximum number of coins that could be pushed into selling in a stress scenario for this class of market participants.

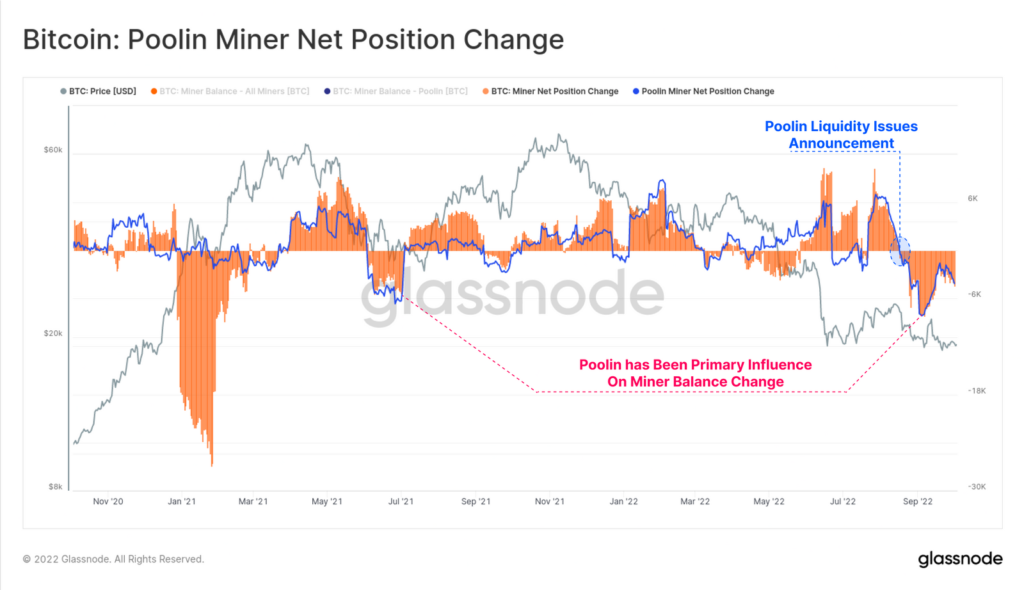

Against Bitcoin’s current stabilisation, analysts noted a slowdown in miners’ monthly coin distributions — down to 4,400 BTC, about half of September’s peak.

Analysts note that the bulk of sales are carried out by miners tied to the Poolin pool. In September, representatives of this companyacknowledged liquidity problems.

In late July, Bitcoin mining difficulty fell for the first time since July.

In September, Arcane Research analysts found that the vast majority of publicly listed mining companies suffered losses due to crypto-winter.

In June, experts noted that the profitability from Bitcoin mining had fallen to 2020 levels. Later they concluded that publicly listed companies in the industry have maintained financial resilience, despite unfavourable market conditions.

Read ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, rates and analytics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!