Analysts point to ‘healthy market dynamics’ for bitcoin

Glassnode sees a new all-time high if bitcoin holds above $118,000

Funding rates for the leading cryptocurrency across major exchanges remain neutral or negative as it trades in a $110,000–$120,000 range. This signals “healthy market dynamics,” noted CryptoQuant analyst PelinayPA.

Bitcoin Funding Rates on Binance Indicate a Potential Rally

“Overall, the setup remains bullish, negative funding suggests accumulation opportunities while strong spot demand underpins the rally’s sustainability.” – By @PelinayPA

Link ⤵️https://t.co/mJmLZJMVhX pic.twitter.com/OHXi1eJUGk

— CryptoQuant.com (@cryptoquant_com) October 2, 2025

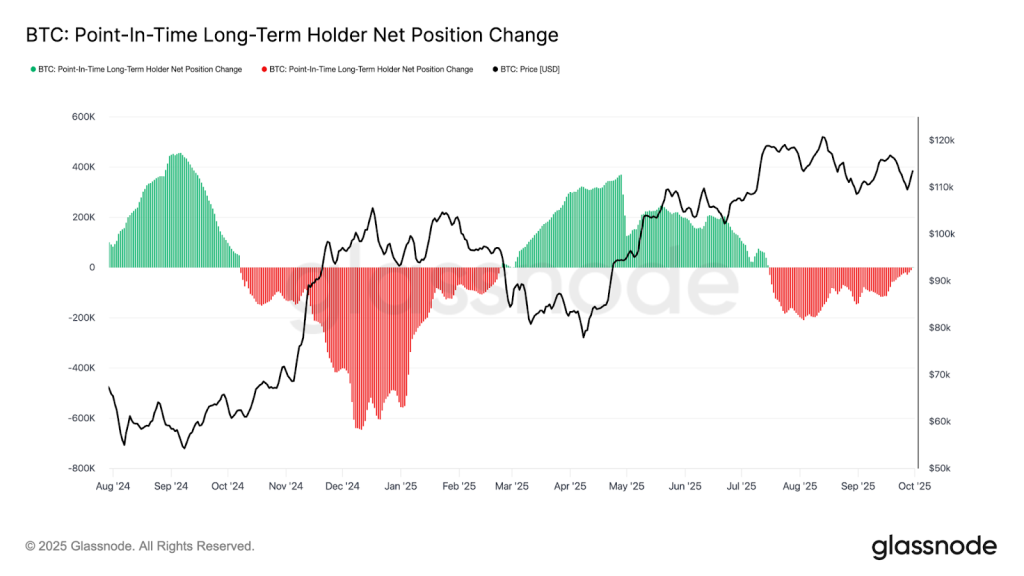

Unlike typical episodes where price gains are accompanied by high leverage, the current backdrop suggests dominant organic demand and accumulation by long-term investors.

In the expert’s view, a key advantage of the current structure is the potential for short squeezes, bolstered by institutional demand.

“Overall, the setup remains bullish: negative funding suggests accumulation opportunities, while steady spot buying provides fundamental support for the rally,” the expert noted.

As a near-term price target, PelinayPA cited $120,000–$125,000. A loss of $115,000 against a backdrop of negative funding could prompt a deeper correction.

Cautious sentiment

According to analysts at Glassnode, a critical level for bitcoin is the short-term holders’ cost basis, which sits above $110,000. They stressed that since May this metric “has acted as support five times, separating bullish and bearish scenarios.”

In their analysis, the experts noted that upside is constrained by a dense cluster of sell orders in the $114,000–$118,000 band. However, by the time of writing the leading cryptocurrency had cleared its upper bound, breaking through $119,000.

“Overcoming the pressure from sellers is a key condition for a fresh attempt by the market to set new all-time highs. A confident hold above $118,000 will signal that demand is absorbing supply from buyers who entered at the peaks; this will strengthen the case for further gains,” Glassnode wrote.

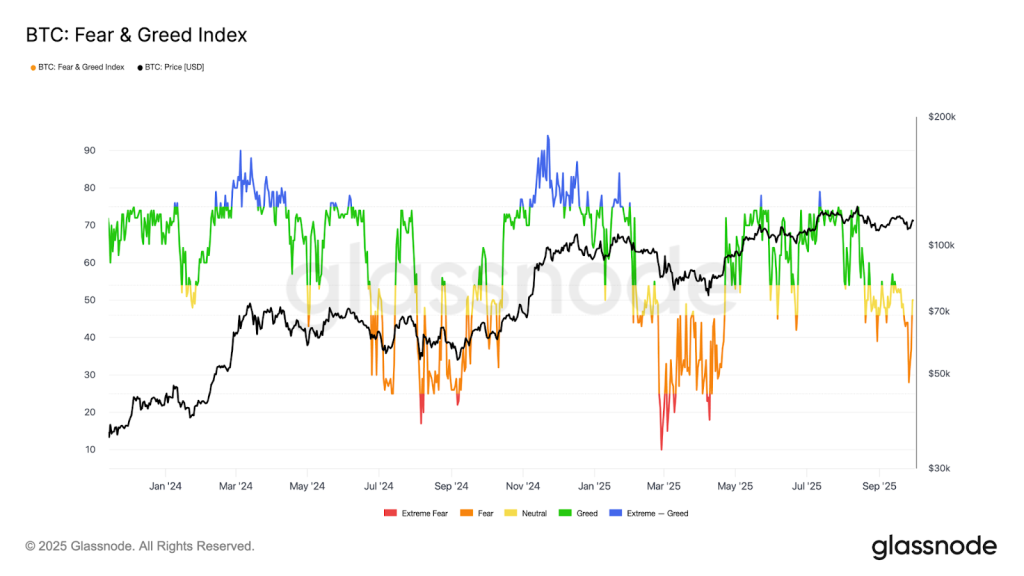

Market sentiment is cooling, they added. They pointed to the short-term holders’ realized price, which has been falling since May. The Fear and Greed Index has shifted into the “neutral” zone.

Long-term investors have scaled back distribution after months of profit-taking, while US exchange-traded funds have resumed net inflows. This balance also sets the stage for potential consolidation.

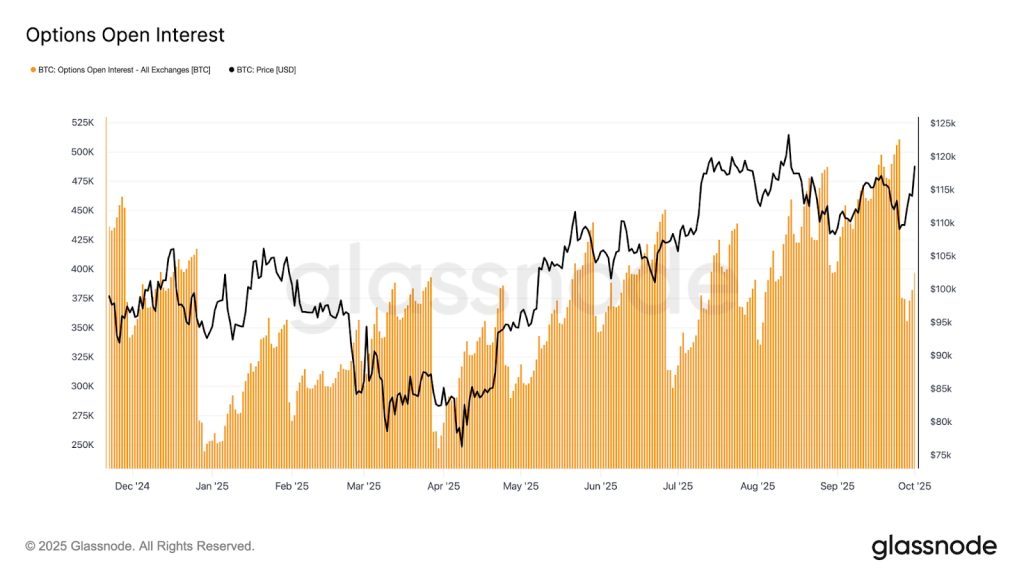

In the options market, following a record expiry, open interest is being rebalanced around a seasonal factor—the expected Uptober. Traders are actively buying calls in the $136,000–$145,000 range while selling puts. In the experts’ view, this reflects cautious optimism about fourth-quarter prospects.

Earlier, CryptoQuant analysts identified conditions for bitcoin to rise to $200,000. The leading cryptocurrency is supported by three key factors: resilient demand, rising stablecoin liquidity and a decline in traders’ unrealised profits.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!